Letter #108: Kevin Harvey (1997)

Benchmark Cofounder and General Partner | Venture Funding for Java Companies

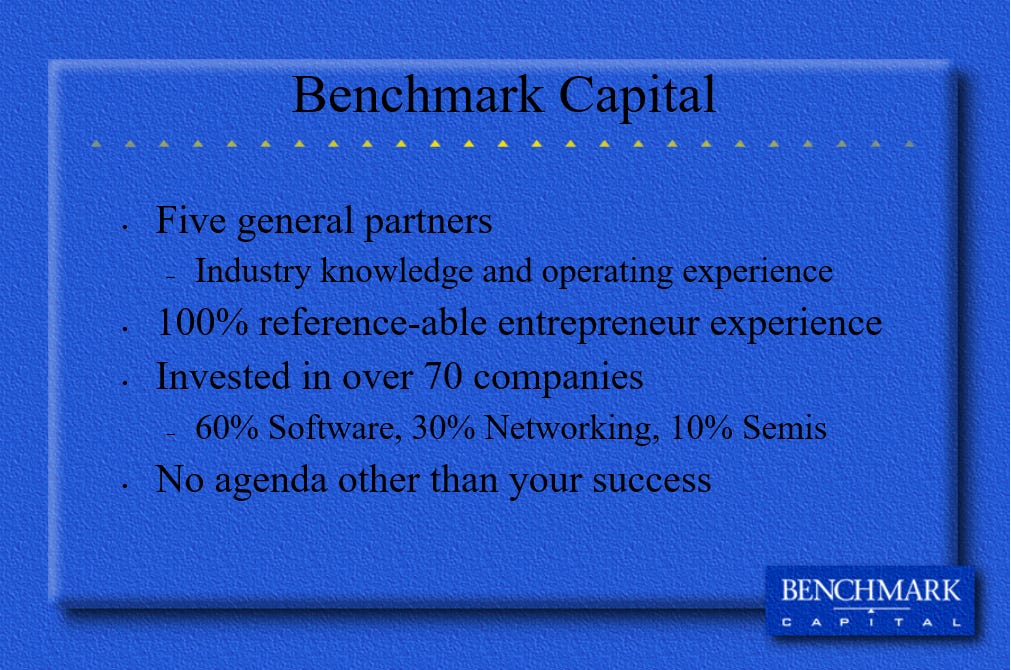

Today’s letter is the presentation made by Kevin Harvey to the JavaOne Conference in 1997. In this presentation, Kevin discusses venture funding for Java companies by going over the state of venture in 1997, jumps into consumer internet and enterprise software, discusses his his favorite Java opportunities and his Java heresies, explains what VCs wanted in 1996 and what that’s changed to in 1997, then shares advice on what VCs don’t want to see, how VCs think, how to present your company, how to choose a VC, and then ends with a quick pitch for Benchmark.

Kevin Harvey was one of the five original founders of Benchmark Capital. Prior to founding Benchmark in 1995, he was a serial entrepreneur, having founded two software companies: Styleware and Approach Software. Kevin founded Styleware in 1985 as a provider of integrated software for the Apple II. Three years later, it was acquired by Claris (Apple’s software arm). Kevin remained at Claris for two years, where he led the team that created ClarisWorks, one of the best-selling software programs for the Macintosh. After those two years, Kevin jumped back into the world of entrepreneurship, this time founding Approach Software, which provided the first easy-to-use client server database for Windows. Once again, three years, later, Kevin’s startup was acquired—this time by Lotus. And once again, Kevin stayed on for two years, continuing to manage the Approach team. After two years at Lotus, in 1995, Kevin joined forces with Bob Kagle, Bruce Dunlevie, Andy Rachleff, and Val Vaden to form Benchmark Capital. That same year, he started planting vines in backyard and making wine in his garage, which led to the founding of Rhys Vineyards.

At Benchmark, Kevin led investments in Bytemobile (acq. by Citrix), Eucalyptus Systems (acq. by HP), Highlight (acq. by Pinterest), Ingenio (acq. by AT&T), Metaweb (acq. by Google), MySQL (acq. by Sun), oFoto (acq. by Kodak), Tellme Networks (acq. by Microsoft), When.com (acq. by AOL), and Zimbra (acq. by Yahoo). He held board seats at companies including Ashford.com, Broadbase Software, Critical Path, and Red Hat Software.

I hope you enjoy this presentation as much as I did! It’s a fascinating look into the early days of internet venture from one of the founding partners of one of the most successful venture funds of all time. (And it’s also fun to see a career that’s moved in parallels—both startups were acquired after 3 years, he worked at acquired company for 2 years, then started something new. He also started one of the greatest ventures of all time the same year he started a winery that has been called “one of the finest wineries in the United States” by famed wine critic Antonio Galloni.)

Relevant Resources:

Benchmark Letters

Letter #14: Bill Gurley

Letter #43: Sarah Tavel

Letter #47: Peter Fenton

Letter #49: Miles Grimshaw

Letter #62: Eric Vishria

Letters #82/83: Evan Spiegel and Mitch Lasky (2014)

Benchmark Compilations

Bill Gurley Compilation (652 pages)

Mitch Lasky Compilation (474 pages)

Sarah Tavel Compilation (300 pages)

Slides

Slide 1

Slide 2

Slide 3

Slide 4

Slide 5

Slide 6

Slide 7

Slide 8

Slide 9

Slide 10

Slide 11

Slide 12

Slide 13

Slide 14

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Copart, Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.