Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

Today’s letter is Scott Cook’s 1996 shareholder letter. This letter is particularly interesting because it was written in 1996, right as the commercial internet was picking up steam. It was also Intuit’s first year of really harnessing the power of the Internet. Scott starts by walking through Intuit’s many product offerings and business groups, then touches on their international operations and their acquisition of Parsons, lays out their operational achievements, recognizes management promotions and adjustments, shares some rationale and results from their sale of ISC, and then jumps into learnings from the internet and talks about the future of taxes.

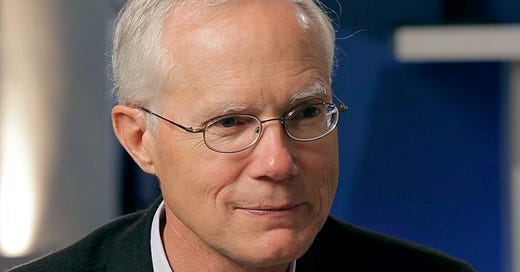

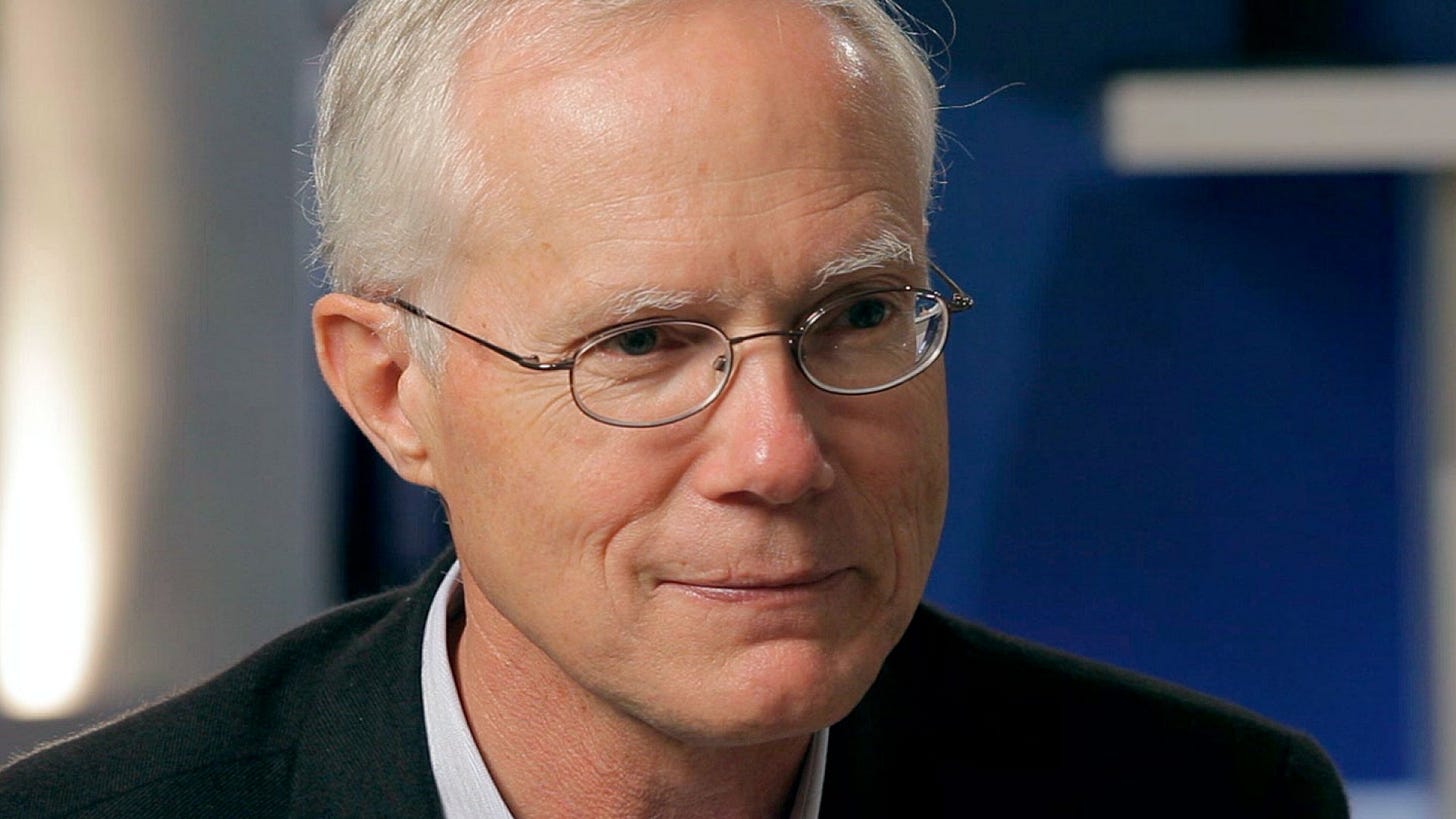

Scott Cook is the Cofounder, Chairman of the Executive Committee, and former CEO of Intuit. He founded the company in 1983 alongside Tom Proulx and has since helped grow the company into a ~$170B business. He served as President and CEO from 1983-1994 of the company before transitioning to Chairman of the Board, which he served as from 1993-1998.

Shortly after his transition to Chairman and Bill Campbell taking over as CEO, Intuit received an acquisition offer from Microsoft for $1.5bn (which would have been Microsoft’s largest acquisition at the time), with Bill Gates noting "Intuit is a phenomenal company and it is a unique situation where the sum is greater than the parts.” The deal was ultimately broken up by the DOJ due to regulatory scrutiny. In the 30 years since, Intuit has more than 100xed in the public markets, going from that $1.5bn acquisition offer to a $170bn market cap company.

Prior to founding Intuit, Scott worked as a management consultant at Bain & Co. in Menlo Park. He started his career at Proctor & Gamble working across a variety of marketing roles, including brand manager.

I hope you enjoy this letter as much as I do!

Related Resources

Letter

