Letters #125/126: Roelof Botha and Miles Grimshaw (2005/2014)

Senior Steward at Sequoia Capital & CFO of PayPal and Partner at Benchmark & Thrive Capital | Sequoia's YouTube Investment Memo and Miles' Note on Roelof's Memo

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

Today’s letters are the memos Roelof Botha wrote for Sequoia Capital to invest in YouTube and Miles Grimshaw’s breakdown of Roelof’s memo.

In his memo, Roelof starts off with an executive summary introducing the company before diving into the deal dynamics, competition, hiring plan, key risks, and recommendation. He then dovetails into the full memo, which covers the investment summary, competitive analysis, technology overview, team bios, company presentation, and company metrics.

This memo holds a special place in my heart because it was one of the first instances I came across what venture due diligence looked like. Special shoutout to Miles Grimshaw who surfaced this memo and helped me think about how to assess and diligence venture investments and venture investors. (It’s also how A Letter a Day started!)

As Miles details in his note, it’s very hard to get genuine transparency on what VCs look for when making an investment. They may share high level criteria, but outsiders can never know how they assess opportunities against those criteria. Miles proceeds to dive into Roelof’s memo, highlighting the areas Roelof focuses on, the arguments he makes and how he makes them, and what he does and doesn’t include in the memo.

In the first letter, we get a rare and fascinating look into how one of the great investors of our time thought about a startup that is now considered one of the best acquisitions of all time behind closed doors and communicated his thoughts to the partnership. In the second letter, we get to see how a young VC (Miles had been one year out of college and at Thrive for less than a year) assesses and learns from a senior in the industry.

Roelof Botha is the Senior Steward of Sequoia Capital, which he joined in 2003. As Senior Steward, Roelof oversaw the fund’s global brand and operations, including the unbundling of Sequoia’s international operations that saw Sequoia China becoming Hongshan and Sequoia India becoming Peak XV. Prior to his role as Senior Steward, Roelof was Steward of US Operations. At Sequoia, his investments include Block, Instagram, MongoDB, Natera, Tumblr, Unity, Xoom, and YouTube. Prior to Sequoia, Roelof was the CFO at PayPal pre-eBay acquisition. He had joined the company as Director of Corporate Develop while still at Stanford GSB. Meg Whitman offered Roelof the opportunity to stay on as CFO post-acquisition, but he chose to join Sequoia. He started his career at McKinsey in South Africa.

Miles Grimshaw is a Partner at Benchmark, where he is an investor in LangChain. Previously, he was an early investor at Joshua Kushner’s Thrive Capital, which he joined immediately after college in 2013. At Thrive, he led investments in Airtable, Monzo, Lattice, Github, Segment, Slack, and Benchling. His early writing had a huge influence on my thinking, and he’s often mentioned as “an actually helpful VC”, “one of the most thoughtful investors”, and “the lowest-key but highest-impact”.

Related Resources:

PayPal Mafia

Letters

Compilations

Elon Musk (512 pages)

Peter Thiel (536 pages)

Sequoia Capital

Letters

Compilations

Michael Moritz Compilation (642 pages)

Don Valentine Compilation (347 pages)

Benchmark

Letters

Compilations

Bill Gurley Compilation (652 pages)

Mitch Lasky Compilation (474 pages)

Sarah Tavel Compilation (300 pages)

Other

Roelof’s Memo

Introduction

YouTube represents an interesting seed-stage investment opportunity. The company’s goal is to become the primary outlet of user-generated video content on the Internet, and to allow anyone to upload, share, and browse this content.

The three entrepreneurs are scrappy and smart. They have built a very easy-to-use, fast growing service that taps several strong veins: user-generated content, online advertising, wide proliferation of inexpensive digital video capture devices, and continued broadband adoption.

The company has also developed code snippets that allow users to embed YouTube videos directly into other sites. In this way, the company is building a wide content distribution network, in addition to its direct-to-site traffic.

Deal

Our proposal is to invest $1m in the seed stage, followed by a $4m Series A once specific milestones are met. Sequoia would own ~30% post Series A, with a pool of ~17%.

Competition

There are several direct and potential competitors to YouTube. These include:

direct competitors (dailymotion, vimeo)

community photo sites (flickr, webshots)

online photo sharing sites (ofoto, shutterly, snapfish) large internet players (Google & Yahoo video search) entertainment sites (big-boys, ebaumsworld)

file sharing services (ourmedia.org, putfile)

IPTV companies (Open Media Network, Brightcove)

YouTube appears to have a clear lead over its two direct start-up competitors. The other categories of potential competitors are not necessarily focused on video content, or are not focused on user-generated content within the context of a community-based site. Nevertheless, the company will need to stay very focused over the next 3-6 months to ensure that it builds a rich set of features and content depth to increase its defensibility.

Hiring Plan

We need to help the company quickly hire a CEO and VP BD/Sales. The founding team is enthusiastic about bringing on an experience CEO to help lead the company. However, I’m not sure whether we can land a CEO before the Series A. I would appreciate any ideas on potential candidates for either role. My preference would be to launch a search immediately and to have a CEO in place within 90 days.

