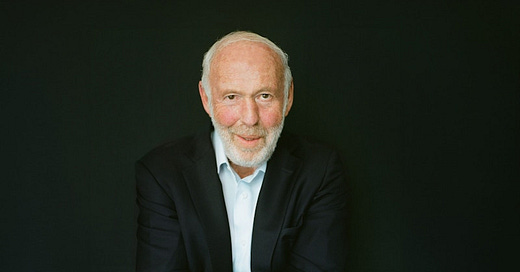

Letter #182: Jim Simons (2022)

Renaissance Technologies Founder | A Short Story of My Life and Mathematics

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Yesterday, Jim Simons passed away. While Jim is well known today as the founder of Renaissance Technologies, he was always a mathematician at heart. So today, I’d like to share with you a talk he gave in 2022 about his life and relationship with mathematics. If there is interest, I will share a letter/transcript focusing more on Jim’s philosophy on and adventures in finance in a future letter.

In this talk, Jim tells the story of his life. He starts with a powerful 20 word summary of his life: “I did a lot of math. I made a lot of money. And I gave almost all of it away.” He then jumps into his story, starting with his early fascination with mathematics and then diving into his formal education in the subject, particularly differential geometry, first at MIT and then at UC Berkeley. He then discusses his time breaking Russian codes at the Institute for Defense Analysis and developing an interest in minimal surfaces. Next, he shares how he joined Stony Brook University and started working on closed, three dimensional spaces—work that resulted in the Chern-Simons Theory, which was later applied to physics and developed a life of its own. Jim ends the talk by touching on his investing career and transition to philanthropy, which was spearheaded by his wife.

Jim Simons was the President and Founder of Renaissance Technologies. He started his career in 1961 teaching mathematics at MIT and Harvard. In 1964, he began working with the National Security Agency (NSA) to break codes as part of the research staff of the Communications Research Division of the Institute for Defense Analysis (CRD of IDA). After leaving the IDA, he joined the faculty at Stony Brook University, where he served as Chair of the Math Department from 1968-1978. While at Stony Brook, Jim began investing in his friends’ companies, and in 1978, left academia altogether to run a fund that traded in commodities and financial instruments on a discretionary basis. In 1982, Jim founded Renaissance Technologies on the basis of a strong belief in the potential of technical trading models. In 1988, Renaissance launched the Medallion Fund, which is known as the greatest investment fund of all time. He led and managed the day-to-day operations of the fund until his retirement at the end of 2009 before transitioning to non-executive chairman, which he served as until 2021.

Relevant Resources:

Transcript

Well, the short talk is this: I did a lot of math. I made a lot of money. And I gave almost all of it away.

That's the story of my life. Now, it's a good story. But it's short.

So, when I was a little boy, I liked math in the sense that I liked to--when I was three or four or something like that--double the numbers: 2, 4, 8, 16, 32, etc. I got up to 1024, and I said: Enough of that. But I liked doubling numbers.

And when I was a little boy, also, I was in my father's--my father was driving me and he said he has to go to a gas station and get gasoline. I said, Why do you need to get gasoline? He says, Well, the car needs gasoline. I said, But you shouldn't need to have to get gasoline. You could just use half of what you now have, and then half of that, and half of that, and half of that, and you'll never run out of gas! Well, that was called Zeno's paradox. But of course, it didn't occur to me that we wouldn't get very far either. But there it was.

But I did always, always like math. And I went to MIT, and I took a graduate course, right in my freshman year, which was puzzling to me-- was abstract algebra. But during this summer, I figured it all out. I got a book, I figured it all out.

And then took a lot of math courses at MIT. And, well, the field that I really liked was called differential geometry. How many of you have you ever heard of differential geometry? Okay, we old folks know about differential geometry. Well, differential geometry is a study of curved spaces in many dimensions, typically with a metric on it, so you can see how far apart any two points would be. And I really liked that field.

And well, I went to Berkeley--forgot my... I graduated MIT in three years, so I stayed as a graduate student for a year. And then they told me, You should go to Berkeley. I said, Why? Why should I go to Berkeley? They said, Well, the great man in your field, differential geometry, a man named Chern, is just going to Berkeley. And you should work under Chern. So I said, Okay. So I went out to Berkeley.

Regrettably, Chern was taking a sabbatical leave that year, and so he wasn't there. So I work with someone else, and that worked out fine. It was interesting, working with this guy. I came up with a little theorem, and I showed it to him. And he said, Oh, that's a nice little theorem. It puts in mind an open question, which I won't really describe to you, but don't work on that question. I said, Why? He said, Because it's too tough. This one worked on it and tried, and that one worked on it and tried. Well, of course, that just sort of got me going. And I said, Okay, but I'm going to work on this problem. And well, I did. And I solved the problem. And I was very pleased with myself, and went back to teach at MIT and Harvard.

But for reasons which I won't go into, I needed money. And I had borrowed money to invest in a company with some friends of mine, and I needed to pay it back. But there was a place in Princeton called the Institute for Defense Analyses, which was a highly classified place under the Aegis of the government, the Defense Department, and what we're supposed to do is break Russian codes. Well, that was an interesting challenge. I liked the work. They told us you could do your own mathematics up to half your time, but the other half, you had to do this code cracking business.

