Letter #172: Ryan Israel (2021)

Partner & CIO of Pershing Square Capital | Music is Universal: Music Industry Overview

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Today’s letter is the Music Industry Overview section of Pershing Square’s 2021 presentation Music is Universal on Universal Music Group, presented by Ryan Israel. In this section, Ryan dives into the music industry, covering streaming, monetization, entertainment value, long-term prospects, industry investments, business quality, improving value propositions, in-demand content, compares the music streaming and video streaming businesses, record label risk, and how streaming benefits the entire music ecosystem.

Ryan Israel is a Partner and the Chief Investment Officer of Pershing Square Capital, which he joined in 2009. Ryan started his career at Goldman Sachs in the Technology, Media, and Telecom group.

I hope you enjoy this presentation as much as I did!

[Transcript and any errors are mine.]

Related Resources

Pershing Square

Bill Ackman Compilation (3,671 pages)

Activist Investors

Dan Loeb Biography (Highly Recommend)

Dan Loeb Compilation (682 pages)

Carl Icahn Compilation (275 pages)

Yahoo! Activism Compilation (Carl Icahn, Dan Loeb, Jeff Smith, David Sambur, Eric Jackson)

Transcript + Slides

Slide 1

Slide 2

Thanks, Bill. As Bill discussed, when you look over the last 20 to 30 years, there's been a dramatic shift in the industry. And as a result, streaming is now the preponderance of the revenue for Universal as well as for the industry overall. And so as you can see on the current page, which represents the overall US market, which is also the world's largest music market and the world's largest streaming market, streaming is over 70% of the total revenue that the industry generates. If you look over the last three years, streaming has grown at more than 20% annually. And even last year, during COVID, streaming grew at a mid teens rate, which is really incredible. And we think likely to continue for the foreseeable future.