Two additional former PayPal engineers are set to join in the next week. Both are exceptional.

The plan is to house the company in our incubation area for the near term. That will help us frequently interact with the team until we can surround the company with an experienced management team.

Key Risks

Competition/defensibility

As outlined above, YouTube faces significant potential competition. The company needs to remain laser focused on improving the user experience to ensure that it continues its early growth trajectory.

Revenue model

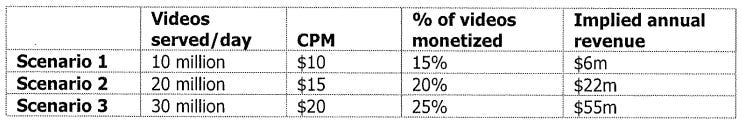

I believe that YouTube has a clear advertising revenue opportunity. However, we don’t yet know what form of advertising would work best. Specifically, can the company develop attractive ad products that are not intrusive to the consumer experience? We can model revenue as follows: # unique videos streamed per day x % of videos monetized x CPM x 365 = estimated annual revenue. Several of the parameters are unknown:

We don’t know what CPM rates YouTube could Video ad CPMs could range from a low of $5 to over $30.

We don’t know what percentage of inventory (videos served) could be monetized

We are not sure how much YouTube could grow from its current level of 100,000 videos served per

Below are different scenarios and their associated revenue potential:

We will need to test these assumptions carefully over the next few months to get an accurate handle on the company’s revenue potential. We also need to test the success of the company’s content distribution network, and whether we can generate advertising revenue from this network. (Google earns ~55% of its revenue from Google-owned sites, and 45% from Network websites.)

