Letter #202: D.A. Wallach (2024)

Founder of Time BioVentures and Artist-In-Residence at Spotify | Streaming Medicine

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Today’s talk is the transcript and slides of a talk given by D.A. Wallach titled Streaming Medicine that shares lessons, draws parallels, and discusses the pasts and futures of the music streaming and healthcare industries. While often cited as two of the most broken industries, very few have explored, or even have the industry knowledge, to properly analyze and compare them. D.A. is one who has.

D.A. Wallach is the Founder of Time BioVentures. He’s also the owner of the most winding career path I’ve ever heard of. It’s taken many twists and turns, but gives him a truly global, interdisciplinary point of view, and speaks to his ability to learn.

He grew up in Appleton, Wisconsin, where he studied economics and was a two-time national finalist in the Federal Reserve’s Fed Challenge monetary policy competition in high school.

He went on to Harvard for college—but chose to study African-American studies—where he studied under Henry Louis Gates Jr. and received Harvard’s first certificate in the Bantu language Gikuyu. And while at Harvard, he auditioned against future Academy Award-winning director Damian Chazelle (Whiplash, La La Land) for the role of drummer in future Academy Award-winning composer Justin Hurwitz’s band. While D.A. lost out to Damian to be the drummer, he was invited to join the band, Chester French, as the lead singer.

Chester French was one of the first bands to use Facebook as a promotional tool, as they were freshmen at Harvard the year Mark Zuckerberg launched the site. Halfway through college, Damian and Justin left the band to focus on other endeavors, but D.A. and bandmate Maxwell Drummey continued as a duo. Their senior year, they sent out demo tapes and caused a bidding war between Jermaine Dupri, Kanye West, and Pharrell Williams. They ultimately signed with Pharrell, produced three albums, and toured with N.E.R.D., Blink-182, and Weezer, among others.

While touring, D.A. met Sean Parker and Daniel Ek, and was chosen to be the official artist-in-residence at Spotify, where he created and led the Artist Services team. As artist-in-residence, D.A. oversaw the company’s relationships with musicians and managers, discussing how the service works, its payment model, and promotions. During his tenure, he launched several products and helped the company grow from 1mn subscribers to 20mn subscribers.

His experience at Spotify encouraged him to return to his high school roots and spend more time in the world of economics—and business. He began angel investing in a variety of technology companies across different industries, such as SpaceX, Spotify, and Ripple. He formalized his investing activities by partnering up with billionaire Ron Burkle (founder of Yucaipa Companies) to form Inevitable Ventures before striking out on his own to found Time BioVentures, where he focuses on all things healthcare and biotech.

From growing up in the Midwest and studying monetary policy to African studies scholar, to touring rock musician, to consumer company builder, to versatile angel, to biotech/healthcare VC and quant aficionado, D.A. has had a wild ride—one that gives him a unique, interdisciplinary view of the world that is evident in his investing process.

I hope you enjoy this talk as much as I did!

[Transcript and any errors are mine.]

Related Resources

Artists

Spotify

Santa Fe Institute

Letters

Compilations

Indexes (Interactive Compilation)

Transcript

Well, thank you very much. It's great to be here, following an actual death panel. And as you heard in my introduction, I'm a bit of an odd duck. I run a biotech and healthcare venture fund in LA called Time BioVentures. But this was my previous life. And as you can tell from this photo, you should take everything I say today with a grain of salt.

I want to talk a little bit about the parallels between the lessons we've learned in the music industry and what I perhaps see on the horizon for the healthcare sector.

