Letter #181: Chi-fu Huang (2013)

Long-Term Capital Management Partner & Head of Asia and Platinum Grove Founder | From Theory to Practice: A Thirty-Year Journey

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Last week was all about Berkshire Hathaway and value investors—so today, I wanted to share the career retrospective of a legendary quant.

Today’s letter is a presentation by Chi-fu Huang titled “From Theory to Practice: A Thirty-Year Journey.” In this presentation, Chi-fu shares his life story, from his college years in Taiwan to his grad school years in the US to working with and becoming one of the most accomplished quants in the world. He discusses key learnings and results from his PhD dissertation and time at Goldman, LTCM, and PGAM.

Chi-fu Huang is a private investor who most recently founded Platinum Grove Asset Management (PGAM) with Nobel Laureate Myron Scholes, and served as CEO and CIO from 1999-2009 and Non-executive Chairman from 2010-2013. While he was CEO and CIO, PGAM was one of the largest fixed income relative value focused hedge funds in the world. Prior to founding PGAM, Chi-fu was a Partner of Long Term Capital Management (LTCM) from 1995-1999 and the Co-Head of their Asia office from 1997-1999. Before LTCM, Chi-fu was the Head of Fixed Income Derivatives Research at Goldman Sachs from 1993-1994. Chi-fu was originally just supposed to visit Goldman for a year while on a leave of absence from MIT, but after just six months, was asked to stay permanently and become the head of their Fixed Income Derivatives Research Group.

I hope you enjoy this presentation as much as I do!

Relevant Resources:

Slides

Slide 1

Slide 2

Slide 3

Slide 4

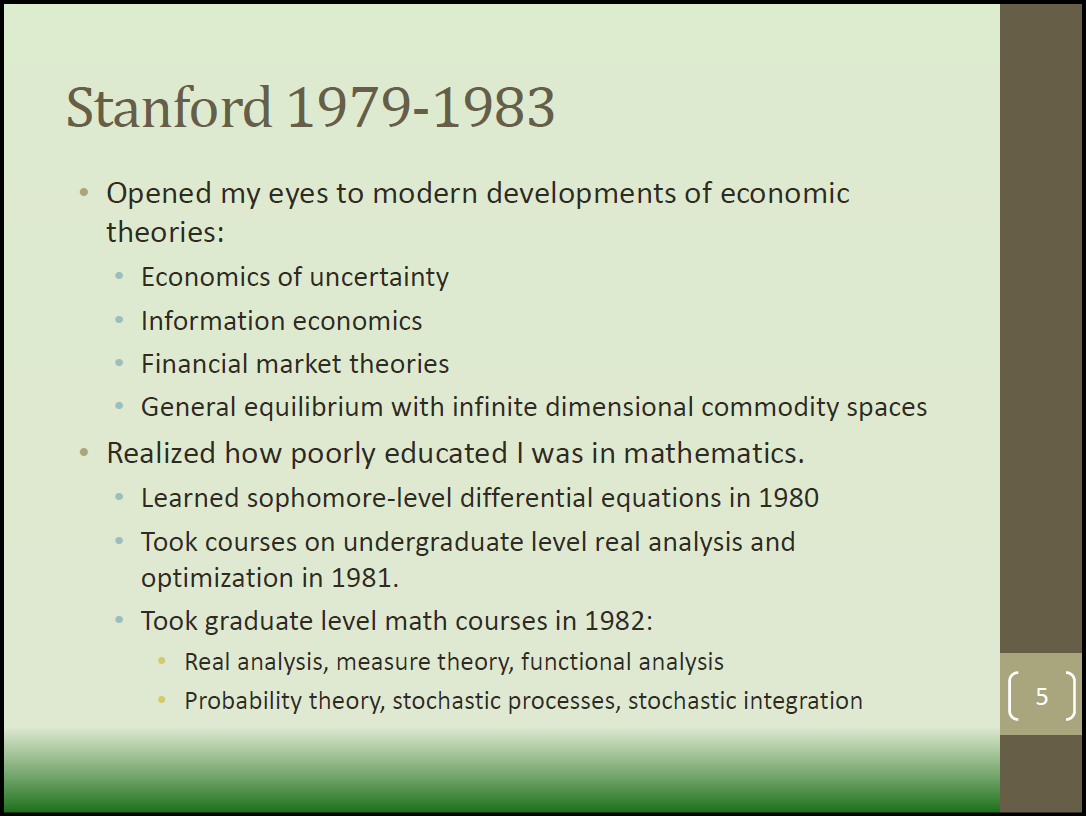

Slide 5

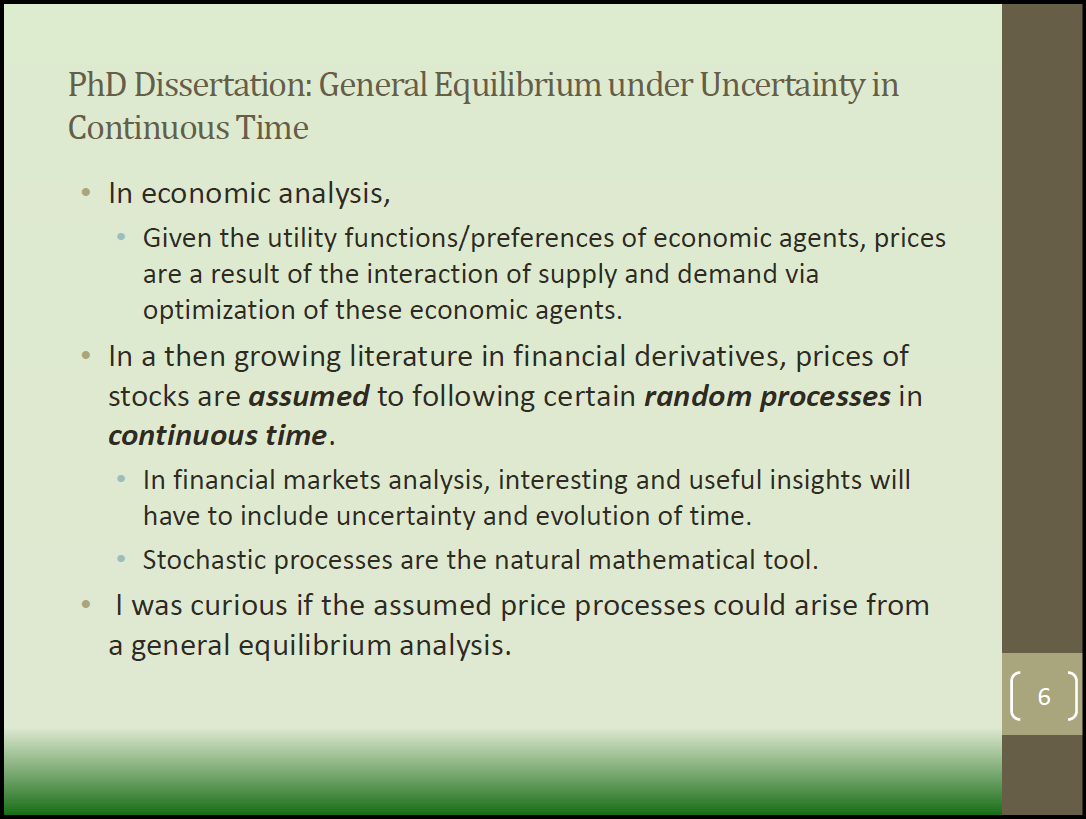

Slide 6

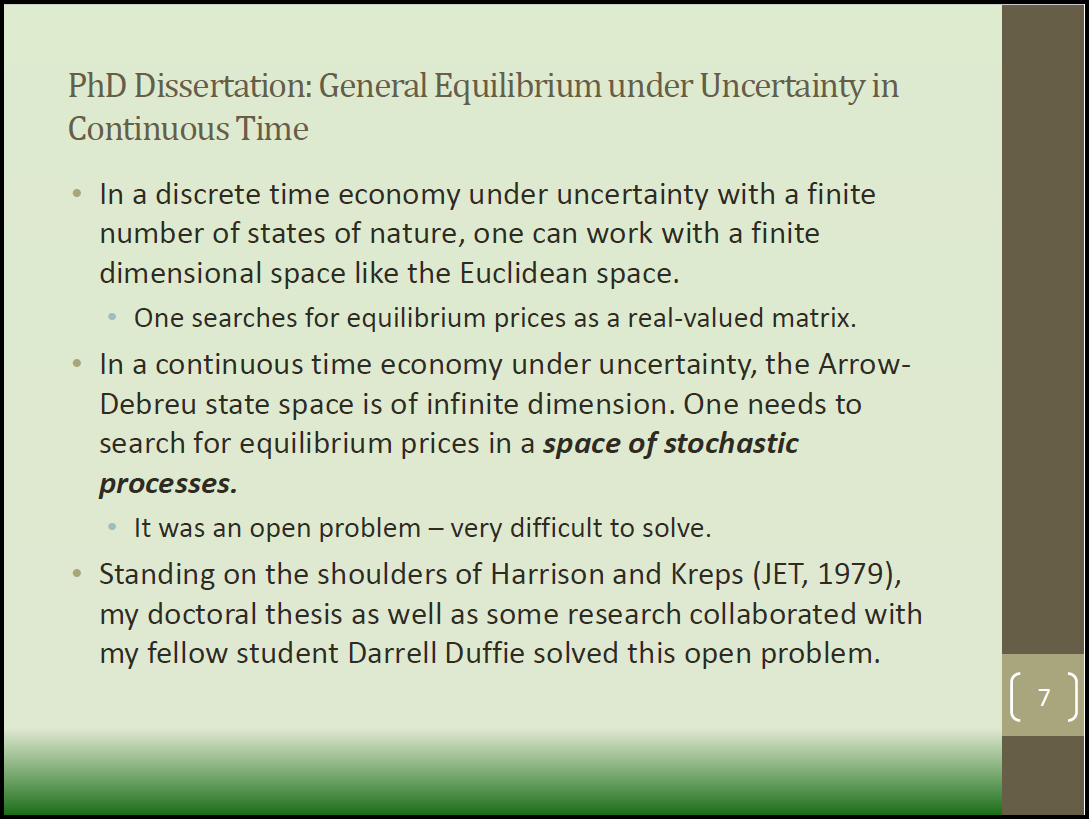

