Letter #167: Sergio Marchionne (2015)

Chairman and CEO of Ferrari and CEO of Fiat Chrysler Automobiles | Confessions of a Capital Junkie: An insider perspective on the cure for the industry's value-destroying addiction to capital

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

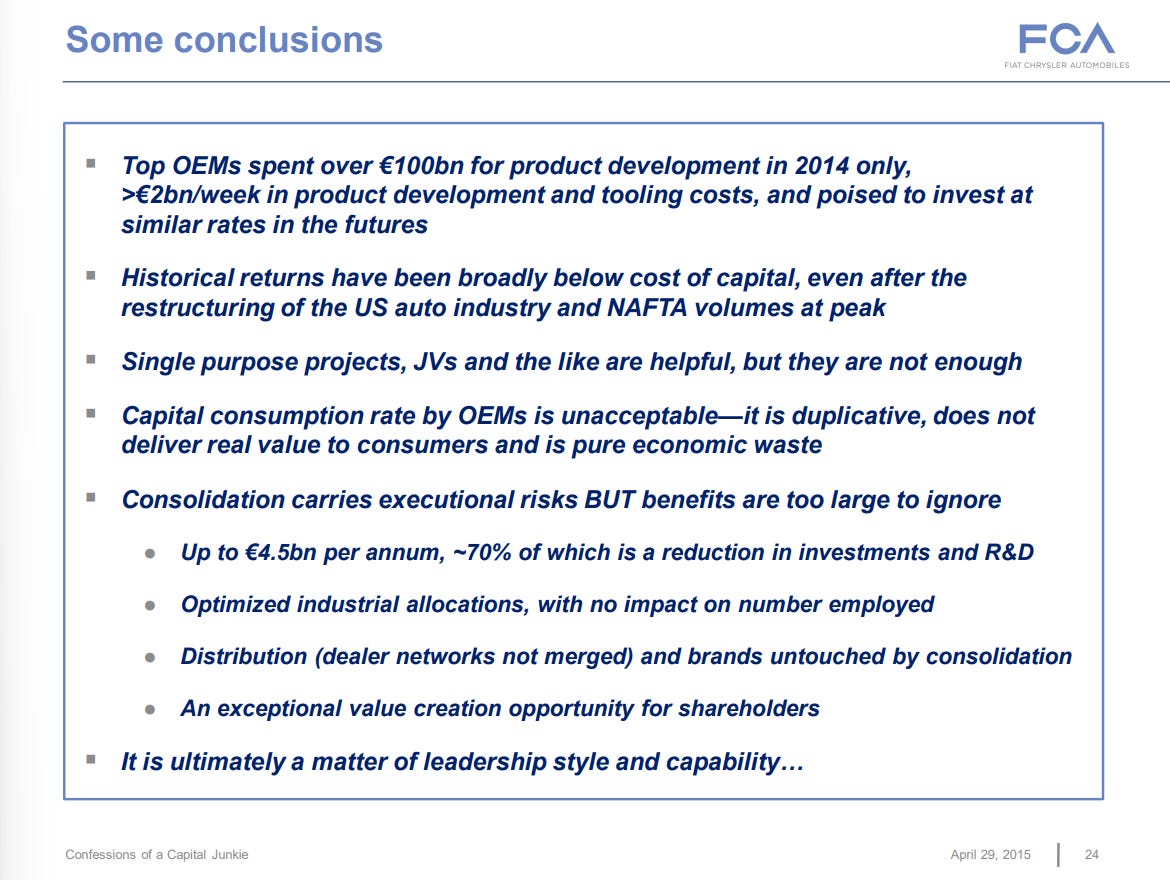

Today’s letter Sergio Marchionne’s 2015 presentation Confessions of a Capital Junkie: An insider perspective on the cure for the industry’s value-destroying addiction to capital. In this presentation, Sergio argues that the automobile industry had not earned its cost of capital over a cycle and that consolidation was the key to remedying the problem. He emphasizes that the presentation is not an excuse for FCA’s industry standing, but about choosing between mediocrity or fundamentally changing the paradigm for the industry.