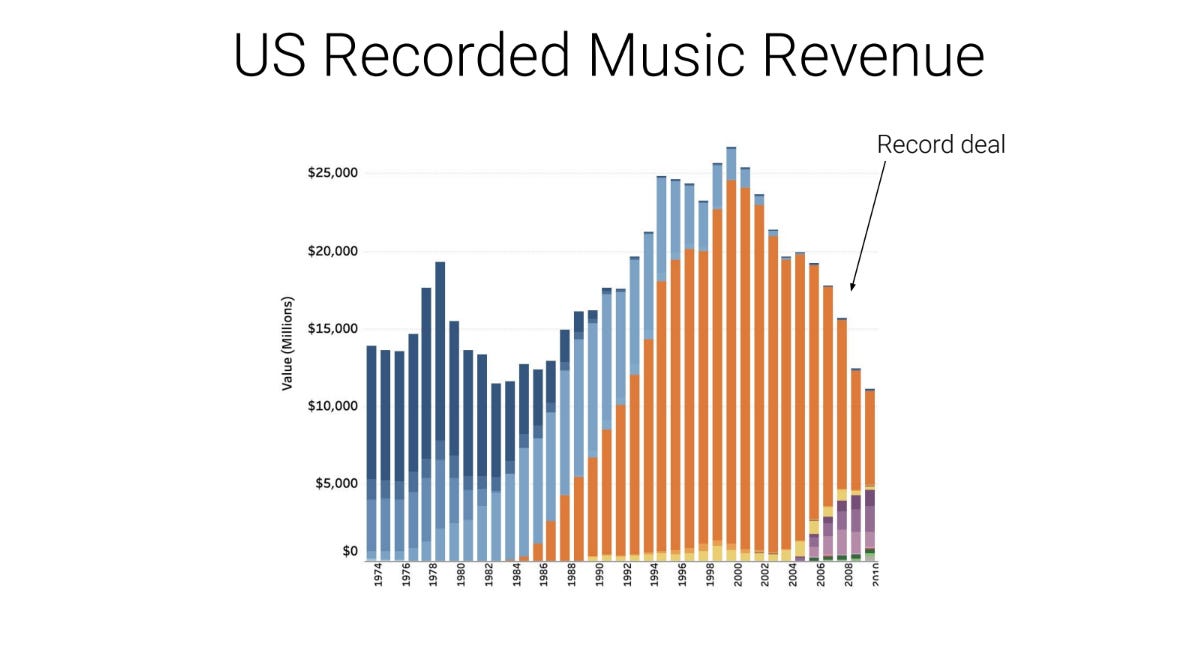

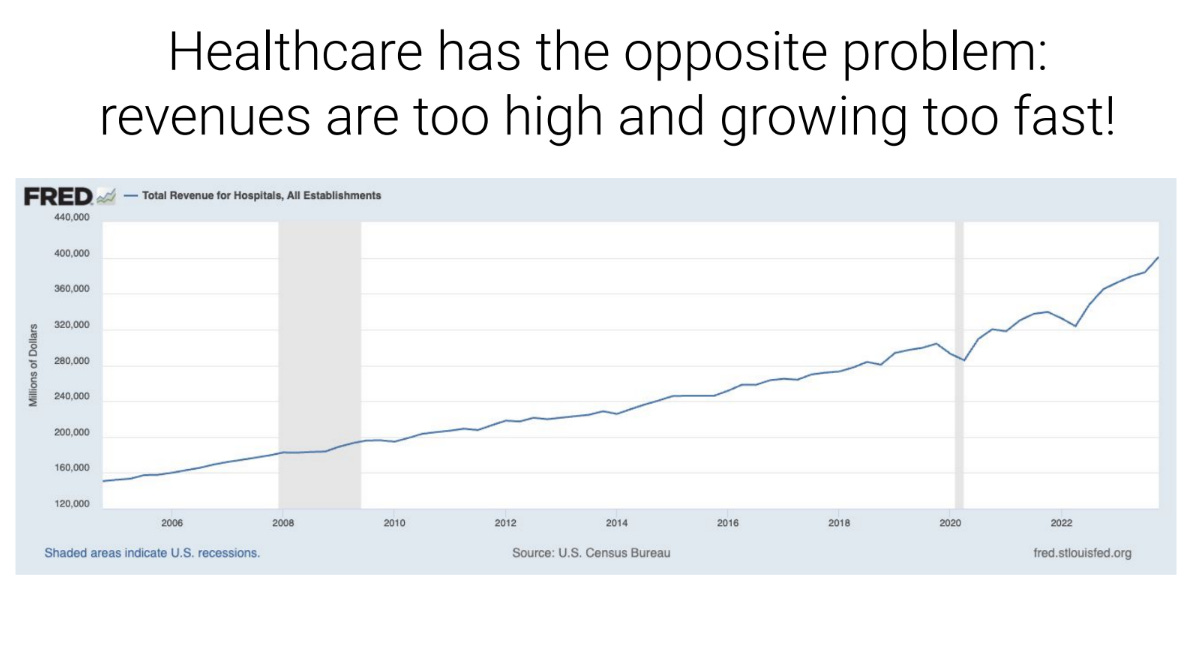

And when I was in college and got my first record deal, we entered the industry at a remarkable time, when things were in total freefall. So what you see in this graph here is US recorded music revenue over time, starting from about 1970. And the peak is the absolute bonanza of an era that the 90s were, as the recorded music industry resold the entire history of music, on compact discs. People were just rolling in cash.

And when we got our first record deal in 2007, this freefall had been catalyzed by the advent of Napster, and then YouTube. And with it, the erosion of consumer spending on recorded music.

So you probably remember these record stores. They were progressively going out of business at this time.

And a couple years after we entered the industry, I had the good fortune of meeting the founders of Spotify. And when I saw their product, I was just completely blown away by the potential that I saw in it to get people paying for music again. It was such a compelling product that you could imagine consumers going from free music to something for which they would pay a monthly subscription. And that's exactly what happened.