Slide 7

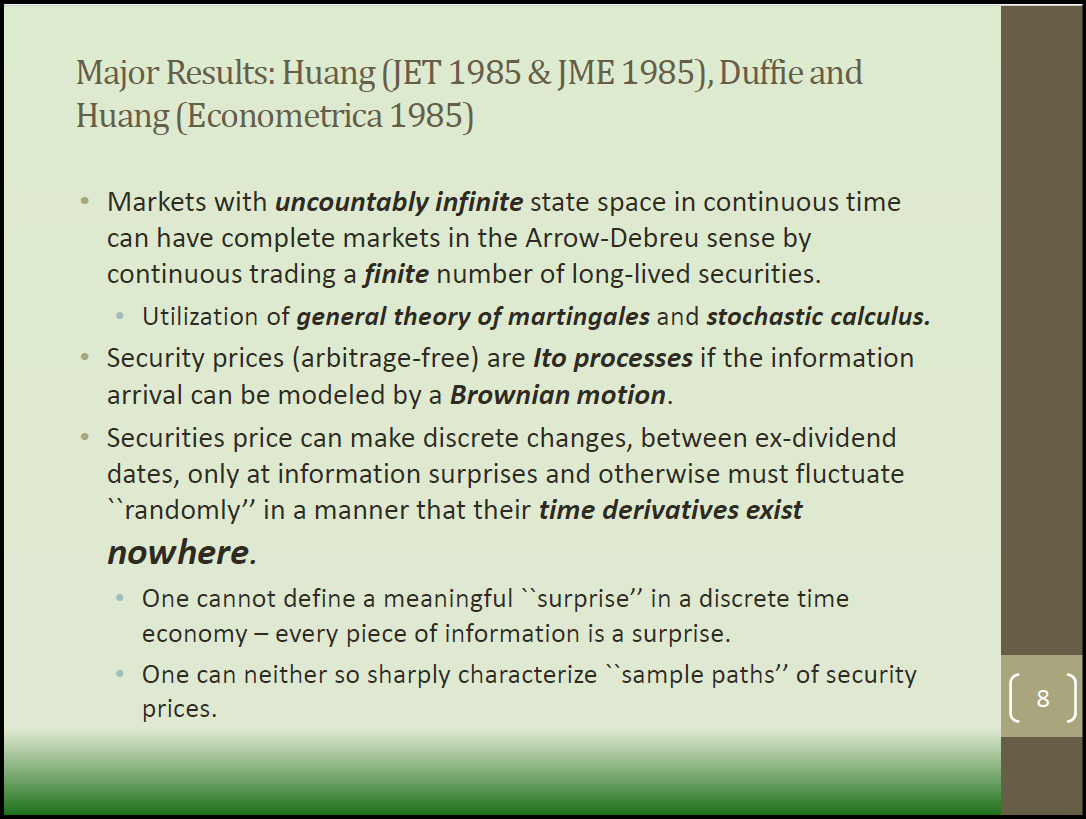

Slide 8

Slide 9

Slide 10

Slide 11

Slide 12

Slide 13

Slide 14

Slide 15

Slide 16

Slide 17

Slide 18