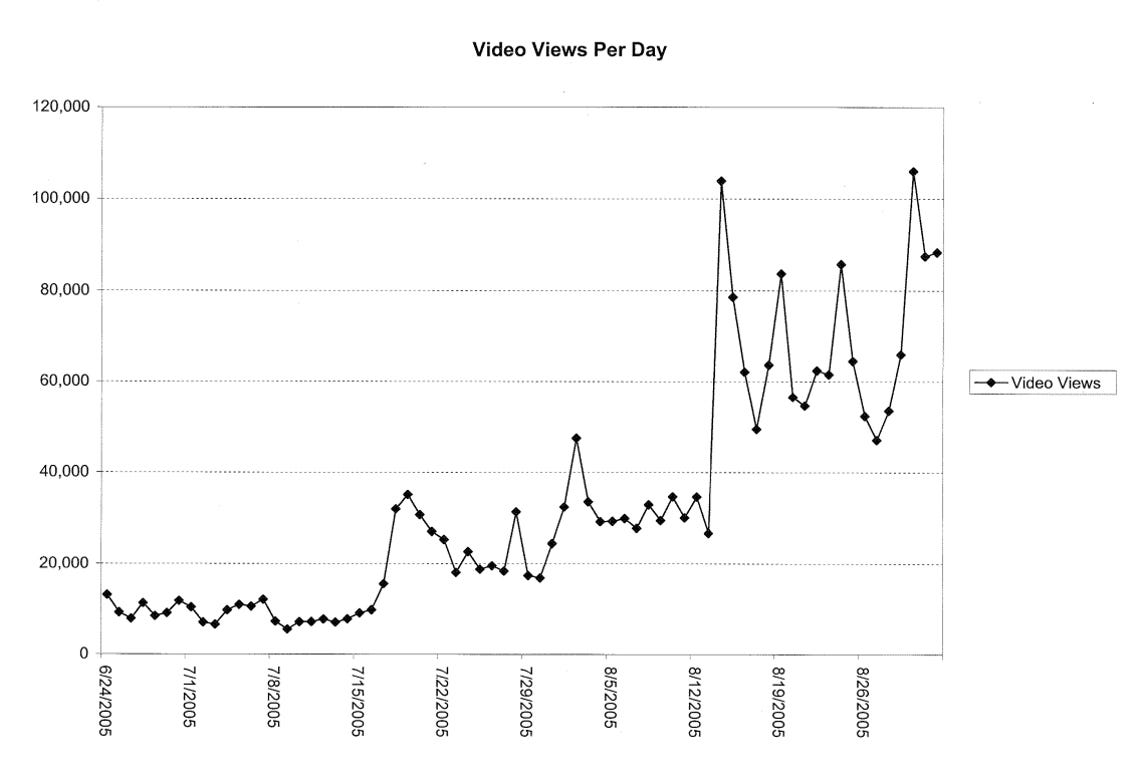

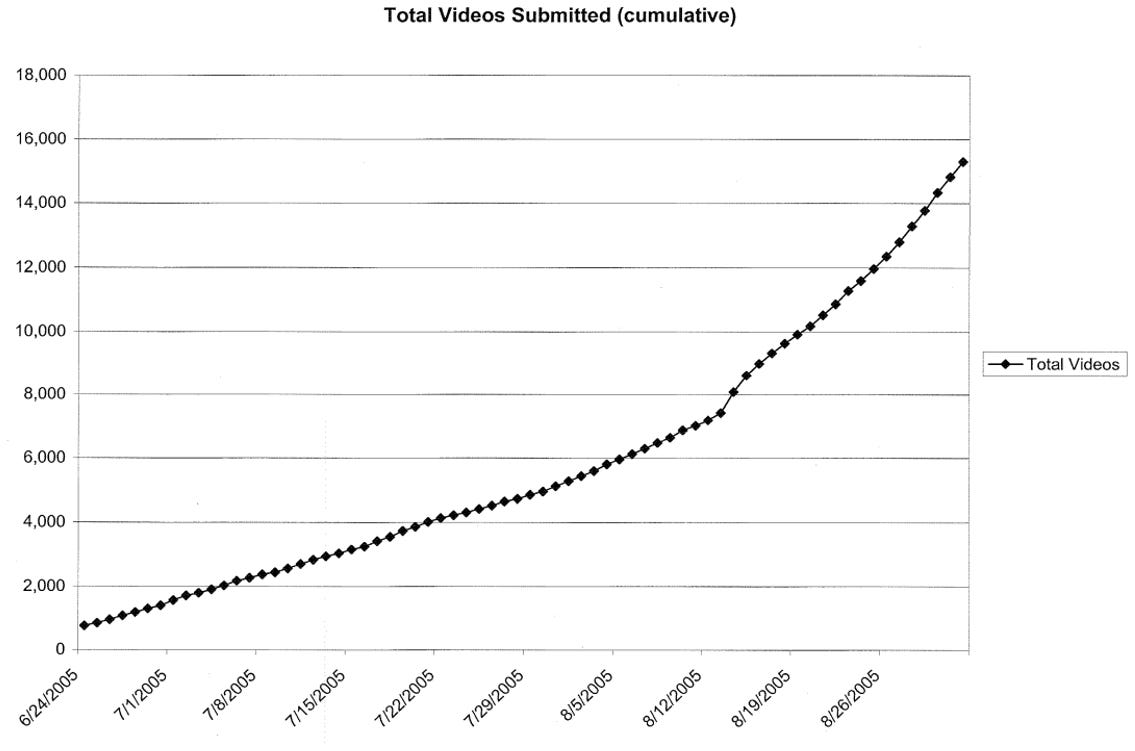

Serving 10-30 million videos may appear daunting, as it represents >l00x increase over the company’s current activity levels. But the company has achieved its current scale in only two months, and only has 15,000 videos today. (For point of comparison, Flickr and Webshots, two comparable photo community sites, serve 200-500x as many pageviews per day as YouTube.)

Scalability

As the table above indicates, YouTube will need to scale significantly from its current level for the company to achieve meaningful revenue. We need ensure that YouTube can inexpensively scale orders of magnitude from current levels.

Balancing growth

YouTube has already drawn the attention of larger media companies (e.g., Turner, Transcosmos) that see the potential of distributing YouTube content. As with any marketplace, we need to ensure that we balance demand and supply. It would be inadvisable to grow the viewer base significantly without a substantial increase in the number of videos available on the site. The company cannot afford to disappoint large numbers of customers due to inadequate depth of content.

Exit

We cannot point to many high comparable exit valuations.

A few comparable companies include Webshots, flickr, Ofoto, Shutterfly, and Snapfish. While these companies deal only with still images, there are some similarities with YouTube. None of these companies have had exceptional exits. CNET bought Webshots for ~$70m, Yahoo! bought flickr for <$50m. Apparently Shutterfly is preparing to file its IPO. Ofoto and Snapfish were acquired by Kodak and HP, respectively, although financial terms were not disclosed.

Another comparable is Blogger, acquired by Google in 2002 for an undisclosed amount. There are some other examples of businesses that built successful models leveraging user generated content, including Tripadvisor, acquired by IAC in 2004 years ago for over $100m (to the best of my knowledge).

Recommendation

I first met with the company three weeks ago, and we are in pole position for the financing. Several VCs have been cold calling the company, and a few media companies have also approached YouTube. I’d like to give the company our decision on Monday.

I recommend that we proceed with the financing as proposed.

YouTube has a great founding team that has hit on several promising themes. The company follows a trend of user-generated content that started with text (biogs), images (flickr, webshots, ofoto), and audio (podcasting). Video is a natural next step, and YouTube is well positioned to capture the lead. The company has not yet enabled advertising revenue streams. But our checks with Yahoo! and Adbrite indicated very strong advertiser demand for online video advertising. We will rapidly need to surround the company with management talent, specifically a CEO.

Contents

Investment summary (1)

Competitive analysis (2)

Technology overview (5)

Team bios (6)

Company presentation (12)

Company metrics (17)

Investment Summary

Founded by three early PayPal employees. Two engineers, one designer. Seed-stage investment opportunity. Top 10,000 internet site within two months of launch.