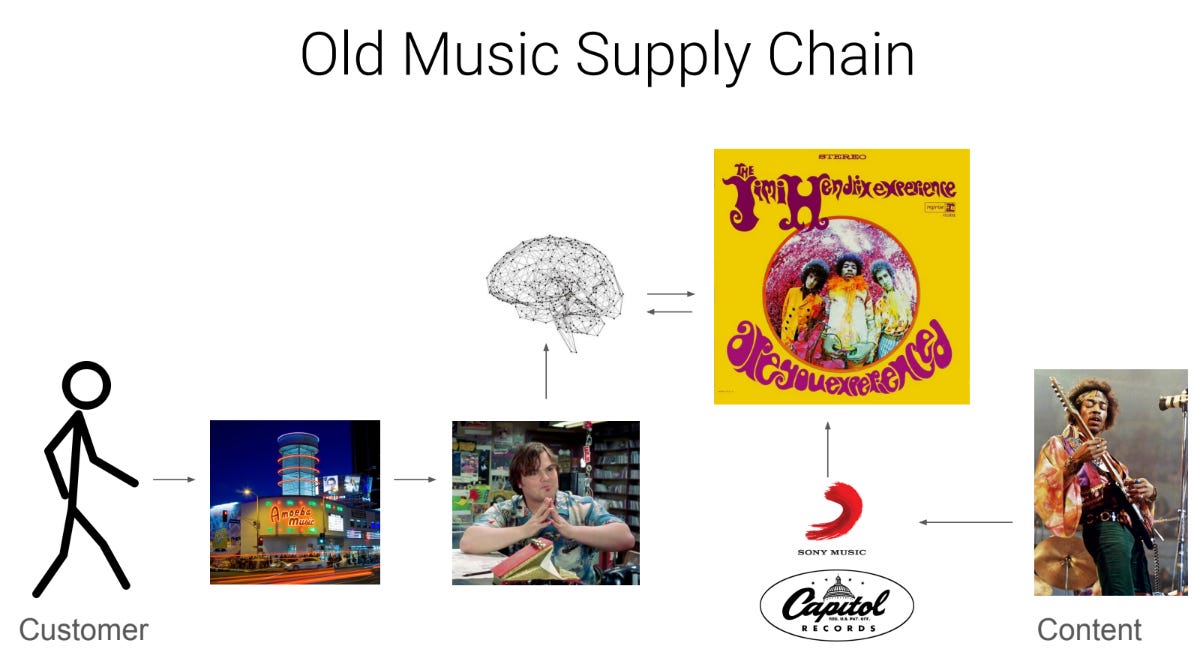

The old music supply chain was, I think, to a lot of folks at that time, clearly anachronistic. And you'll remember these days, it was basically this very clunky, intermediated system to get content to consumers.

So you'd go into a brick and mortar record store, and you'd sort of prostrate in front of some Grand Wizard of music, who would query their huge brain for all of the history of records, and they'd recommend you just the perfect record to get. In this example, the Jimi Hendrix Experience.

And that record typically would have come through one of just a few record labels, like Capitol, or Sony, that were basically the sole distribution channel through which artists could get their content into their fan base.

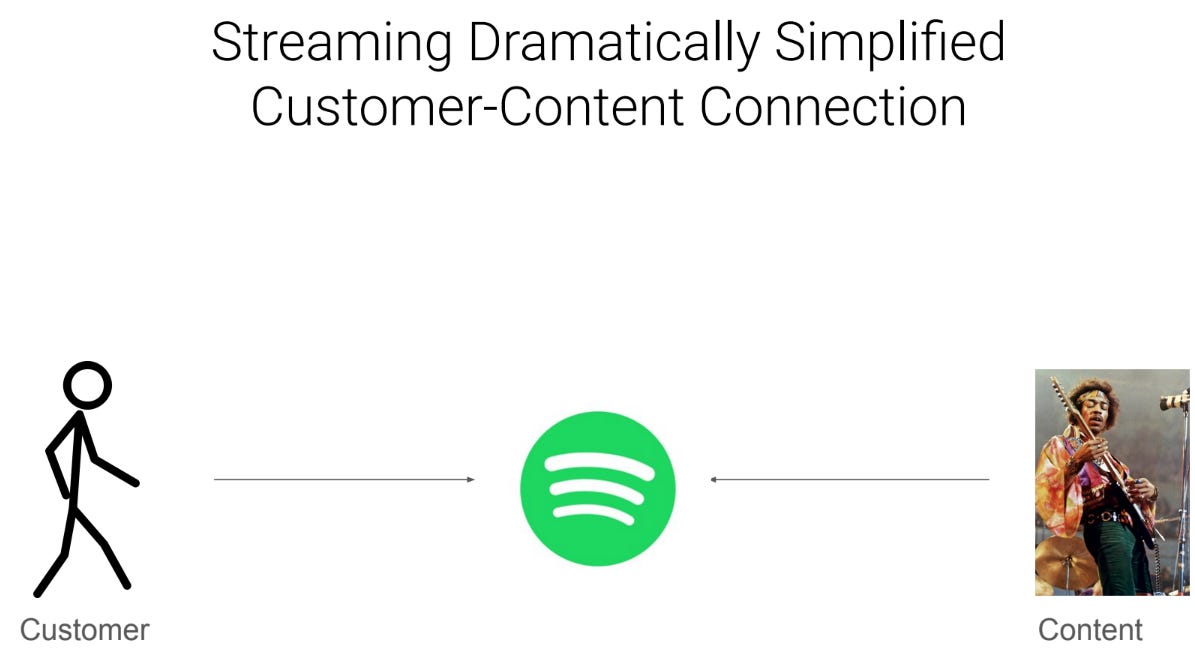

And Spotify succeeded by dramatically simplifying that connection between consumers and content. And it put all consumers on an equal footing, such that they could access the same catalog of music globally, for a very low monthly price.