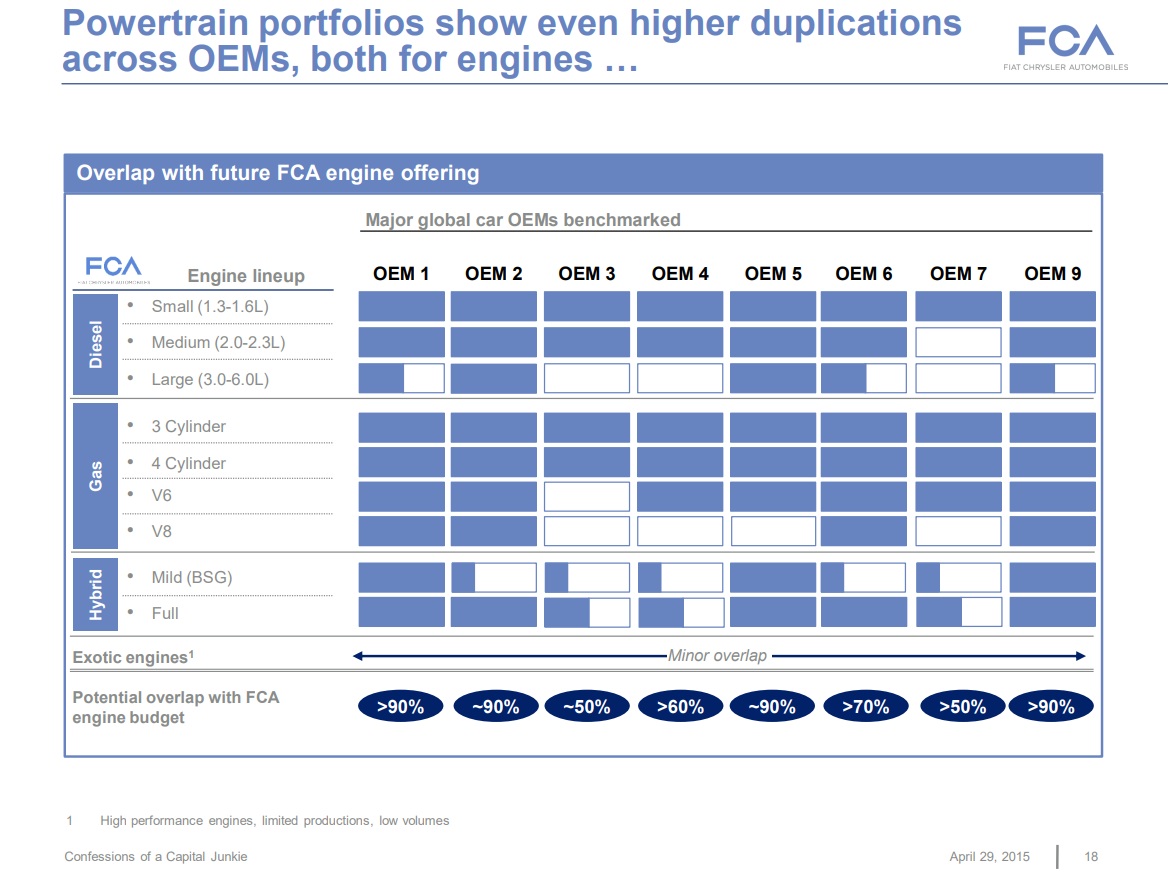

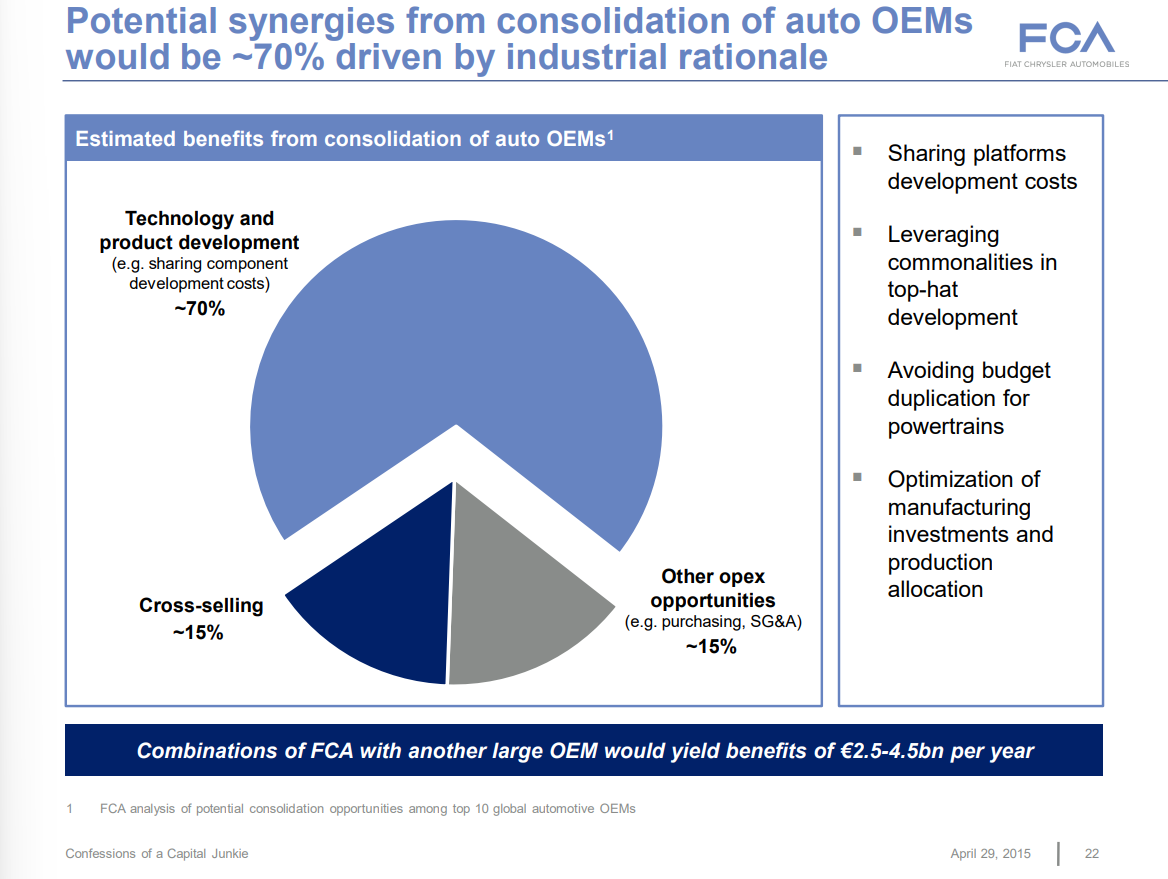

He starts the presentation by showing that the auto industry’s capex and R&D requirements had grown significantly, then explained why going forward, new technological challenges would only increase the capital requirements. He then showed that product development costs were consuming value at a much faster rate than in other industries, and that high operational leverage amplified profitability swings across the cycle, which resulted in structurally low and volatile returns. He argues that this is the result of OEMs spending vast amounts of capital to develop proprietary components, many of which aren’t discernible to customers. He then walks through proposed industry solutions, including one focused on reducing the number of active platforms and increasing scale, some OEMs trying larger scale commonization across diverse brands, and others who were doing one-off co-ops, JVs, and other types of equity tie-ups. He ends by explaining why those approaches haven’t worked, before laying out his case for industry consolidation and sharing conclusions.

Sergio Marchionne was Chairman and CEO of Ferrari, CEO of Fiat Chrysler Automobiles (FCA), and Chairman and CEO of FCA US LLC. Sergio started in career in 1983 as an accountant and tax specialist for Deloitte in Canada. He left Deloitte to become the Group Controller and then Director of Corporate Development at the Lawson Mardon Group. He then moved to Glenex Industries, where he was an EVP. After