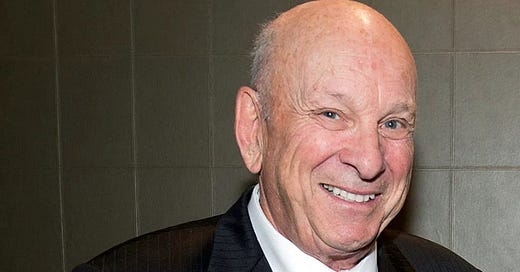

Letter #197: Seymour Schulich (1997)

Cofounder of Franco-Nevada Corporation | Interview at the Western Investment Mining Conference

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Today’s letter is the transcript of an interview conducted with Seymour Schulich at the Western Investment Mining Conference in San Francisco. In this interview, Seymour discusses his large cash position and weathering the storm, how optimistic he is about the price of gold, how he is thinking about allocating capital and whether he is looking to bargain hunt for cash strapped companies, being the banker to the gold mining industry, his involvement in selecting properties to put in his portfolio and collect royalties on, the hit their stock price had recently taken and how it had held up well thanks to diversification, their ability to make money and what might damage it, new royalties, how the Franco-Nevada and Euro-Nevada companies differ in their structure, and what he’s saving $500mn worth of cash for.

Seymour Schulich is best known for being the first person to apply the oil and gas royalty model to the gold business with the Franco-Nevada Mining Corporation, which he grew from an initial market cap of $2.3mn in 1983 to more than $3bn in 2002 when it merged with Newmont Mining. He started his career at the Shell Oil Company, moved on to Eastern Securities, and then joined the newly formed Beutel, Goodman & Co., where he became a Partner and VP, then Vice-Chairman Emeritus as the company grew into one of the largest pension fund management firms in Canada (in 2023, they managed >$43bn CAD.

While at Beutel, Seymour became the first person to apply the oil and gas royalty model to the gold business when he cofounded Franco-Nevada with Pierre Lassonde with the hopes of gaining consistent revenue from production protected from cyclical prices. He and Pierre then formed a second royalty company, Euro Nevada, and expanded their portfolio of royalties into other metals and commodities. One of them, the Midas gold-silver property, became one of Nevada’s most profitable mines, and was subsequently acquired by Australia’s Normandy Mining for 20% of its shares and a 5% royalty. When a South African company made a bid for Normandy in 2001, Seymour and Pierre convinced Newmont Mining to make a rival bid for Normandy, and at the same time acquire Franco-Nevada through a friendly merger. Franco-Nevada shareholders ended up with a 32% stake in the world’s largest gold-mining company, while Schulich became a Director of Newmont Mining and the Chairman of Newmont’s merchant banking division, Newmont Capital.

I hope you enjoy this interview as much as I did!

[Transcript and any errors are mine.]

Related Resources

Energy Investors and Operators

Jack Welch Compilation (101 pages)

Transcript

Richard Saxton: I'm Richard Saxton at the Western Investment Mining Conference in San Francisco. My guest is Seymour Schulich. He is the chairman of Franco and Euro Nevada mining companies, which combined, would be the 26th largest company on the Toronto Stock Exchange 300. A couple of very large companies, primarily in the mining royalty business, and you have a big cash position. So you're probably weathering the storm pretty well.

Seymour Schulich: Thank you. Yes, sir. Our cash is, in aggregate, about $500mn US. And we have a positive cash flow. And we are weathering the storm, and, contrary to a lot of people, quite optimistic about gold.

Richard Saxton: How optimistic are you? And where do you see the price of gold going from these low levels?

Seymour Schulich: Well, let's jump back a second as to why we're optimistic. We believe that gold is doing its job. If you live in Thailand, and you'd invested in gold, you've seen your own currency drop dramatically, approximately 35-40%. And if you had invested part of your savings in gold, that has not gone down at all. The same thing is true of the Philippines. The same thing is true of true of Indonesia. And Korea. And if we go back a year ago, I mean, gold has done its job in Mexico, it's done its job in Russia. If you lived in Kuwait and you put some money in gold prior to the invasion, it did its job over there. South Africa is another country. All the Latin American countries right now. As a matter of fact, if you take the world population, I would say gold is doing his job for about 80% of the people in the world. It's a store of value and it's a better means of saving than holding paper money, which is produced very easily on printing presses.

Richard Saxton: So it's really in US dollar terms, what you're saying, that we've seen a major drop in the price of gold.