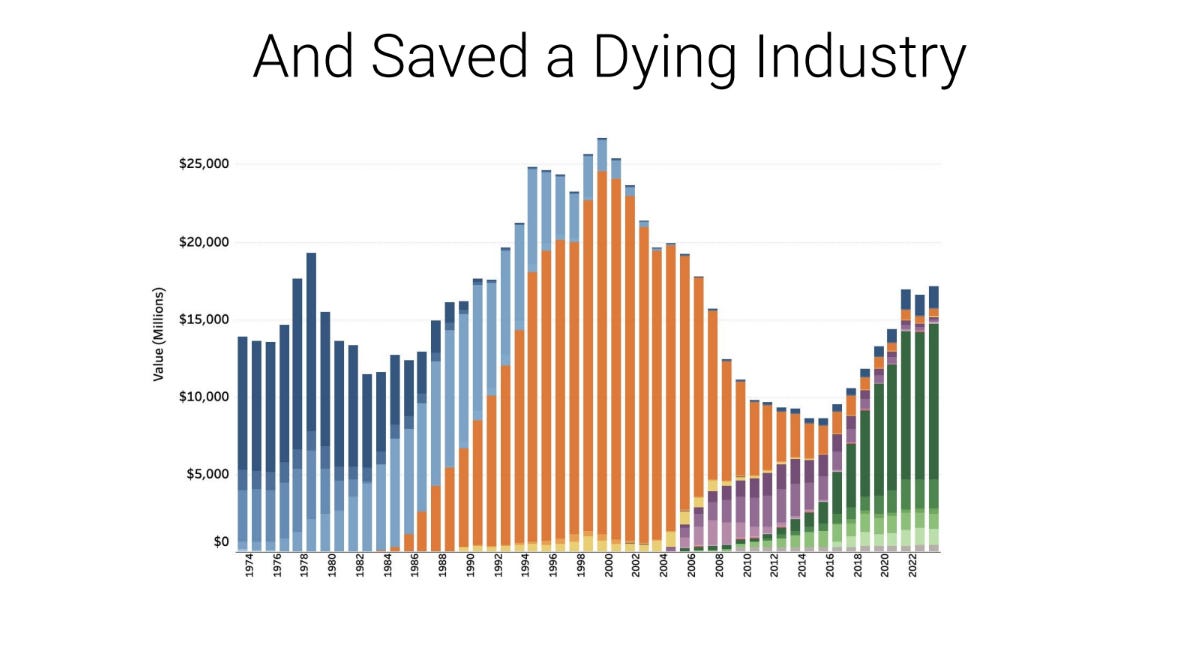

And here's the end of that story, or at least up until today, what's happened with streaming, which is depicted in green here. Consumers started to pay, and revived the industry.

Healthcare, in some ways, has the exact opposite problem, which is that we're spending too much, and the amount that we're spending is growing too fast.