Business

YouTube’s goal is to become the primary outlet for user-generated video content on the internet. The company provides a very easy-to-use interface for users to upload, share, and browse their

Every digital camera now ships with digital video recording capability. But consumers have no easy way to share their personal video content – files are too large, hosting and bandwidth is expensive, and there are no standardized video file

Users upload videos to YouTube. The encoding backend converts uploaded videos to Flash Video, which works on ~98% of web browsers. The streaming format means that no file downloading is

Market

YouTube provides a platform and community for video self-publishing. We’ve seen similar self publishing emerge for text (biogs), photos (flickr, webshots, hotornot), and audio (podcasting). This presents interesting advertising revenue

There are also interesting vertical market opportunities: eBay auction videos (e.g., autos), real estate videos,

Financials – TBD

The company currently serves 100,000 videos per day, at an all-in hosting cost of $4,000 per

The team has developed a software abstraction layer that enables it to use very inexpensive hardware and bandwidth to deliver

Competition

Big players: Google Video Search, org, Open Media Network

Small players: DailyMotion, Vimeo, Putfile

Team

Steve UIUC, CS. Recruited as one of PayPal’s earliest engineers

Chad Hurley. PayPal’s first designer, responsible for site design and logo

Jawed UIUC, CS. Graduate CS student at Stanford. Also one of PayPal’s earliest engineers

Proposed terms

Two-stage, milestone-based financing: $1m seed stage, $4m Series

SC to own ~30% after Series

Proposed Series A milestones:

Develop comprehensive business plan, including financial plan

Develop self-serve advertising product

Sign up at least five (5) advertisers who place $5,000 or greater advertising orders

Ensure platform scalability to handle at least one million video views per day

Recruit a VP of Business Development

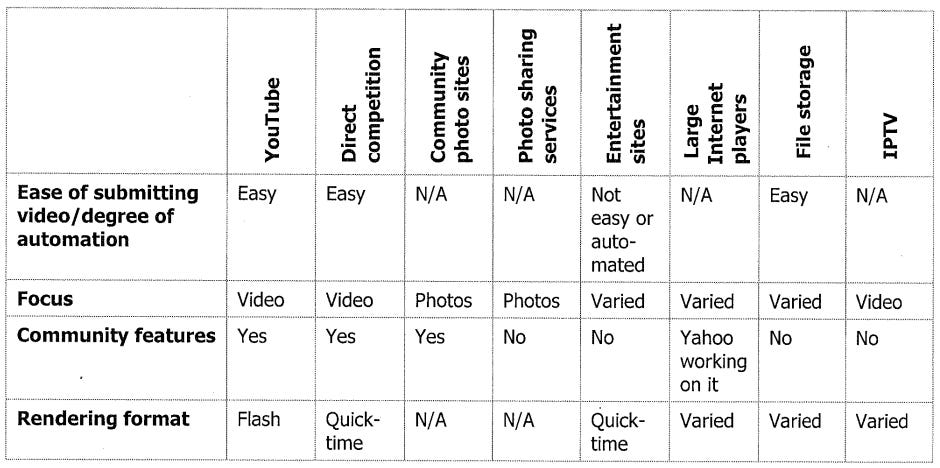

Competition

There are several potential and direct competitors to YouTube.

Direct competition

The two direct start-up competitors are Dailymotion and Vimeo.

Dailymotion is based in France. It positions itself as a site to ‘watch, publish, share.’ The site has pretty good UI, but its navigation and layout is not as intuitive as for YouTube. All videos are encoded and rendered in Quicktime. Quicktime has lower penetration than Flash, so users may be faced with needing to download the player to experience the site.

“Vimeo is for sharing your video clips.” Vimeo was started by Connected Ventures in New York. Their mission is to “develop and manage good websites.” They also run a popular site called CollegeHumor. The also claim to draw inspiration from flickr, and launched in February 2005. Vimeo also uses Quicktime. Their site layout is not very intuitive, and makes it hard to find content (e.g., there is no search capability).

The graph below shows the comparative daily pageviews for YouTube, Dailymotion and Vimeo. YouTube’s traffic has rapidly overtaken that of these two competitors.

Community photo sites

Community photo sites share many features with YouTube: tagging, social networking, discussion groups, ease-of-use. However, they seem focused on still images rather than video.

YouTube admits that it drew inspiration from the popular site Flickr. Flickr has ~200-300x the number of daily pageviews of YouTube. Yahoo! acquired Flickr earlier this year for an undisclosed sum, believed to be ~$30m. Reid Hoffman was in investor in Flickr, and assures the YouTube team that they have no plans to launch a video product in the next 1-2 years.

Webshots is another potential competitor. CNET acquired the company in 2004 for ~$70m at a time that they forecast $15-17m annual revenue. The founding team all just left the company, and it unclear how much new product innovation there is. Webshots seems very focused on photos for now.

