Compilation #1: Outstanding Investor Digest

1,500+ Pages of Interviews, Letters, and Speeches by the Greats

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Compilation #1: Outstanding Investor Digest

If you read this newsletter, you probably know about my compilations. In fact, you’ve probably even bookmarked a few. But you’ve probably (definitely) never actually read one cover-to-cover.

Unlike my letters, which are typically a single letter that gives you insight into a single person, or my anthologies, which are my way of telling a story of some of the people and companies I find interesting through a series of letters, notes, quotes, and/or videos, my compilations range from tens to thousands of pages and are a deep dive into a specific person, firm, or theme.

Compilation

Introduction

I’ve never had a mentor.

There was no singular person who took me under their wing—no long lunches, no late-night phone calls filled with war stories, no hindsight gifted directly into my life. And for a long time, I thought I was at a disadvantage because of that.

So I went searching.

I found mentors in pages instead of people—dead or alive, known or unknown, investors and non-investors alike. I began collecting fragments of wisdom wherever I could find them. And again and again, I found myself returning to one source: Outstanding Investor Digest.

Buried in each edition were thought processes captured in print—raw, unfiltered, and remarkably candid. The greats—Warren Buffett, Walter Schloss, George Soros, Julian Robertson—spoke freely about their philosophies, their frameworks, and even their trades. It wasn’t hindsight polished into legend; it was insight unfolding in real time.

As the internet took hold and markets grew noisier, investors stopped sharing. And the publication quietly faded. The interviews became elusive, scattered, half-forgotten. But I never forgot.

I started collecting every issue I could find—from garage sales in San Francisco and estate sales in New York to anonymous scans uploaded online and library archives buried in dust.

This compilation is the result of that search.

This isn’t filtered commentary or secondhand interpretation. It’s direct transmission. Firsthand wisdom. A front-row seat to the evolving minds of history’s most exceptional investors. Some ideas are timeless. Others are time-stamped. But the thinking—the clarity, the discipline, the frameworks—that’s what endures.

For me, these pages became my mentors. They may not have been in person or real-time, but they were what I had. I can’t say for sure that they were more impactful than a real mentor would have been, but I can say for sure that they made a big impact on me.

Many of the interviewees returned to OID again and again over the years, which meant I could study the cadence of conviction in their responses. I could see how their thinkings evolved, how their frameworks refined, how their boldest calls played out. Some investors chase complexity. Others seek simplicity. I learned from both.

The beauty is: anyone can do the same.

You don’t need a Wharton degree. You don’t need insider access. You just need the patience to read slowly, the humility to learn deeply, and the curiosity to really listen.

This isn’t a bundle of old newsletters. It’s a living archive of wisdom—collected, preserved, and shared for those still hungry to understand.

Whether you’re just beginning your investing journey or decades into it, I hope you’ll treat this collection not as a relic of the past, but as a living conversation—between the minds that shaped markets, and those still hungry to understand them.

KG Note: If you’ve had a mentor who has played an impactful role in your life/career, I’d love if you could share some of your favorite lessons from them. Please comment below, email me, or DM me on Twitter.

README

1) Special thanks to Adam Mead and his friend Helen who put the majority of these issues into public domain. I had managed to track down roughly 2/3 of these issues through a variety of channels, but Adam and Helen tracked down nearly all of the issues in this compilation.

2) Please note that not all of the issues included in this compilation are complete—some only include certain sections and interviews. As such, some of the interviews listed in the “Table of Contents” will not be in this compilation.

3) This compilation is missing a number of issues. If you have any of these issues, or complete ones of the incomplete ones in this compilation, please email me at kevin@12mv2.com.

Download the Compilation

*Additional Notes

If you enjoy this compilation, see this page where I’ve shared 80+ of my compilations.

If there’s anyone you want to see a compilation of that isn’t there, feel free to email me or DM me on Twitter—I may have one made in my personal archives and willing to share!

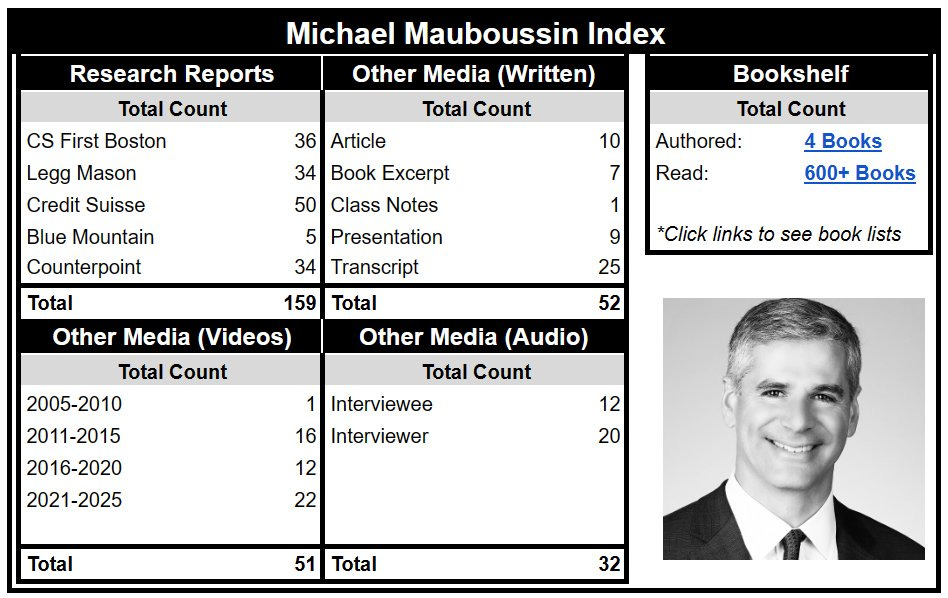

If you’re not sure where to start, I’d suggest this Michael Mauboussin Index. It’s not one of my traditional compilations, but it’s the easiest by far to navigate.

And if you want to chat with Michael, check out this project by Ethan Lambeth.

Truly amazing and a labor of love.

This is great, thank you!