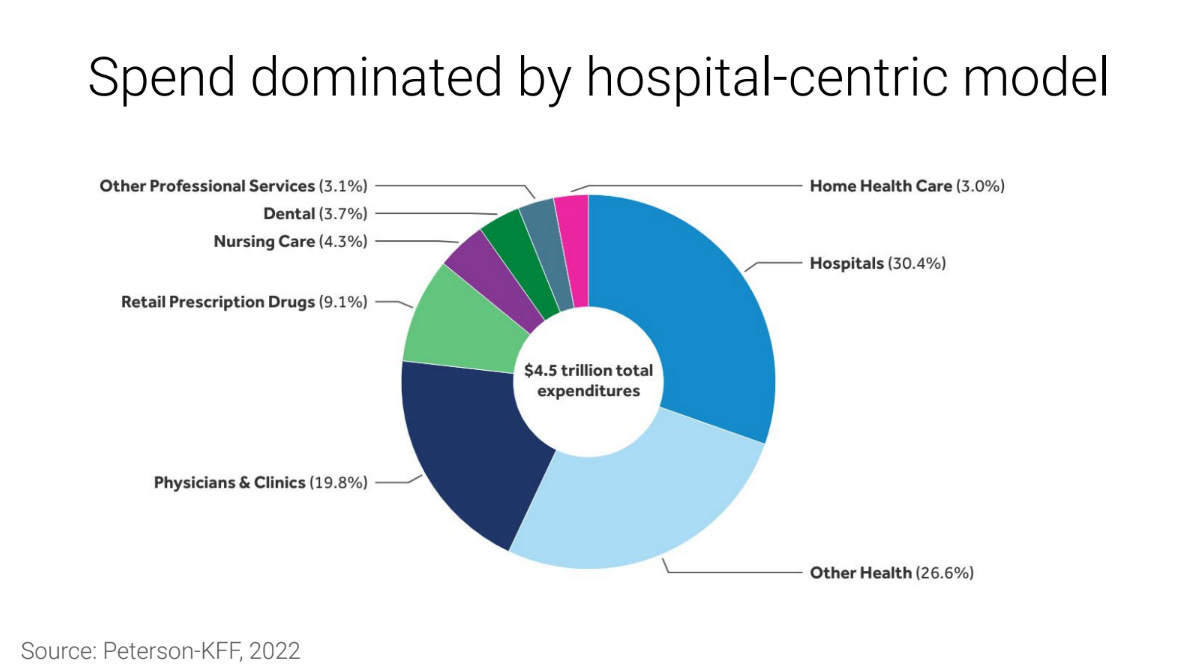

And most of that spending is on our hospital centric business model.

So as you can see from this breakdown, of the $4.5tn we're spending in the US per year, something between 70-80% of it is basically going to human mediated health care services, be it hospitals or brick and mortar clinics.

And this model, as I see it, is really trapped in an 18th and 19th century factory paradigm, where the concept is basically get a bunch of big brains into big buildings, and you'll realize production efficiencies. And we have similar issues in education, with large universities, and in criminal justice.

These are all paradigms that originated in the 18th and 19th century, and they're all in certain similar ways failing us today. That fits into a supply chain--it might be a little bit of a stretch, but I think it's actually reminiscent of the music industry supply chain that I described previously.

Instead of going into a record store, you go into a hospital or a clinic, and you're seen by a physician, who queries their huge brain, which has been stuffed full of information, the whole corpus of medical knowledge, and they will try and identify for you the perfect intervention. If that happens to be a drug, as here, that drug will have come from one of a few large pharmaceutical companies, like Pfizer, which similar to the record labels, are essentially now the distributors for those who really create new medicines, which are the small and mid sized biotech companies.

And so the question I want to raise is whether we should do to these--and please forgive me. When I was putting these together, I did not know that Johns Hopkins or CVS were sponsors of this great event. Nothing against either of them. I think they're fantastic organizations--just a little bit dated. And so I wonder if we should do to these, what we did to these?

And if we do, what would the equivalent of Spotify even be? What would streaming medicine be?

What I'd propose is that what we need to build--and this includes AI and a lot of the other technologies that people have been talking about today and yesterday--is a single global catalog, containing all medical knowledge, all diagnostics, all interventions, and all medical reasoning.

Essentially, the super AI of medicine in the cloud, to which people can connect from anywhere in the world and connect to the exact same knowledge--just like today they connect to the same music catalog through Spotify, or the same film and TV catalog through services like Netflix.

My belief is that this type of knowledge centralization is actually the only way to make medicine modern. And I would define modern medicine as evidence based--I don't see why we should distinguish between medicine and evidence based medicine. I don't think anyone goes to the hospital looking for non evidence based medicine.

It should be personalized with validated algorithms that are universally applicable to patients everywhere in the world. It should always be up to date.