Online photo sharing sites

The main online photo sharing services, Ofoto, Shutterfly, and Snapfish, are also potential competitors. They do not have community-like features. They also earn revenue primarily from printing. As a result, I think they will remain focused on photos.

Entertainment sites

There are several popular online entertainment sites that have significant traffic: Big-boys, ebaumsworld, ifilm.

According to YouTube: “Big-boys and ebaumsworld get a lot of traffic but that’s to be expected for the type of content they host. You are guaranteed to have something interesting, something shocking to watch when you visit these sites. However, the disadvantage is that they can never transition their sites into an actual product. Due to the content on the site, they’re forever stuck in that segment of the market. If I were to categorize the content on YouTube today, I would break it down into two large categories: personal videos and viral videos. The viral videos, due to copyrights and obscene content, I admit, big-boys and ebaumsworld may beat us there. Although, we have seen our share of viral videos on YouTube. The bigger draw for YouTube is all the personal videos, the ones of your pet, your kid, your family, your vacation, so on. Big-boys and ebaumsworld, due to their origins, can never transition their product into something that hosts these other types of files.”

Big-boys and ebaumsworld also position themselves as much broader entertainment sites, offering “Jokes, Pictures, Office Humor, Flash Animation, Soundboards, Prank Calls, Audio, Video, Games, Illusions, Magic.”

“IFILM is one of the leading video-entertainment destinations on the Web, offering channels of movies, short films, TV clips, video-game trailers, music videos, action sports and its celebrated Viral Videos collection. !FILM.com delivers more than 30 million streams per month, making it one of the top ten streaming media sites in the world.” IFILM is a clear potential competitor, although they don’t have the same focus on user-generated content, nor YouTube’s community features.

Larger competitors

Google and Yahoo are building video search products. Google requires the user to download a new “Google Video Viewer” while Yahoo plays videos in the native file format. In neither case are they providing the simple consumer upload and share experience, nor the community features.

File storage services

Putfile and Ourmedia.org are examples of file storage providers that essentially provide a free, web interface to FTP. None of them seem to have a compelling product, and do not focus solely on user generated video content.

IPTV

Finally, there are companies such as the Open Media Network and Brigthcove that are focused on the delivery of mainstream video over the Internet. I do not believe that this competes directly with YouTube’s proposition.

The table below attempts to summarize the competitive matrix:

The Technology Infrastructure (Company Supplied)

As mentioned previously, in order to keep costs down, our video distribution technology is built on clusters with multiple machines in each cluster for redundancy and higher throughput. When a video is uploaded to the site, it is sent to a single machine within a single cluster. This is chosen based on space and, in the future, cpu/bandwidth utilization on the machine and cluster. Newly uploaded videos are picked up by two services running on each of the machines, 1) convert and 2) replicate.

The converter will analyze the video and look at things like framerates, aspect ratios (16:9 vs 4:3), audio encoding (sampling rates, audio codec), and the video codec used on the original video. It uses these heuristics to best convert the video to play on YouTube with adjustments to things inserting the black bands on top/bottom of a 16:9 video, altering the sampling rate to best conform to the incoming sound, guess at frames per second of the incoming video, etc. As part of this process, video stills of each video are also generated.

At the end of this process, the video server communicates back to the central database changing the status from “Uploaded” to “Awaiting Replication”.

While all this is going on, the replication service is standing by looking for videos that need to be replicated. When a video enters this queue, it’s picked up by the replication service and the video is replicated to every machine within the video cluster. After the replication is finished, it talks to the database and marks the video as “Processed”.

A newly uploaded video will go from a “Uploaded”-> “Awaiting Replication”-> “Processed” state in about 1-2 minutes.

The best part about this technology is that it really is infinitely scalable. We can add more capacity directly at the video conversion/transport layer at will,

The math for this comes out to:

By bandwidth —

$239 / 1 machine/ 1 month

1 machine has 2000 GB transfer/ month

2000 GB * 1000 MB / GB = 2,000,000 MB transfer/ machine/ month 7 MB average size of video

2,000,000 / 7 = 285,714 videos served from each machine/ month

$239.0 / 285,714 = $0.00083 cost per video served.

By storage —

$239 / 1 machine/ 1 month

1 machine has 2×160 GB HD for 320 GB

320 GB * 1000 MB/ GB = 320,000 MB/ machine 7 MB average size of video

320,000 / 7 = 45,714 videos/ video cluster

$239/45,714 = $0.005228 cost per video stored.

$0.005228 * 2 machines/ cluster = $0.010456 / video replicated.

The video serving technology provides a substantial barrier to entry. The video clustering solution sounds obvious and straight-forward post implementation but it certainly wasn’t when we were faced with the question of — “how do we keep costs down while having access to massive storage/bandwidth?” There’s also the encoding technology. We’re constantly improving this side of the product by incorporating the latest codecs.

Team Bios

Chad Hurley is a co-founder of YouTube. Chad has an experienced background in web development and graphic design. He was the first member of the PayPal design team, where he lead efforts to develop the interface for the original Palm-based program that enabled secure wireless money transfers between handhelds. As the product evolved, he effectively designed auction features which solidified PayPal’s long term success and is a credited member of two critical auction patents. Chad looks forward to building an empowering video service for the world.