Slide 3

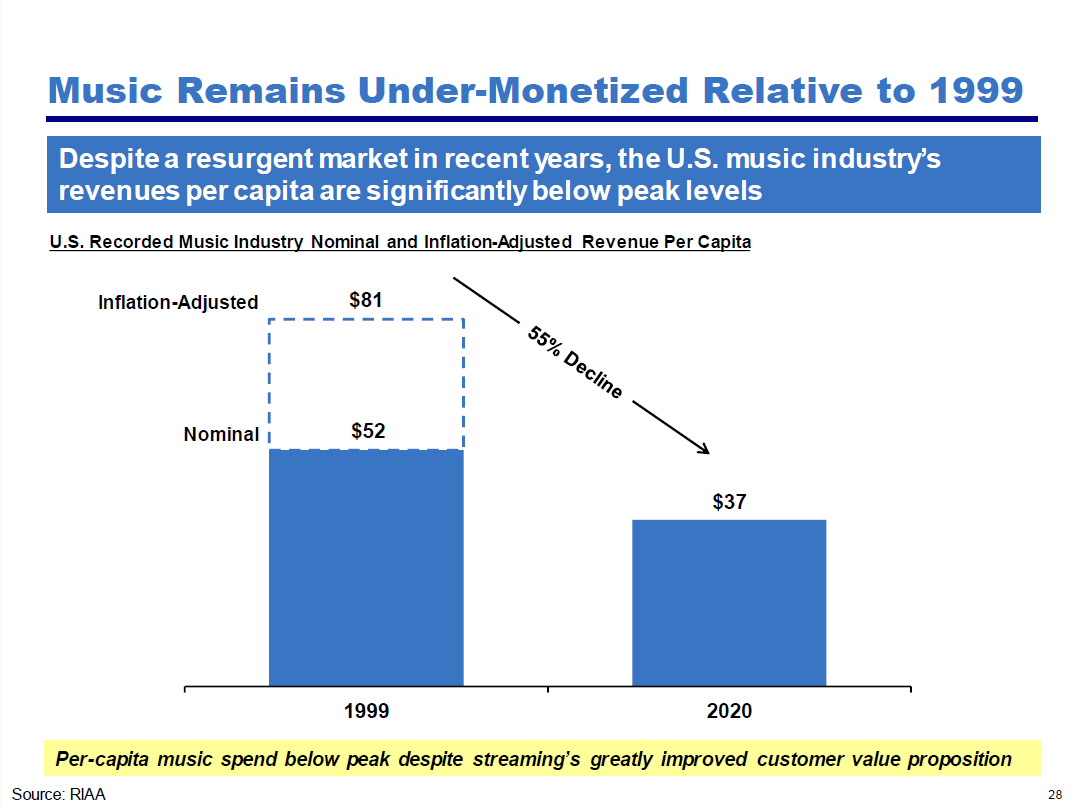

Despite this growth, what's interesting to us is the--effectively, music is not monetized as high as it was even 20 years ago when the format was not nearly as efficient and didn't offer as much of a consumer value proposition. And so what you can see, again, for the US market, is that the average person, or the per capita spend on music, last year, was about $37, which is a significant decline from what people spent in 1999, more than 20 years ago. And if you inflation adjust the dollars that they spent over 20 years ago to make them current with what that money would buy today, it represents over a 50% decline.

Slide 4

One of the reasons that we are excited about music is because it's such a high value form of entertainment, that costs so little. It's really probably the cheapest form of high value entertainment you can find. And we estimate that it costs about 10 cents per listening hour, which is just incredible, when you think about some of the other things that we enjoy doing and how much they cost. Even some of the other low cost forms of entertainment, such as video games, are about 5x as expensive, or watching your favorite cable TV show can be about 8x as expensive. And we think this provides an opportunity, over time, for music streaming to continue to grow, as well as to improve the monetization levels for the foreseeable future.

Slide 5

So overall, as I think you've heard from Bill, and as we believe, we think streaming growth over the long term is likely to remain at a very high level due to a couple really attractive characteristics. First, music's unique, and it has an enormous addressable market. Music really is universal. Almost everybody listens to music. Consumption of music is at an all time high. And what's unique about it is people enjoy listening to the same song many, many times. And music is the ideal short form content to consume, because you can use it as a primary activity, you can have in the background, and overall can enable any other activity that you're doing to be enhanced. And you can do it almost every single hour that you're awake. Some people even do it while they're sleeping. We also think it offers an amazing value proposition. Just about everybody on the planet who has a smartphone today can get a library of 60mn songs on demand with just a little click on their phone or the computer. At the same time, you're adding tens of thousands of songs a day. Spotify is adding, itself, about 60,000, and there are several other music providers out there that are adding tens of thousands more. You can also personalize the music. Artificial intelligence can suggest you songs to listen to. There are a lot of curated playlists. And so it's never been easier to consume music in the way that you want and listen to the songs that you love the most, or even songs that you're going to love that you didn't know that you were looking for. And overall, it's an incredible value. Today, you can listen, for an entire month worth of--most of the songs that have ever been produced that matter--for the cost of buying less than one CD 20 years ago. And when you compare streaming of music relative to other things that you stream, or other forms of entertainment, it's an incredible bargain. It's a little bit less than half the price of Netflix, it's about a third of the price of digital TV, and it's 1/10th of the price of your basic cable package. So music is an essential form of entertainment, and it's one of the lowest cost forms of essential entertainment.

Slide 6

One of the things that we really liked about the industry is that a lot of the most well capitalized and largest technology companies are investing significant dollars in order to drive the growth of streaming. So everybody knows about Spotify, which you can see is by far and away the leader of paid streaming users today. But what's interesting is some of the largest companies, whether it's Apple or Amazon or Google, they're investing very heavily to build their own streaming services, because they view music as a really important tool to better cultivate their customers, to be able to sell them other products outside of music. And we think that investment is going to continue to drive the growth of the market [in a newer] to UMG's benefit over time.