The Internet is a sea change. It's not the normal technology change that occurs every year. The Internet is a shift of giant proportion. The best response is to recognize the shift quickly and act decisively. This we are doing to unlock new opportunity for Intuit.

This letter summarizes the changes and the achievements of the year, and briefly describes how Intuit is using the Internet.

In fiscal 1996, revenues increased 28% to $538.6 million, up from $419.2 million in the previous year, reflecting strength across key parts of Intuit's core businesses. Income from continuing operations, excluding acquisition related charges, increased to $32.2 million in fiscal 1996. In fiscal 1995, income from continuing operations, excluding acquisition related charges and the Microsoft merger termination fee, was $27.5 million. Results reflect a higher mix of aggressively priced OEM sales, increased investments in new businesses and increased customer service costs.

Intuit's mission is improving the financial lives of consumers, small businesses, and financial providers. Our business has two characteristics: One, we choose markets where people's needs are durable and long-lived. Two, we target businesses where there is exciting opportunity. Opportunity possible because the pace of technology enables us to serve people's needs in better and better ways.

Tax

Let's start with tax, Intuit's largest business. Tax demand is durably reliable, just like taxes. Further, annual tax changes require customers to re-buy each year.

In fiscal 1996, Intuit's tax teams led us to new record highs in revenue, in units sold, in share of retail sales, and in profits. Tax profitability leapt up, with contribution as a percent of sales growing by over 10 points in our TurboTax® and ProSeries® businesses. I'm so proud of the work by our tax people in San Diego, Cedar Rapids, Edmonton, Fredericksburg, Tucson, and Munich.

In the fiscal year we began delivering state income tax solutions via the World Wide Web. This is just the beginning of using the Internet to re-engineer the tax process, further eliminating the hassle of taxes, and growing the share of tax returns prepared with Intuit technology.