And well, during that period, I was very interested in an area of mathematics called minimal surfaces. Does any of you know what a minimal surface is? Well, someone must know what a minimal surface is. Okay, so a minimal surface is a surface of minimal area with respect to its boundary. So imagine taking a wireframe, just any closed frame, dip it in soap suds, and then take it out, and there'll be a film that is bounded by this thing. And that film, that soap film, has less area than any other surface with that boundary. So that's a minimal surface.

And the first Fields Prize winner, back in maybe 1905, had proved that any such boundary would have a minimal surface--just one--and it would be smooth. It wouldn't have any points or anything like that. It would just be a nice, smooth surface.

And as I said, he won the Fields Medal for that. And so I got interested in that area while I was there at the Institute for Defense Analyses. So in my spare time, which was quite a lot, I worked on that problem. Because in higher dimensions, it was an open problem. Someone had done it in one dimension higher, so that would be a three dimensional surface with a two dimensional boundary in four dimensional space. And well, but that's where it stopped.

So I worked on that problem in higher dimensions, and was lucky enough to solve the problem through ambient dimension seven. But in dimension eight, my proof didn't work. And I constructed what I thought was a counterexample. A counterexample was something that you think you've proved this theorem, but someone comes along with an example that shows you didn't prove that theorem, because this was a counterexample. So I found what I thought was a counterexample. I couldn't prove it. But a couple years--the paper got published--it was was a pretty good paper, actually. And--but a few years later, a couple of mathematicians, one of whom was named Bombieri, showed that my counterexample was really a counterexample. So that killed the problem altogether.

Well, at a certain point, I came to Stony Brook University--I was 30 years old--to be the chair of their math department, which was not a very strong department. And I was pretty young to be the Chairman. But I thought it would be fun. And I had a lot of money to work with, because the governor at the time was a guy named Rockefeller.

Now, I think everyone has probably heard of the name Rockefeller--but has anyone not heard of the name Rockefeller? Okay, most of you have heard of Rockefeller. Rockefeller loved the State University, and was pouring money on it. So I had a lot of money to work with, and hired some terrific people. So, hired some terrific people.

But at the same time, in that timeframe, I started to get interested in another area of math. And I worked on that area and came up with something really quite beautiful. In three dimensions. It was a function--I can't really describe it, but it lived in three dimensions. Closed, three dimensional spaces. And I was quite pleased. I showed it to Chern. When I say I showed it, I sent it by the mail, because in those days there was no email. And Chern said, Well, you've done this in three dimensions, but it should work in all dimensions. I was very dubious. But I said, Okay, let's work together and see. And he was right. It would work in all dimensions. And I was very pleased.

We published the paper. And about five years later, a physicist named Witten saw this paper and thought--and he was right--it could apply to physics. And then some other physicists saw how it could apply to physics. I didn't know any physics at all. Chern might have known something, but it never occurred to him that would apply to physics. And remarkably--so, you never know where something will go. You think you're doing math--you're actually doing physics, maybe. Or whatever.

So today, that is called Chern-Simons theory. It's all over the place in physics. On average, every day, four papers in physics reference this Chern-Simons theory. So I can't take any credit for it at all, but there it was. And of course, I'm quite pleased about it. But I can't say that I invented this, the physics.

Well, shortly after that, I started to get interested in the world of investments. I had come in to a very small amount of money, but it was enough to start investing. And one thing led to another. I started hiring people. And we made what was called a hedge fund. And it was remarkably successful. It's still going. I'm not with it anymore, but I made a tremendous amount of money from this hedge fund.

Now, my lovely wife, Marilyn, said, Let's give some a bit away. So I said, Okay, fine. So we gave some charity. And then she said, Well, why don't we start a foundation? And, okay, we start a foundation. She started a foundation, I put money into it.

The good thing about putting money into a foundation is you can give the money away, you get the tax advantage, but it doesn't have to be spent immediately. So you can put money into the foundation and say, Well, we'll see what we want to do with it tomorrow or next year or whatever.

But it grew and grew and grew. So it, today--Oh, well, we decided to focus on science with our foundation. Focus on science. 90% of it should be science, 60 of that should be basic science, and 30 of that could be translational science. And 10% could be education and outreach and things like that.

So today that foundation is extremely large. And so most of the money that I made was put into the foundation. So I'm not so rich as I was before, but rich enough. And we had this wonderful foundation. And running it most of the time was my wonderful wife. Any questions? No questions.

Audience Member: Yuri's there too?

Jim Simons: Yeah, Yuri is in the foundation. He just talked.

Audience Member: How did you manage to get such a wonderful wife?

Jim Simons: That's a very good question. I could go into that, but it's a long story. So I won't. Any other questions? Okay. Good luck to all of you.

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.

I am struck that Jim Simon was interested in minimal surfaces as a young man. I'm finding out that this 1880's discovery of geometric spatial design by a brilliant geometer (like Jim) named Hermann Schwarz has applications in physics as well as the structural and manufacturing domain in which I am applying it.

what a great style of talking. reading it reminds me of rene goscinni kids books. minds that can handle great complexity are also able to speak in the simplest way, awesome