Slide 7

So streaming is an incredibly high quality business. We talked about how it generates a recurring stream of revenue over time, and nothing is a better example of this persistent high growth than the successful performance during COVID last year. But what's also interesting is how streaming drives enhanced profit margins at the same time. Under kind of the old world before the transformation, in a physical environment, you had to invest very heavily in manufacturing and distribution. Today, in a streaming world, those costs no longer exist, which makes it a much higher profit margin. What's great about the business is, Universal is able to take the savings on manufacturing and distributions, and invest it by paying artists an even higher royalty rate on streaming than they did previously, when they had to distribute the music in a physical environment. So artists make more money. But at the same time, those savings on manufacturing more than offset the incremental rates that they pay to artists. So it's a more profitable model for the record labels as well. And then lastly, it's an improved mix of the high value back catalogue, which has songs that are older than three years. More people listen to the catalog in a streaming world than they did in a physical, which makes a lot of sense, because you're more likely to listen to a song you heard 30 years ago that you liked, when you have 60mn songs at your fingertips, than you are to have to go out and buy that record in order to listen to that music. And what's great about the catalog is it's a much higher margin business than the current--or what they call frontline music today that's less than three years old--because a lot of the costs that you incur for the catalog happened many years ago, when you were first creating that music when it was new as well.

Slide 8

So a lot of people today will say, Well, what's the value of a record label? It's never been easier, Spotify is around. There's a lot of services that help artists be able to create music and upload it rapidly. But the problem is, that's available for every artist now. And so while it is easier to distribute music, or to make your own music than it may have been in the past, the problem is, every single artist has that advantage. And so you've had a proliferation of music by every single artist in the world. How does anybody stand out? And the answer is, the record labels can become critical. They still are very important to producing and distributing high quality music around the globe, but they're even more critical than they've ever been in helping artists break out. And helping established artists continue to maintain their popularity. So if you kind of take it from the new artist perspective, the labels are experts in finding and breaking these new artists. To some extent, the digital service providers such as Spotify make it easier for the labels to be able to spot trending talent, and then help bring them in, and further be able to break that talent by providing funding, providing marketing dollars, collaborating, and a lot of the relationships in the industry that are so important for new artists to break out. And as we talked about, there's really no way that any artist today who doesn't work with a record label has a real shot at being able to become the next big artist without the record label's help. At the same time, for the established artists, record labels matter more than ever. We think about what a record label provides: world class marketing, global operations, which help artists go from wherever their local geography is all around the world by being able to link them with consumers from all different places--they really have unrivaled distribution. And those things matter a lot to maintaining and helping expand the popularity of even established artists in any market. At the same time, the streaming industry has transformed data and analytics. There's an amazing amount and wealth of information that the record labels have and own in a streaming world that was just not possible for them to receive 20 years ago in a physical world. And they can use that data to help best understand and be able to share with artists ways that artists can improve their performance, help them better engage with their customers. And lastly, as I mentioned previously, the royalty rates in the streaming world are much better for the top and established artists, and that provides them an additional value when they're getting a growing stream of revenue off of which they get a royalty, plus a higher royalty rate. So we really think that the record labels have an advantaged position in the streaming world for both new artists and established artists.