Jawed Karim is a co-founder of YouTube. He was previously a computer science student at the University of Illinois, where he was recruited by Max Levchin to become one of the earliest engineers at PayPal. There hepled the implementation of PayPal’s first real-time anti-fraud models for credit card and bank payments, working closely with Roelof Botha. As part of PayPal’s Architecture Team (a group of five out of a total of over 100 engineers), he later worked on challenging scalability problems to ensure PayPal’s ability to scale to 80 million users and beyond. He is currently a graduate student in computer science at Stanford.

Steve Chen is a co-founder of YouTube. As the Chief Technology Officer for YouTube, he is responsible for leading the engineering efforts in distributed video clusters and meeting the high availability demands of video. Before YouTube, Steve spent 6 years at PayPal on the technology team. At PayPal, he led the engineering teams behind products such as PayPal China, PayPal Developer XML APis, and PayPal Shopping Cart.

YouTube

Company Purpose:

To become the primary outlet of user-generated video content on the Internet, and to allow anyone to upload, share, and browse this content.

Problem:

Video content is currently difficult to share:

Video files are too large to e-mail (E-mails with video attachments bounce).

Video files are too large to host (viewing just fifty videos at 20 MB each means serving 1 GB of bandwidth- exceeding most website quotas).

No standardization of video file formats. To view many video file formats means having to install many different video players and video codecs.

Videos exist as isolated files. There is no interaction between viewers. There is no interrelation between videos.

Solution:

Consumers upload their videos to YouTube. YouTube takes care of serving the content to millions of viewers.

YouTube’s video encoding backend converts uploaded videos to Flash Video, which works in any web browser supporting Flash. (Flash penetration is 97.6% of Web users according to Macromedia.com.) Flash Video is a highly compressed streaming format that begins to play instantly. Unlike other delivery methods, it does not require the viewer to download the entire video file before viewing.

YouTube provides a community that connects users to videos, users to users, and videos to videos. Through these integrating features, videos receive more views, and users spend more time on YouTube. Because these features are similar to Flickr, YouTube is often referred to as “the Flickr of Video”.

Market Size:

YouTube’s growth will come as a result of these recent developments:

Digital video recording technology is for the first time cheap enough to mass produce and integrate into existing consumer products, such as digital photo cameras and cell phones, giving anyone the ability to create video content anytime, anywhere. As a result, user-generated video content will explode.

Broadband Internet in the home has finally reached critical mass, making the Internet a viable alternative delivery mechanism for videos. Viewers are flocking to the Internet because it offers more variety of content and allows people to choose when and how to see it. Traditional media want to enter this space because they want to follow the audience, and because content there is cheaper and easier to distribute. Early examples of video content that has reached more viewers on the Internet than on television : Indian Ocean Tsunami videos, Jon Stewart’s Crossfire appearance, Janet Jackson’s Superbowl wardrobe malfunction.

Initially, YouTube will target home-grown (user-generated) video content, because in the short term that represent the fastest-growing type of video content, possessing the fastest growing audience. This phase will enable YouTube to establish itself as the dominant player for Internet video content. Once YouTube’s audience reach rivals that of traditional media networks, it will then be positioned to syndicate traditional media content (news, entertainment, MTV, etc) as well.

Competition:

Big players:

OurMedia.org – Very technical and complicated for the average user

Open Media Network-windows/IE only software, no community

Google Video – going after Hollywood, not personal videos

Small players:

dailymotion – good technology, no exposure

vimeo – bad technology, has potential for exposure (owned by CollegeHumor)

PutFile – focuses on file hosting, lacks community, bad revenue model

Product Development:

Demo basic functionality.

Community

Connects users to videos. Users find videos through:

Search

Related videos

Related tags

Top rated, top viewed, most discussed

User videos,

User favorites

Connects users to users:

Video discussion groups

Video comments

Private messages

Private/public video sharing

Social networking (Friends)

User videos

User favorites

Connects videos to videos:

Related videos

Related tags

Open architecture

Developer XML APis

RSS feeds

Externally embeddable video player (“YouTube com”). By letting people embed YouTube videos right into their own web sites, YouTube’s audience reaches even beyond YouTube .com

Target vertical markets with a need for video content:

Auction videos for eBay items (perfect for eBay Motors)

Real estate videos for houses/apartments for sale/rent (“Do-It-Yourself MTV Cribs”)

Become the video platform for special interest websites: Car sites, Sports, Politics, etc

Features currently in development:

Community features: groups, sharing, better ways to find videos

Driving external reach: external player, developer APis

Sales & Distribution:

Revenue-generating options:

Ads:

“Google Adwords” approach for YouTube: Allow advertisers to upload ad

videos to YouTube. Thumbnails of these ad videos will be shown alongside other videos in video search results, and as “related videos”. As with Google Adwords, ad videos will only be shown when relevant, and will be clearly marked as ad videos.

