Letter #20: John Carter and Sherman Fairchild (1957)

President and Founder of Fairchild Semiconductor | 1957 Fairchild Shareholder Letter (Fairchild Semiconductor section)

Hi there! I go by KG, and I love studying the history of business and investing. I’ll be sharing some notes from one Investor/Shareholder letter per weekday (mostly from my compilations) here.

Today’s notes are on the Fairchild Semiconductor section of Fairchild Camera and Instrument’s 1957 Annual Report. This was Fairchild Semiconductor’s first year of incorporation after the “Traitorous Eight” left Shockley Labs.

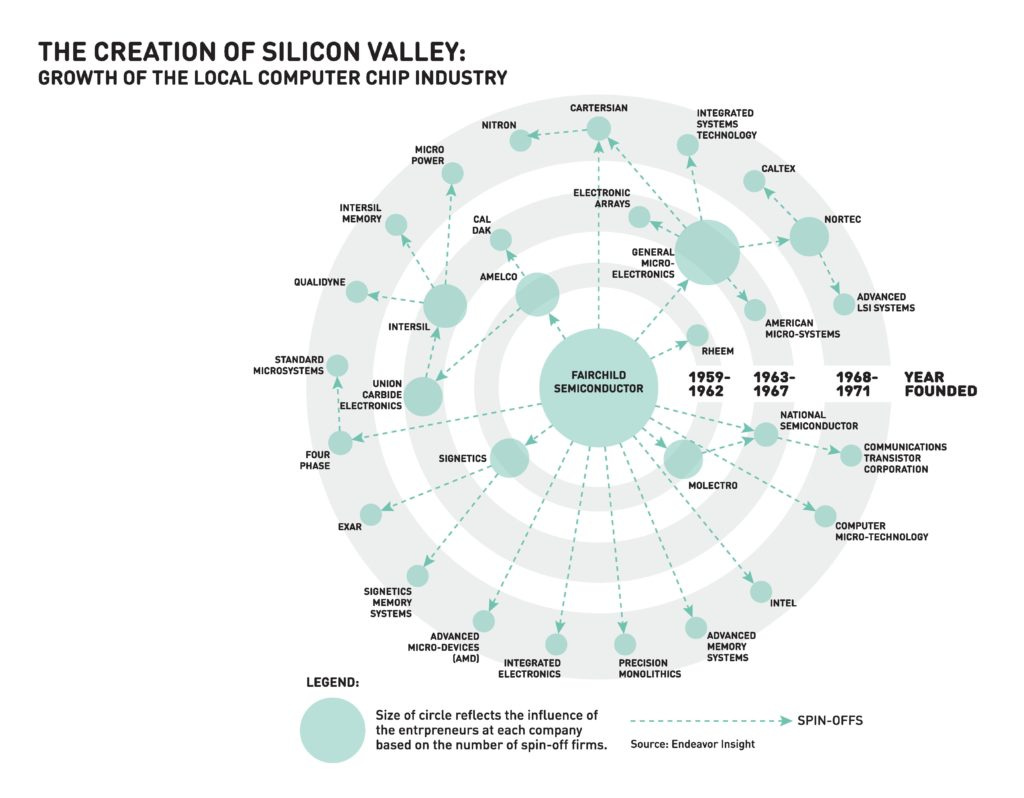

For a little more background, Fairchild Semiconductor is considered the first “Trillion Dollar Startup,” as the company spawned hundreds (thousands?) of ventures that established Silicon Valley as a world center of entrepreneurial activity and technological leadership. Although the firm’s market valuation never exceeded $2.5 billion, its surviving combined progeny have been estimated to be worth over $2 trillion. Fairchildren include Sequoia Capital, Kleiner Perkins, Intel, AMD, and many others.

Letter

For a considerable time Fairchild has been well aware of the attractiveness and growing importance of the transistor industry. Transistors, which are made from newly developed materials called semi-conductors, can be [substituted] for many types of vacuum tubes and, at their best, are more compact, more durable and require less electrical energy. The public is most familiar with these remarkable electronic circuitry components through portable radios or hearing aids with a greatly extended battery life.

First, they define what transistors are

Then, they explain how this technology is used and point to everyday objects the shareholders will be familiar with to emphasize its pervasiveness and importance

These are the new Fairchild Semiconductors (transistors) now under development. Shown actual size they are used in the miniaturization of electronic circuits and take the place of many conventional radio vacuum tubes.

The problem that Fairchild faced, despite its keen interest in transistors, was one of how to get into the field without very large capital investment and a prospect of years of research before production might be feasible. Competition of some types of transistors was already sharp. Qualified technical personnel was in extremely short supply.

Just because you’re interested in something, doesn’t mean you can take advantage of it — rings very true for VCs (especially non-top-tier and junior analysts). VCs can see a space, and like a company, but that doesn’t mean they can invest.