Slide 9

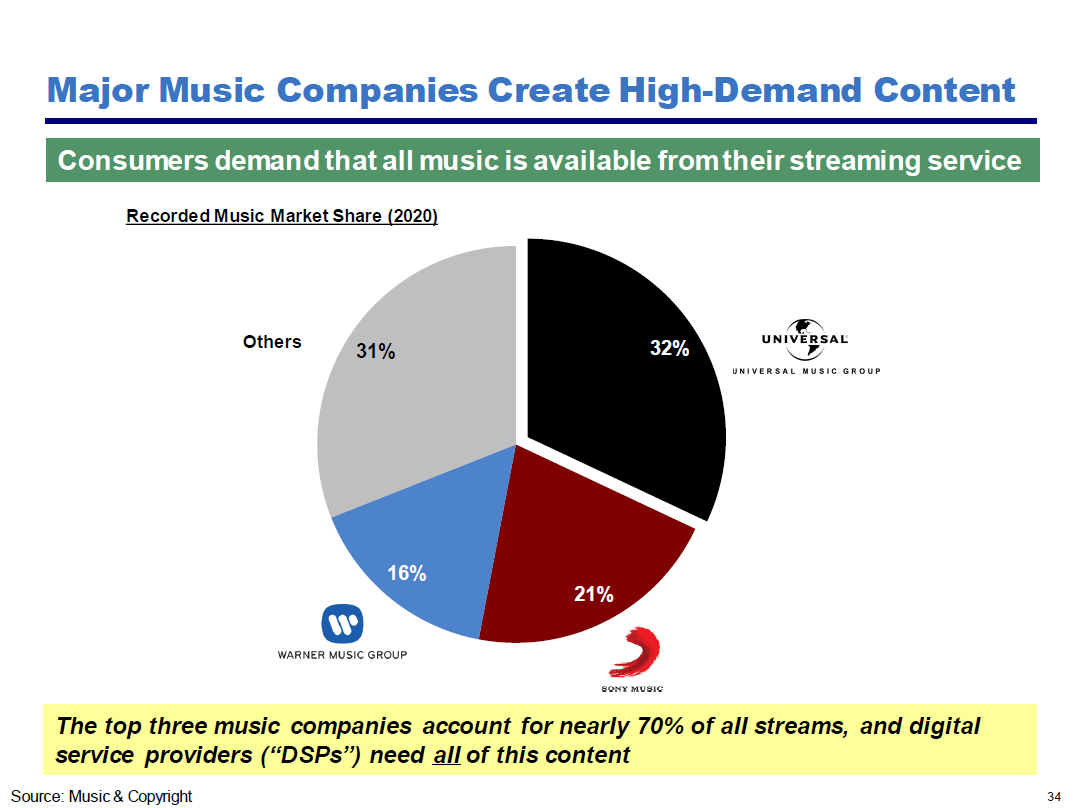

One of the things that's amazing about the industry overall, is that the music companies create such high demand content, and that consumers need all of that content to be on any streaming service that they find that for. And so when you look here at the the market share chart that we have, the top three music companies: Universal, Sony, and Warner account for nearly 70% of all the streaming that happens in just three companies. And by far and away, UMG is the market leader. And all of the service providers, think your Spotifys, Amazon, Apple, they need all this content from each of the labels in order to be attractive to their customers. And so that gives the labels a lot of negotiating leverage with the content providers.

Slide 10

And that's one of the reasons that we think, when we make an analogy to the video industry, why music content is much more valuable than video content is in a streaming environment. Because the record labels and publishers have much better bargaining power with the content distributors than is the case in the video. So for example, in music, each of the providers needs effectively all the music that matters in order to be attractive to their consumers. And that's not the case in video. The digital service providers really only need a critical mass. You may not, as a consumer, need Spotify and Apple and Amazon to listen to music. But a lot of people who stream probably have a handful of apps. You probably have Netflix, Hulu, and perhaps another service. In the music world, there's only really three people who produce 70% of the content, whereas in the video world, there's an enormous number of people that produce content. In music, distributors have very little of their own exclusive content, whereas in video, think about Netflix--there's a lot of exclusive content there. And then in music, the content's effectively evergreen. You can listen to your favorite song hundreds of times, whereas in video, most people only watch something once, and even your favorite shows you've probably only watched a handful of times over again. And then as we mentioned before, music is just so complimentary. It's compatible with so many activities, it can be listened to so frequently, whereas video generally requires your full attention, and it's just not something that you can listen to in the background as easily during all of your waking hours.

Slide 11

At the same time, we think that the streaming world has really lowered the overall risk for record labels. They're able to use more data in order to improve their decision making, and at the same time, the upfront costs are lower, which results in lower investment risk. So in terms of the data, the labels are able to have much better artist discovery, and enhance the promotion of their existing artists when they utilize the data to better improve the decisions they're making, as well as using data to figure out which artists are likely to be successful. From a manufacturing perspective, not having to have physical inventory or have large amounts of startup costs for distribution or manufacturing, significantly reduces your inventory risk. And from an artist perspective, because in a streaming world people are getting paid off of and only need to create individual tracks in order to make money, you don't need to invest in a full album before you get the feedback from the data and gauge the consumer reaction before you produce incremental songs, which is good for both lowering risks for the artist and the record label as well. And then lastly, the data that the labels gain allows them to enhance the value they can provide an artist. At the time of signing or renegotiation of a contract, the label is able to show all of the data, very concretely, to the artists that the label brings, which is something they couldn't do prior to the transformation of the physical world. And at the same time, a lot of the data that the labels own and get, they're able to use to help artists better engage with their fans.