Display interactive ads within the Flash video pla yer, superimposed over the playing

Play a short video ad at the beginning of the actual

Display an ad image at the beginning of the actual video.

Act as a for-pay distribution channel for promotional videos:

Events, conferences, concerts

Charge members for premium features:

Ability to download original videos / view high resolution videos

Video editing features (within the browser, using Flash): video effects, transitions, titles, etc

Advanced features for the externally embeddable video player

Offer specialized features for embedded auction/real estate videos (see Product Development)

Charge viewers for premium content:

Allow members to sell their video content to YouTube viewers, with YouTube taking a cut of the proceeds

Metrics:

Launched June 11th. Has already overtaken all previously existing competitors and is now the dominant player in this space.

By bandwidth:

$239 I I machine / 1 month

1 machine has 2000 GB transfer / month

2000 GB * 1000 MB I GB = 2,000,000 MB transfer/ machine / month

7 MB average size of video

2,000,000 I 7 = 285,714 videos served from each machine/ month

$239.0 I 285,714 = $0.00083 cost per video served.

By storage:

$239 / l machine/ 1 month

1 machine has 2xl60 GB HD for 320 GB

320 GB * 1000 MB I GB = 320,000 MB I machine

7 MB average size of video 320,00017 = 45,714 videos/ machine 2 machines / cluster

(2 * $239) I 45,714 = $0.01 cost per video stored redundantly on a cluster.

Team:

Founders:

Steve Chen:

Recruited by Max Levchin as one of PayPal’s first engineers

University of Illinois, Computer Science

Chad Hurley:

PayPal’s first designer, responsible for PayPal site design and feature development

Jawed Karim:

Graduate student in Computer Science, Stanford University

Recruited by Max Levchin as one of PayPal’s first engineers

University of Illinois, Computer Science

Company Presentation

Slide 1: Cover Slide

Slide 2: Company Purpose:

To become the primary outlet of user-generated video content on the Internet, and to allow anyone to upload, share, and brose this content.

Slide 3: Problem

Video files are too large to e-mail.

Video files are too large to host.

No standardization of video file formats.

Videos exist as isolated files.

Slide 4: Solution

Consumers upload their video to YouTube. YouTube takes care of serving the content to millions of viewers.

YouTube’s video encoding back-end converts uploaded videos to Flash Video.

YouTube provides a community that connects users to videos, users to users, and videos to videos.

Slide 5: Market Size

Digital video recording technology is for the first time cheap enough to mass-produce and integrate into existing consumer products.

Broadband Internet in the home has finally reached critical mass, making the Internet a viable alternative delivery mechanism for videos.

Slide 6: Competition

OurMedia.org, Open Media Network, Google Video

PutFile, DailyMotion, Vimeo

Slide 7: Product Development

Community

Open architecture

Target vertical markets with a need for video content

Features currently in development

Slide 8: Sales & Distribution

Advertising

Act as a for-pay distribution channel for promotional videos

Charge members for premium features

Charge viewers for premium content

Slide 9: Team

Steve Chen: Recruited by Max Levchin as one of PayPal’s first engineers; University of Illinois, Computer Science

Chad Hurley: PayPal’s first designer, responsible for PayPal logo, main features, and design

Jawed Karim: CS Graduate student at Stanford University; Recruited by Max Levchin as one of PayPal’s first engineers; University of Illinois, Computer Science

Slide 10: Metrics

Launched June 11th. Has already overtaken all previously existing competitors and is now the dominant player in this space.

Company Metrics

Miles’ Memo

It is very hard to get genuine transparency on what VCs look for when making an investment. Some investors share their investment criteria, but rarely how they have assessed opportunities against those criteria.

The only public domain investment memo I have found is by Roelof Botha recommending that Sequoia make a seed investment in Youtube [1]. Roelof has supported some of the most exceptional companies over the past decade including Youtube (I think one of his first), Instagram, Tumblr, Evernote, Square, MongoDB and others. It is a rare opportunity to see how such an accomplished investor thought about the opportunity behind closed doors and communicated his thoughts to the partnership.

[Embedded PDF – see Letter above or email Kevin for PDF]

[1] Roelof included the investment memorandum as part of testimony in the Viacom vs. Youtube (Google) case.

Introduction

In 3 succinct paragraphs Roelof articulates his primary theses that underpin why he thinks YouTube is a compelling opportunity. The most fundamental of these is his hypothesis that Youtube can become the ‘primary outlet of user-generated video content.’ This is supported by calling out several ‘strong veins’ (macro trends) that Youtube taps into [2].

[2] These are user-generated content, online advertising, proliferation of inexpensive digital video capture devices, and continued broadband adoption.

Roelof lets his simple thesis and supporting macro trends stand for themselves. He doesn’t feel the need to defend these foundational premises or articulate them further to the partnership. This concise thesis, articulated in 9 lines, seems obvious in hindsight but at the time video was basically non-existent on the web.