If you like a space, but the economics don’t make sense or you don’t have a way to make them make sense, it’s probably not a wise idea to enter it

Understand the competitive landscape — if competition is sharp, and you have no competitive advantage, don’t even bother

If there’s a shortage of qualified personnel (which always happens in the hot space ie AI today), it won’t even seem feasible to create a competitive advantage

The answer came when a group of leading semi-conductor scientists came to Fairchild with a proposal that the company finance and administer them as the [nucleus] of a specialized semi-conductor business. The men, who had previous association with such companies as Western Electric, Philco and Dow Chemical, had more recently worked with Dr. Shockley, Nobel Prize winner, at Beckmann Instruments’ semi-conductor laboratory. Thus, they were an experienced group, steeped in the latest knowledge of semi-conductor techniques, and accustomed to working together.

Then the Traitorous Eight falls into their lap

Talk about blessing — in comes a group of eight cutting edge scientists, brought together with a business plan written by an investment banker

Notice the emphasis on previous experience — while the Internet has democratized education and VCs don’t look for pedigree as much (aka college dropouts are fine), this holds true for DeepTech companies.

Best of all, they can already work together as a team — chemistry is one of the most important makeups of a team. If the team can’t make vibe with each other, they’re not going to be able to make magic

Fairchild believed their proposal represented the least costly and the least risky way to prepare the company for developing a competitive semi-conductors business. Accordingly, it accepted the group’s proposals, secured modern facilities at Palo Alto, California, and employed Dr. E. M. Baldwin, previously with the Hughes Aircraft Company’s semi-conductor division, as vice president, a director and general manager of the promptly established Fairchild Semiconductor Corporation.

Minimize risks and costs — but don’t compromise on value

I wonder why they named Dr. Baldwin by name but not any of the scientists… probably just to name-drop him+Hughes tbh

The broad assignment given to this new company was to design transistors either of the most needed types or to perform better or uniquely in applications for which few if any present transistors are suitable.

Very, very broad mission.

Core focus on transistors that can be adapted to solve for biggest pain points, whether that be general (highest volume) or customized (higher margins)

As was true of the origin of the Components Division of your company, the new transistor affiliate was set up in part to meet the company’s own needs. One of the major tasks of the Nuclear Instrumentation Department is the transistorizing of radiation detection circuits. Transistors are playing an increasingly important part in computers of all types an in the kind of control systems utilized for reconnaissance. They are needed for missile and satellite equipment. In addition, it is inevitable that Graphic Equipment Division will turn to the use of transistors to replace the dozens of vacuum radio tubes now employed in each Scan-A-Graver as soon as reliable transistors of the proper types are available.

One of my favorite mental models is the “Choose the Hard Path.” How would you go about starting a company? Well, you simply find a hard industry, and you ask the people in the space — what’s the hardest thing about your job? Then you go and solve those — this is how Peter Kaufman ended up with Glenair making Mission-Critical Interconnect Solutions.

Multi-use technology — one core technology used for many purposes

Consumer: Identify the wave of computers and the importance transistors will play in them

Military: Needed for missile and satellite equipment (midst of the Cold War)

Secret of the accuracy of semiconductors is the degree of purity of crystals of semiconductor elements. This shows part of the apparatus used for “growing” crystals with proper characteristics.

In the brief time since the transistor company was set up, research has progressed well. Operations are ahead of schedule. This is obviously encouraging, but it should not be assumed that any new group in such a technically difficult field can develop into [a] profitable operation quickly. A year or more is the span suggested by the experience of your company and others with the natural cycle of organization, research, development, production prototype and pre-production runs. In the meantime, Fairchild will endeavor to keep startup costs to a sensible minimum and to assist the promising new affiliate in any possible way. The effort is fully justified both by the present market for transistors and their potential.

Oh, hardware is hard — don’t expect us to make a profit for a while. We estimate it’ll take around…

… a year. A single year. That’s how long they expected it would take to turn a profit. In the hardware space. Let that sink in. One year. Hardware. Profits. That’s unheard of today. Even software companies take forever to turn a profit (yes yes I understand being “pre-revenue [insert EBITDA or earnings as you desire]” is a fundraising technique, but still)

Focus on keeping startup costs as low as possible — lean startup anyone? Boggles my mind when startups spend lavishly on random stuff. Yes yes, I know the happiness of your employees is important, but so is the financial health of the company — especially at the earliest

Interestingly, this is where Chinese companies shine — bare minimum + culture of hard work -> major productivity.

Current and future market size justifies our acquisition

Some Thoughts

Since the Traitorous Eight didn’t leave Shockly until mid 1957, it’s no surprise that there is barely anything about the actual business. As such, their inclusion in the annual report is much more of a PR announcement — although it does lay out Fairchild’s rationale for taking on the eight scientists (market opportunity + team).

There’s definitely some wisdom to be gained in thinking about how to think about starting a business, but if nothing else, it is a fun narrative to understand the beginning of what is arguably the most iconic company in Silicon Valley history.

[redacted]

There’s no doubt in my mind that without Fairchild Semiconductor, Silicon Valley, and the United States as we know it, would not exist.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

Please DM or email me any time — to share non-obvious intel, views and correct or solicit mine. I appreciate your continued support and partnership :D.

All compilations here.

Support

As many of you know, making compilations and this newsletter is a (very time consuming) passion project for me. Multiple people have reached out about how they can support me so that I continue, so I set up with a few ways:

1) Patreon

3) Bitcoin: 3NMAiprwVj5513FSqHUNycor6itT55atpo

Thank you!