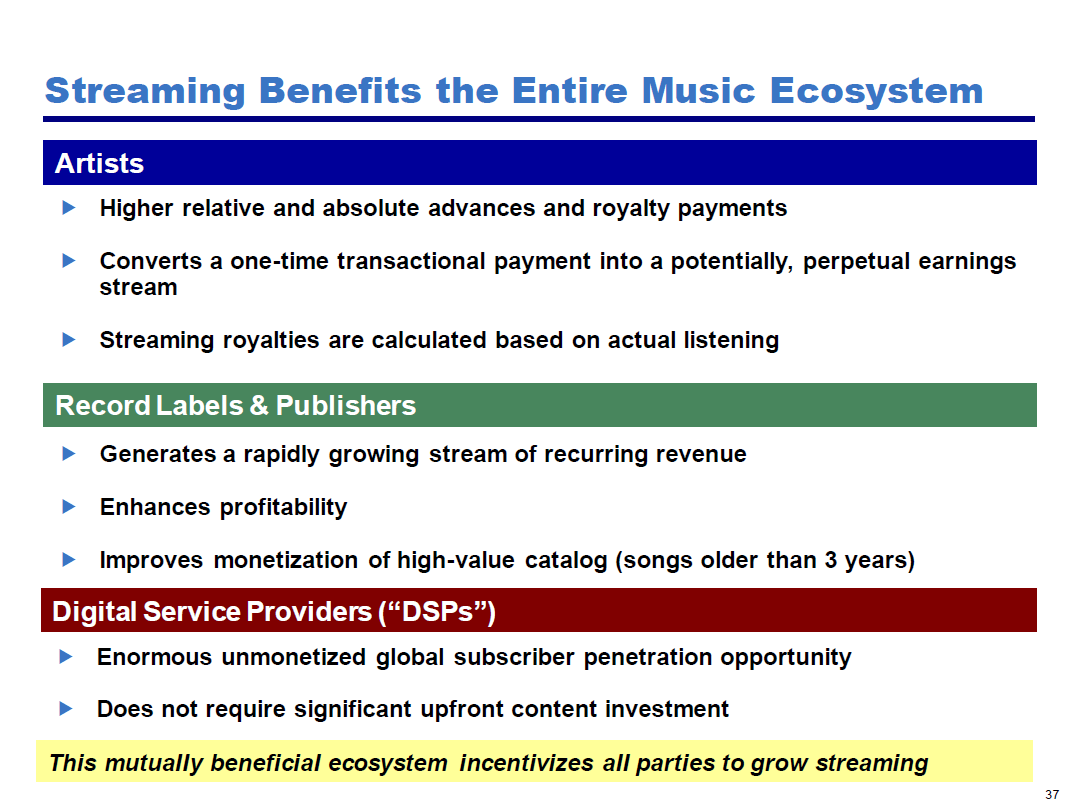

Slide 12

So overall, what we like about streaming is it's a growth industry, it's creating a very attractive situation for the labels, but it also benefits all of the parties who play in the broader music ecosystem. If you think about it from the artists' perspective, the artists are able to receive higher royalty rates off of a much larger and faster growing revenue pool than in the past, the artists are able to take what was previously a one time transactional payment, for example, when someone would buy a CD, and they've converted that into what could potentially be a perpetual earning stream. And lastly, streaming royalties are based on actual listening, and so artists that produce more hit songs that are listened to over and over again make more money. So it's more democratic from the artist perspective and how they're paid. From the standpoint of the record labels and the publishers, they're generating a rapidly growing stream of effectively royalties on music, they have enhanced profitability because it's higher margin, and they're improving listening, and ultimately, the monetization of the catalog, which is very attractive. And then from the digital service providers, the Spotifys and Amazons and Apples of the world, there's an enormous opportunity of people who, over time, will become subscribers that are not yet subscribers today. And they don't have to invest in the content in the same way that in the video world Netflix does. And so we think the fact that this system benefits all parties is likely to continue to enhance the growth over time.

If you got this far and you liked this piece, please consider tapping the ❤️ above, subscribing, or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta (Facebook) and interesting new frameworks like the Consumer’s Hierarchy of Preferences.

Cloud Valley — Beautifully written, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “An international treasure”.

Memos — A selection of some of my favorite investor memos.

Bookshelves — Collection of recommended booklists.