Deal

Roelof lays out the shell of an investment in a single sentence: $1M followed by a $4M Series A for ~30% of the company post Series A. It is interesting that Sequoia intended to traunch the investment contingent on the company achieving 5 ‘specific milestones’ spanning business planning, product, customer acquisition, and hiring.

Assuming Sequoia maintained ~30% ownership in the company through the Series B, Roelof returned ~$480M on a cumulate investment of <$10M between writing this memo on September 2nd, 2005 and the sale to Google on October 9th, 2006 for $1.6B.

Competition

Roelof indicates his position on the company’s top priority over the next 3-6 months: focusing on product development to ‘increase [YouTube’s] defensibility.’ This would likely have translated into his key priority when he joined the board. Documenting this in the memo can be valuable in solidify the investor’s perspective, and also to ensure the investor’s perspective is aligned with the founders and his partnership at the time of the investment.

Hiring Plan

Roelof also calls out finding executive talent to support the founders as an area for the partnership to help: ‘I would appreciate any ideas on potential candidates for either role.’ He also hints at management as an item for discussion as a team: ‘My preference would be to launch a search immediately.’ In this way, Roelof keys up conversation for the Monday meeting, and turns the memo from being an essay of personal thoughts to a collective document detailing the partnership’s priorities.

Key Risks

This is the longest section of the memo, comprising 50% of the 3 pages. This section could also be titled monetization, as Roelof primarily assesses if YouTube could reach the scale to generate meaningful ad revenue. Roelof breaks out the key risks across the following 5 subcategories, almost all of which are relevant when thinking about any opportunity:

Competition and Defensibility

Revenue Model

Scalability

Balancing Growth

Exit

Roelof again makes it clear that defensibility should be the primary focus: ‘The company needs to remain laser focused on improving the user experience …’

The ‘Revenue Model’ section is the only place in the memo when Roelof uses the word ‘believe’: ‘I believe that YouTube has a clear advertising revenue opportunity.’

He makes it clear to the partnership that the revenue model is still unclear and raises questions for the rest of the partnership to consider, again, teeing up topics for discussion on Monday: ‘can the company develop attractive products that are not intrusive to the consumer experience?’

In the rest of the ‘Revenue Model’ section Roelof lays out 3 different bottom up market sizings based on the 4 key revenue levers in sees in the business [3]. Roelof notes that he intends to make sure the company carefully tests these levers over the coming months. Again, Roelof’s investment memo for the team likely translated closely into his key priorities for the board post-investment.

[3] It’s funny to play monday morning quarterback and think about how wildly small Roelof’s bull case of 30M video views per day was given that YouTube passed 4B in January 2012.

In the ‘Exit’ section Roelof succinctly states that: ‘we cannot point to many high comparable exit valuations.’ Unknown exit opportunities doesn’t deter him from recommending an investment though, nor does he feel the need to further articulate his thesis.

Recommendation

Roelof updates his partnership on how Sequoia is positioned relative to other VCs (‘pole position’). Despite being pole position, Roelof doesn’t want to wait around the hoop.

He tells the partnership he would ‘like to give the company our decision on Monday.’ The memo is dated September 2nd, 2005, which was a Friday, so the partnership likely had the weekend to review the memo.

In the last paragraph Roelof clearly lays out why he recommends an investment:

Great team

The growth of user-generated content with video as the next step

Early indication of video ad potential based on diligence

Abstracting a level higher we can group these under: management, market, and monetization.

It is easy for VCs to operate in silos, but throughout the memo Roelof emphasizes Sequoia’s collective role in evaluating the opportunity and supporting the company by using ‘we.’ In this section, when articulating his final perspective based on the analysis, Roelof switches to the first person subjective: ‘I recommend that we proceed with the financing as proposed.’

He ends by reiterating the team’s immediate focuses post investment: ‘we need to surround the company with management talent [4].

[4] The memo has the following backup material: 1) Investment summary 2) Competitive analysis 3) Technology overview 4) Team bios 5) Company presentation 6) Company metrics. The investment summary seems to be a 1 page document written in advance of the full investment memorandum. The document is likely an early set of bullet points on the opportunity so the rest of the team knows about the company early in the diligence process. The investment summary may also be a consistent framework that the teams uses to analyze any opportunity and provide rigor. In the supporting materials on ‘Competition,’ Roelof walks through each of the subcategories listed in the memo in more depth, including any public traction and exits. The remaining 4 sections of additional content are information provided by the team.

Final Observations

It’s particularly interesting that through the memorandum Roelof doesn’t appear to try and sell the opportunity to the partnership. The memo doesn’t have a section titled ‘upside’ or ‘opportunity,’ and he clearly calls out what he doesn’t know. Between the section on key risks and competition, over 50% of the memo focuses on discussing areas of concerns. The team likely already agreed on the macro trends that could support a mass market UGC video platform, which allowed them to focus their diligence and debate on whether or not YouTube could monetize and if management was the team to build the product.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.