Glenex, Sergio served as VP of Finance and CFO at Acklands, and then VP of Legal and Corporate Development and CFO of the Lawson Group. After Lawson was acquired by Algroup, Sergio remained, and became CEO after 3 years. During his tenure, Algroup spun off the Lonza group, and Sergio became its CEO and Managing Director. Two years later, he became the CEO and Managing Director of SGS S.A. A year after he joined SGS, Sergio was elected an independent board member of the Board of Directors of Fiat S.p.A, where he was appointed CEO just a year later. In 2009, after Chrysler emerged from Chapter 11 bankruptcy protection, Fiat received a 20% stake and Sergio was appointed CEO. In 2016, Sergio was appointed CEO of Ferrari, where he oversaw its IPO and subsequent spin-off from FCA.

Related Resources

Automobile Companies

Slides

Slide 1

Slide 2

Slide 3

Slide 4

Slide 5

Slide 6

Slide 7

Slide 8

Slide 9

Slide 10

Slide 11

Slide 12

Slide 13

Slide 14

Slide 15

Slide 16

Slide 17

Slide 18

Slide 19

Slide 20

Slide 21

Slide 22

Slide 23

Slide 24

Slide 25

Slide 26

If you got this far and you liked this piece, please consider tapping the ❤️ above, subscribing, or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta (Facebook) and interesting new frameworks like the Consumer’s Hierarchy of Preferences.

Cloud Valley — Beautifully written, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “An international treasure”.

Memos — A selection of some of my favorite investor memos.

Bookshelves — Collection of recommended booklists.