Personal Finance

In Quicken® we are fortunate to have a business which both acquires new customers for Intuit and generates profits. Some companies spend a fortune to acquire new customers, in some cases spending $100 per new customer or more. In contrast, Quicken is a customer acquisition engine that generates profits, too.

Quicken gives Intuit an asset of over 9 million active users, up from 8 million last year, which is a key driver in the success of many of our new businesses: QuickBooks®, the Quicken Financial PlannerTM and Intuit's new on-line businesses. This is why we manage the Quicken business for customer acquisition, even when that means pricing that lowers current revenue growth and profits, as it did in fiscal 1996.

This year the Quicken teams made a giant leap with Quicken for '97 which made its debut on October 24, 1996. Its new design is stunning. Quicken for '97 pioneers new ground in combining the best of the Internet with the best of client software. Quicken delivers speed of use that the Internet alone just can't on dial-up lines. And the Internet gives Quicken up-to-the minute currentness--delivering late-breaking financial news, stock quotes, and more, including a unique system that brings the "best of the Web's" financial sites right into Quicken.

Business Products

Small businesses must keep books. Capturing more of this durable demand has become an increasingly important part of our business. Intuit technology now does the books, taxes, or both for over 3 1/2 million businesses, and is used most often by the business owner. Only a handful of firms worldwide reach so many businesses and business owners.

In fiscal 1996, our QuickBooks® business achieved new record highs in revenue, in units sold, in share of retail sales, and in profits. I'm so impressed with the QuickBooks teams' progress in customer learning, product design, engineering process, tech support, and marketing. One success was the introduction of QuickBooks ProTM. Pro's average selling price is twice that of basic QuickBooks, which improved profit margins.

QuickBooks Pro's success shows the potential for more advanced business products and services to reach new markets at higher price points. We are spending to develop these technologies in fiscal 1997 for shipment in subsequent fiscal years.

Electronic Financial Services

Eighteen months ago Intuit worked with only a handful of financial institutions in the United States. Now Intuit software or Web sites are used by over 100 U.S. financial providers and more providers overseas. In the U.S., these relationships include 40 financial institutions, over 60 mutual fund families, and 5 insurance companies. This list includes 11 of the top 20 domestic banks. Intuit's insurance progress comes from collaboration with Interactive Insurance Services, a company we acquired in June 1996. The results in mutual funds come from a longer collaboration with GALT Technologies, a company we acquired in September 1996.

International

Intuit's penetration of international markets has increased, paced by growing adoption of PCs worldwide. While this work has been difficult and expensive, Quicken is now in 15 countries outside the United States and tax is in 4. Small businesses are a particular focus since in every country businesses must keep books. In Japan, Intuit merged with Milkyway, a leading accounting software maker, to address this growing segment in one of the largest markets in the world. Also in the year we successfully launched QuickBooks in Germany, as well as Quicken in France and Spain.

Parsons

When we acquired Parsons Technology in fiscal 1995, we saw great potential, not only in Parsons products, but in Parsons' mastery of direct marketing skills. This year for example, Parsons grew legal title unit volume 65% via direct and retail marketing of the Quicken Family LawyerTM and the new Quicken Business Law PartnerTM.

Coping with legal and regulatory requirements is one of those durable realities of life. Legal software is already Parsons' largest business, and we have only begun to apply technology and the Internet to ease the burden of complying with government rules.

Financial Supplies

Intuit's Financial Supplies group again delivered substantial growth and new record highs in revenues and profits. This was paced by dramatic process re-engineering that moves orders directly to the printing plate, saving costs and slashing delivery time by four days. Supplies' phone staff has focused on selling, producing sizable increases in average order size.

Sales, Service and Operations

1996 was a year of tremendous achievement by Intuit's customer support, sales, and service organizations.

Intuit's retail sales organization led us all on one of Intuit's core values: do right by the customer. Their expertise and trusted relationships led to new ways to build our customers' revenue and profit.

