Letter #133: Thomas Peterffy (2008)

Chairman, CEO, and President of Interactive Brokers | IAB 30th Anniversary Letter

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

Today’s letter is 30th anniversary letter and first shareholder letter as a publicly traded company from Thomas Peterffy for Interactive Brokers. In this letter, Thomas emphasizes Interactive Brokers’ single-minded focus on building a global marketplace connecting the world’s exchanges through automation, speed, and efficiency, before explaining how Interactive Brokers has positioned itself at the intersection of four historic trends: 1) globalization, 2) adoption of technology, 3) spreading equity culture, and 4) optimizing the allocation of resources. He ends with their goal to become an even larger part of the network by providing liquidity and technology to institutions and investors worldwide.

Thomas Peterffy is the Founder of Interactive Brokers, an automated global electronic broker that specializes in routing orders and executing and processing trades in financial instruments. It traces its lineage to 1977, when Peterffy bought a seat on the American Stock Exchange as an individual market maker and formed T.P. and Co. in 1978. It was renamed Timber Hill in 1982, and then Interactive Brokers in 1993. They were known for innovating, having been the first to use fair value pricing sheets on an exchange trading floor, being the first to use handheld computers for trading, Peterffy having created the first fully automated algorithmic trading system to automatically create and submit orders to a market, and becoming the first online broker to offer direct access to IEX. Today, the company operates the largest electronic trading platform in the US by number of daily average revenue trades, and has a market cap of ~$35bn. And even after an IPO, Peterffy owns ~75% of the business.

Thomas was born in a hospital basement in Hungary in 1944 during a Russian air raid. His father emigrated to the US after the failure of the Hungarian Revolution, and Thomas dropped out of his engineering program to join his father in the US. But when his father didn’t have room to accommodate his son, he gave him $100 and told him to “make something of himself.” Despite speaking no English, Thomas got a job as an architectural draftsman working on highway projects for an engineering firm. He volunteered to program a newly purchased computer, and was off to the races. He eventually found himself designing commodity trading software for Mocatta Metals. After years of judiciously saving, he quit his job and purchased a seat on the American Stock Exchange to trade equity options, before founding T.P. and Co. He stepped down as CEO in 2019, but remains the Chairman and largest shareholder.

I hope you enjoy this letter as much as I do! It’s an amazing example of clear thought and concise communication from one of the greatest entrepreneurs of all time. This isn’t a long letter, but as the saying goes, “I wrote a long note because I didn’t have time to write a short one.” This is a short letter — and every sentence plays a purpose and carries great meaning.

Related Resources

Hungarians

Jim Breyer

Andy Grove (Letter, Compilation)

Charles Simonyi

George Soros (Letter, Compilation)

Steven Udvar-Hazy

Letter

Dear Fellow Shareholders,

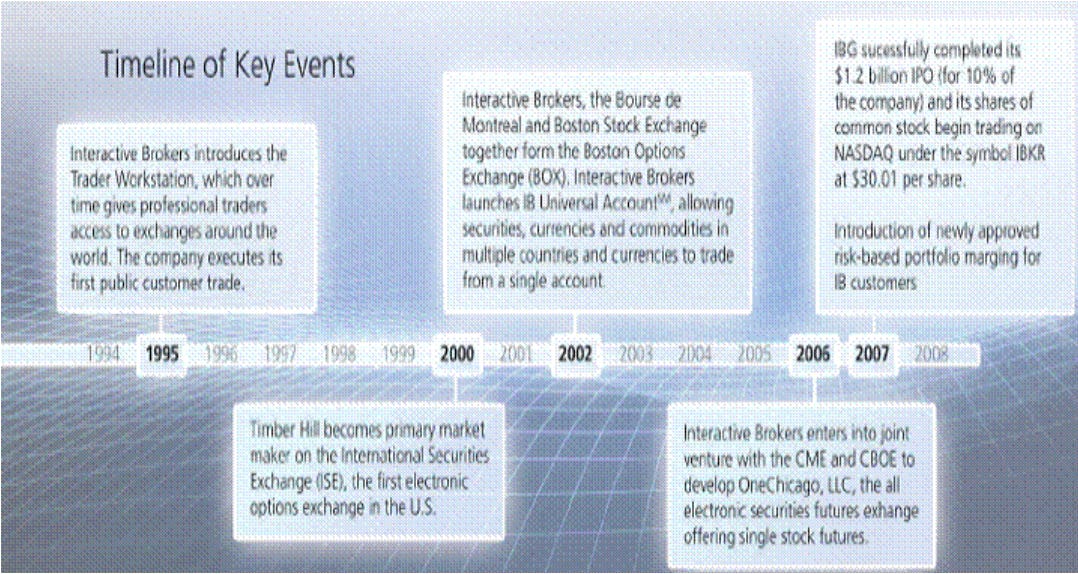

2007 marked the 30th anniversary of our founding and our first year as a public company. Throughout our history, we have maintained a single-minded focus on building a global marketplace connecting the world’s exchanges through automation, speed and efficiency.

We have uniquely positioned ourselves at the crossroads of four broad historic trends:

First, Globalization, that is, the coming together of the world’s economies via the integration of the world’s markets. Indeed, we have been integrating the world’s markets on our platform for many years and we are further advanced in our mission than anyone else in our industry. We provide liquidity and, in most cases, give our customers access to 70 exchanges in 25 countries in 14 currencies in stocks, futures, options and forex.

Second, Adoption of Technology. We have been the leader in applying computing and communications technology to the market making and brokerage businesses and we continuously adapt our processes to new technologies as they become available. Automation has two important advantages: First, software is less expensive and less prone to error than humans. And second, automation makes us one of the lowest cost producers in our industry. It explains the 70 percent pre-tax profit margin we achieved in the first quarter of 2008.

The primary advantage of our automated market making engine is providing quicker feedback of liquidity imbalances on markets around the world, which allows us to transfer liquidity from where it is available to where it is in demand. This is a mathematically complex process, a task for which computers and specialized software are ideally suited.

Our proprietary software, which we have been building for the past three decades, continuously communicates with liquidity centers, exchanges, clearing houses and our customers around the world. In essence, we function as a toll taker of sorts, by providing value in the form of liquidity and brokerage services to our institutional and professional investor customers.

The third trend we are witnessing is a Spreading Equity Culture around the world. A growing investor class, the popularity of derivatives, and the increasing acceptance of electronic trading and investing are all part of this phenomenon and are important trends that will continue to drive our business.

And finally, Optimizing the Allocation of Resources in this global network of electronic platforms is a long-term trend of our time. Electronic exchanges, clearing houses, brokers and customers make up the network. We have built ourselves deeper into this network than anyone else in our industry. Our early and continuous investment in technology has given us a significant advantage over our competitors.

Our goal is to become an ever greater part of this network by providing liquidity and state-of-the-art technology to a growing audience of institutional and professional traders and investors at the lowest cost worldwide. We expect to continue this integration effort by bringing new countries, new electronic exchanges and new products to our platform for years to come.

Thomas Peterffy

Chairman, Chief Executive Officer and President

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Copart, Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.