Slide 19

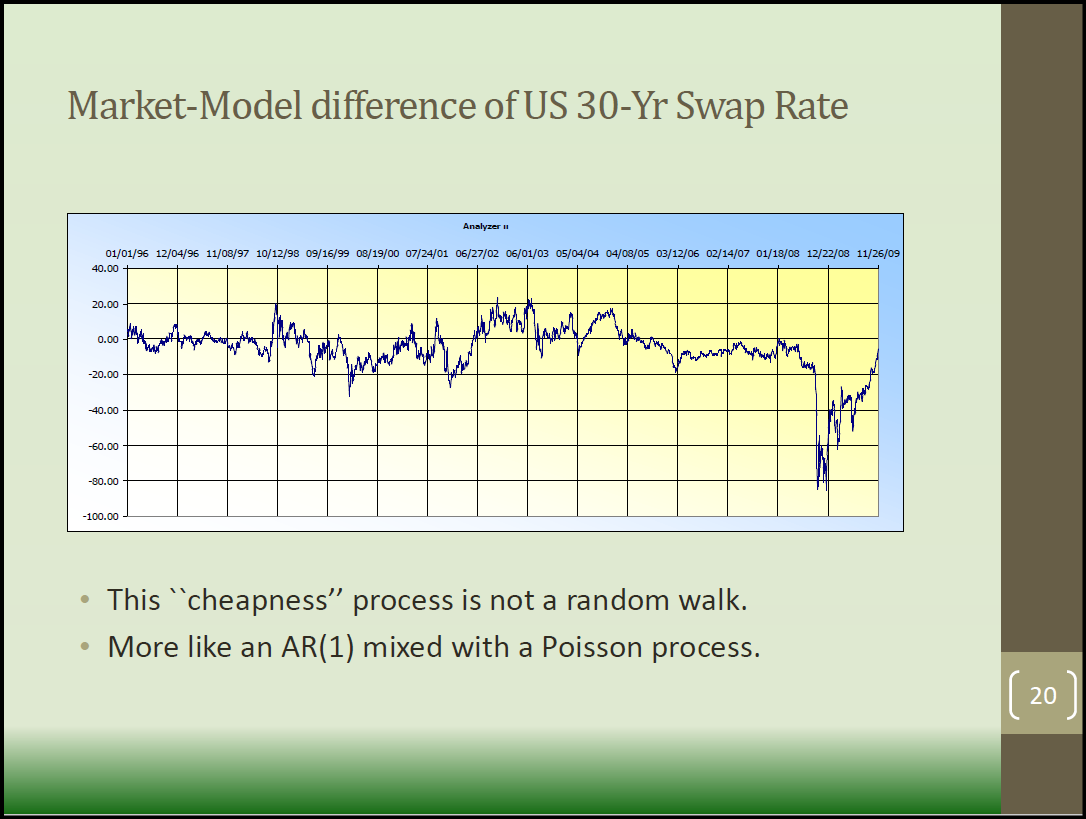

Slide 20

Slide 21

Slide 22

Slide 23

Slide 24

Slide 25

Slide 26

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.