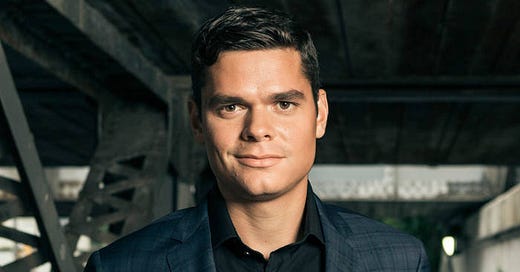

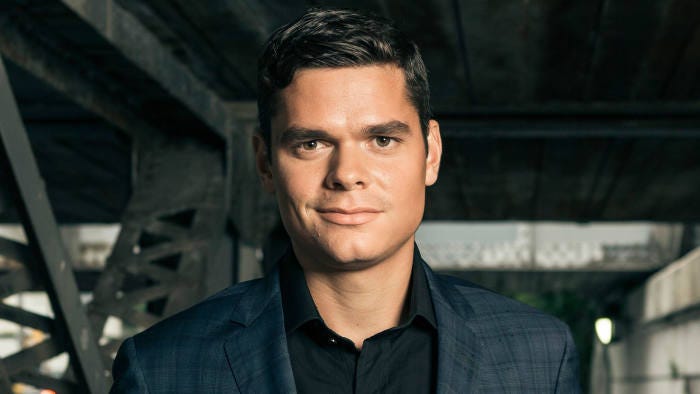

Letter #114: Milos Raonic (2015)

World #3 Tennis Player | How I learned to save 90% of my income

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.”

Earlier this week I saw a video of a Milos Raonic slice serve that provided an interesting vantage point to understanding just how difficult a sport tennis is (I was actually once a ball boy for Milos, so I’ve seen it up close before). And it got me thinking: Today, we see global superstar athletes who are building business empires, but often times they work with others to manage their money. Milos is one of the few who took an early personal interest in saving money, and actually wrote an essay about it. As such, today’s letter is the essay he wrote about how he learned to save 90% of his income. It’s a fun look into the intersection of money and sports and how a world class athlete sees the overlap in building good habits for each.

Milos Raonic is a Canadian tennis player (born in Yugoslavia) who at one point was ranked as one of the top three players in the world. He’s perhaps best known for his breakout year in 2016 where he reached the finals of Wimbledon and the semifinals of the Australian Open, two of tennis’ four grand slams (ie imagine if the NBA had four championships or the NFL had four Super Bowls). Statistically speaking, he is one of the greatest servers, having won >90% of his service games.

I hope you enjoy this essay as much as I did!

Letter

I approach building good money habits the same away I approach my tennis game: In a slow, disciplined way, with lots of short-term goals that are part of a long-term plan.

My initial lessons on budgeting and saving started when I was just 10 years old. My parents would drive me to tennis tournaments several hundred kilometers away from my home in Thornhill, Ont. They paid for everything, but I handled a lot of the actual transactions. I would swipe their credit card for all purchases on the road—gas, coffees, meals, lessons, and other routine expenses—and those costs quickly added up. I learned that someone needs to pay and I knew one day soon, it would be me.

So in my teens I began to save 90% of all the income I earned from playing. I know that’s a lot, but it was my rainy day savings plan. The day would come when I’d have to start paying for all my competition expenses. As I got older, the day would also come when I’d have to stop playing tennis.

I learned that good budgeting means understanding the difference between needs and wants. My parents were never wasteful. In fact, my dad, a nuclear engineer, has owned only three cars in his whole life —he’s put more than a million kilometres on those vehicles. His philosophy? Why buy a new car when the old one does the job? For dad, cars are a need, not a want, so driving an older one is just fine. Saving the difference has helped him to pay for more important things—like three kids’ passions and a good post-secondary education.

Those lessons were key for me when it came to budgeting my own money. They helped me to become a patient, hard-working person who always keeps his eye on the end game. Perhaps that’s why I’ve spent the last few years educating myself about money management. I’ve found the most valuable lessons are simple concepts that many of us overlook. For example, learning the difference between net and gross earnings. When you’re responsible for paying your own living costs, as well as your coach’s salary, hotel fees, and other expenses, and you have an uneven income—because I only get paid if I win—then budgeting based on what you get to keep at the end of the day (net earnings) is much more important than relying on what you earn on paper (your gross earnings).

Believe it or not, part of my ongoing financial learning comes from the tennis associations. Every time I win, I must personally show up at the association office to collect my cheque. Before I leave, I sit down with an accountant who shows me how every dollar was earned, and deducted, from my paycheque. I’m always surprised at how much smaller my earnings are after deductions, which reinforces why it’s so important for me to save 90% of my earnings. I want to feel secure knowing that I can pay for my tennis expenses for a long time into the future.

But while planning for the future is important to me, I can’t risk letting it impact my tennis game. It’s one reason why I’m a very risk-averse person. Currently, all my money is invested in bonds. Sure, I could have a 200% return with riskier investments, but I’m more motivated by avoiding the 50% loss than chasing returns.

Have I lost out on some great investing opportunities? Sure. Three years ago, my manager and I left a Tesla dealership in San Jose, Calif. He immediately bought Tesla shares and he’s much richer today because of it. I didn’t. But I hate to lose more than I like to win and I can’t afford to lose sleep over market losses. Mental clarity is key to my tennis success and I know enough not to mess with that.

Right now, I’m happy to keep my full head of hair and stay worry-free on the tennis court. Someday, building a well-diversified stock portfolio will be important to me. But not today. Instead, I keep my financial priorities in line with my tennis aspirations and continue to pay myself first. The strategy works, and I’ll use it until I leave the tennis court behind. It’s about keeping it simple and I’m very proud of that.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Copart, Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.