Seymour Schulich: Yeah, I think--yeah, there's been a drop in the price of gold in US dollars. The consumption this year is up 17% in total. It's up 6% in the last quarter. And our problem has been with the central banks, I think... and it's quite an enigma, because most of the central banks are long the commodity. So why it's in their interest to denigrate it is a little hard to understand. I think the World Gold Council will be making an effort to get the story of gold across to the central bankers. I just came from two days of meetings with them. And we are allocating a much larger proportion of our budget to liaison with central banks and to try to establish a commonality of interest with the central bankers. Because we think we're all in the gold boat together. And we don't understand why it's in their interest to basically be driving the price down.

Richard Saxton: So what are you looking to do? Are you looking to bargain hunt, maybe for companies that are going to be strapped for cash at this price level?

Seymour Schulich: Well, the IPO market has been cut off right now for most of the companies. We regard ourself, in many ways, as a banker of last resort to the industry. We're looking, like a lot of people, for low cost world class projects. We hope in the next year or two to get involved in two additional projects to what we already have on our plate. We have very good growth profile, we're bringing on-stream a mine in Northern Nevada, and our royalty stream is continuing to grow as we bring on new properties that we invested in a few years ago. So our outlook is pretty good, irregardless of what's happening in the market, which is--market's really determined by the marginal share that's traded. I mean, sometimes less than 1/10th of 1% of the shares outstanding will trade, and it determines the price. So there is a bit of a sale going on right now in gold shares and on gold itself. If gold keeps falling, I think you'll see 25-30% of the mines in the world shut down. And when you invest in a commodity where it can't be produced by a lot of the players at these prices, that's a very good sign that the commodity is probably selling very near its low.

Richard Saxton: And over the last 15 years, have made a lot of people very wealthy, including yourself. An interesting concept in basically being, as you were saying, the banker to the gold mining industry.

Seymour Schulich: We basically... through either buying existing royalties or creating royalties through lending money to companies, have created a portfolio of royalties in the business. And many people think our business is more akin to banking than it is to mining, and that has in fact been the case for the last 15 yours. And we've come from $2mn originally, raised in 1983, to a total market cap in US dollars today of the two companies of $3bn US. So we've had a fair amount of success.

Richard Saxton: And a lot of that, I mean, is due to yourself in selecting the properties that you want to put in the portfolio and collect royalties on. You've got to be very cautious in that selection.

Seymour Schulich: Well, I'm the banker, but I have a partner that's a mining engineer by the name of Pierre Lassonde and he's been instrumental in the property selections. We also have royalties in oil and gas. We have royalties on over 2mn acres of productive oil and gas lands in Canada. And we also have platinum royalties and--but 90% of our business is gold royalties.

Richard Saxton: Your stock has taken a little bit of a hit, I guess, with the mining industry, but has held up well, because of the diversification.

Seymour Schulich: I think we were the last ones to go down. And we've had about 33% taken off our market valuations in the last month or so, in concert with the group. Usually, the rule of thumb is the last firms to decline are the first ones to rebound. And we hope that'll be the case with us.

Richard Saxton: Your earnings are going up. I mean, you're continuing to make more money. What would damage that? Would it be just a further decline in the volume price that stopped mines from producing?

Seymour Schulich: We've had a number of new royalties come on-stream in the last year, the Miko mine being the major one operated by Barrick. We have a 4% net smelter return royalty and a 5% net profit interest there. And that's been the main driver behind the increase in earnings. And there's been two other properties, the Briggs and Rosebud in Nevada that have come on-stream in the last 12 months that are also fueling the earnings increase.

Richard Saxton: So you're optimistic for both companies--or, Franco and Euro, how do they really differ in their structure?

Seymour Schulich: Franco is more diversified into other materials, Franco is involved in oil and gas royalties, and in Platinum royalties, and other commodities like uranium, copper. It's still--87% of its income is derived from gold, but it has got a diversified feature. Franco is primarily involved in Canada and the US. Euro-Nevada is primarily involved in the US and Australia, is pure gold, and has a portfolio of 21 gold royalties today that are in all-in production.

Richard Saxton: I guess the big question is, with that 500mn in cash, what are you saving it for?

Seymour Schulich: Well, we're saving it for a rainy day. And it's raining out. And our experience in the business from 15 years in merchant banking is--after a seminal event like the Bre-X situation, you get your best bargains about 12 to 18 months from that event. And when seven months have gone by, so somewhere between five and 10 months from now, you can expect us to do one or two things that hopefully are of a size that will have an impact, positive impact, on both our companies.

Richard Saxton: So it's a buying opportunity for Franco and Euro Nevada?

Seymour Schulich: Bear markets are good for us, no question about it.

Richard Saxton: Thank you very much for spending the time. Great meeting you.

Seymour Schulich: Thank you for your interest.

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.

Very interesting article 👍