Intuit's service teams moved to integrating sales with service, paced by the Parsons, Supplies, ProTax, and Direct Sales and Service groups. This was aided by vastly better matching of workforce to the 5X swings in call volume we receive. The result is less time on hold and more time to serve and sell.

Powerful Web sites take technical support, too. Intuit's Alexandria and Fredericksburg units have pioneered tech support for Intuit's InsureMarketSM Web site with advanced software enabling our phone support people to see the page the caller is using.

Operations pioneered innovative ways of distributing new products. For example, "virtual warehousing" significantly reduced time to market for new products.

At the same time, Intuit's service costs are higher than we want. Our goals are to provide these service levels at significantly lower cost.

Management

As we have grown to about 3,500 employees, the management team, under Bill Campbell's tremendous leadership, has grown in its capability and leadership. To that end, Bill has organized a senior management team of Executive VP Bill Harris managing our Tax and Financial Services businesses, Senior VP Eric Dunn leading our Quicken, Banking and International groups, Senior VP Jim Heeger managing our Finance, Operations and Customer Services teams, Senior VP John Monson heading our Small Business and Financial Supplies initiatives, VP Alan Gleicher running sales, and VP of Human Resources Mike Ahearn, all reporting to Bill Campbell. To this group of executives falls the responsibility of developing the generation of leaders capable of capitalizing on the changes in our business.

Sale of Intuit Services Corporation (ISC)

On September 16, 1996 we announced the sale of our private network hub and bill payment processing operation to CheckFree Corporation. We concluded that we weren't world class--as we needed to be--in high volume transaction processing. These businesses were retarding the acceptance of our other efforts by financial institutions and they were painfully diverting money and management time from the businesses we are really good at. At closing, Intuit will receive CheckFree stock worth over $227 million valued at the market price at the time of the announcement, a five-fold return on our total investment in a business we were in for just over two years.

Instead of using only ISC's private network, we will use the Internet for connectivity to Quicken and other products. This communication will use protocols open to all financial institutions, processors, and software firms--a set of protocols called OpenExchangeTM.

The Internet and the Future

The Internet means change. The Internet means choice. The Internet does not change people’s fundamentals.

I can summarize our first year of Internet learning in three points:

The Internet means change. Those who don't change will get left behind.

The Internet means choice. Alternatives are now just a click away. Those who aren't best of breed, and don't enable their customers to use the best of breed, will get left behind. That's the lesson we learned from our billpay business.

The Internet does not change people's fundamentals. Their hopes and fears, their passions and pains, and their financial needs remain profound and durable.

Intuit's mission remains profound and durable: to change for the better how people and small businesses manage their financial lives. And to change for the better how financial providers reach, sell, and serve many of their most attractive prospects.

What does the future hold? The Internet opens exciting new opportunities, often the result of the collaboration of many companies via open standards, like OpenExchange.

Tax Returns in the Future

Taxes will be re-engineered so data like 1099's flows in electronically, delivering completed tax filings with very few keystrokes and no paper. One's portfolio and spending records will similarly be automatic. Businesses will send bills electronically and have payments booked automatically, saving money and time.

Technology will aid making confident decisions in a financial world that's increasingly complex. These include making decisions on insurance, as we're pioneering with our InsureMarket Web site and major carriers including State Farm, Allstate, Zurich Direct - a unit of Zurich/Kemper, and John Hancock. And decisions on mutual funds, as we're pioneering with our NETworthTM Web site together with dozens of fund families. And decisions on retirement and 401(k) planning, as we've announced we're pioneering with Fidelity Investments.

Internet-driven software will enable one's trusted financial advisor to know when and how to serve the client better. For financial providers, electronic channels will become essential to reach a growing segment of upscale customers. These channels will use technology and trust to acquire customers and build revenues at lower cost to the financial provider.

None of this future is easy or inevitable. Great progress will be achieved only through the energy, inventiveness, and teamwork of the people of Intuit and our partner companies.

Scott D. Cook

Chairman of the Board of Directors

October 17, 1996

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.