So the standard of care that someone gets in Botswana should be exactly the same that they get in Los Angeles or New York. We should be honest that if we're not giving people the same high quality care everywhere, we're doing that because they're poor, not because they deserve a different standard of care. And it should be geography and income invariant. Again, the same medicine, no matter where you are, no matter who you are.

With that type of centralization of knowledge, I believe we can actually decentralize the care itself.

So on the one hand, centralize the information out of hospitals, sort of evaporate into the cloud, and then push down care into the community through decentralized delivery. And I've chosen the village people here, not because I think they should be your doctor, but just to make the point that perhaps people who today have different jobs, even outside of healthcare, in the future, when paired with this type of technology, streaming medicine, could end up being superior as a way of delivering care to even super doctors like House. And so I think in the future, we're going to marvel at the fact that you had to be a genius to be a doctor in the past.

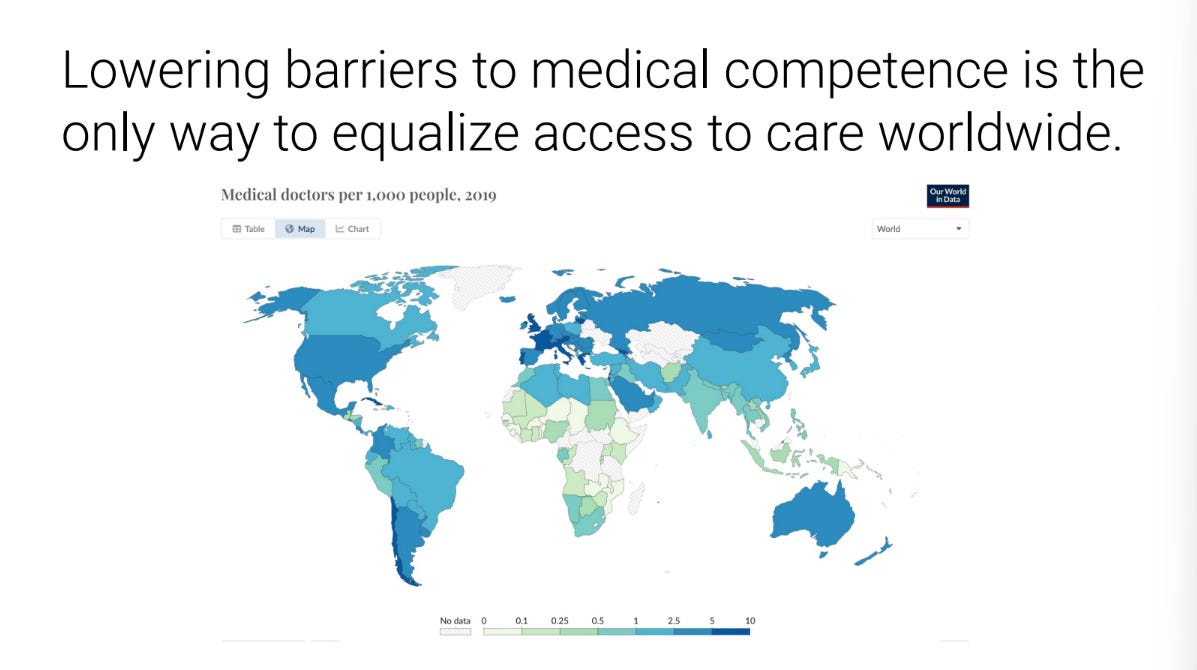

I actually think that's a moral imperative, because lowering the barriers to medical competence is the only way that we can possibly scale up high quality care globally.

What you see here is that the darker countries are those with a higher density of physicians per capita. In the US, it's about three doctors per 1000. When you get into countries like Madagascar, it's less than 1/10th of a doctor per 1000 people. So we're not going to fix that by manufacturing doctors in our current paradigm. It's just impossible. I would propose that maybe the doctor of the future is more like an accountant.

It's a highly trained, specialized person, but not necessarily someone who was educated for 15 or 20 years.

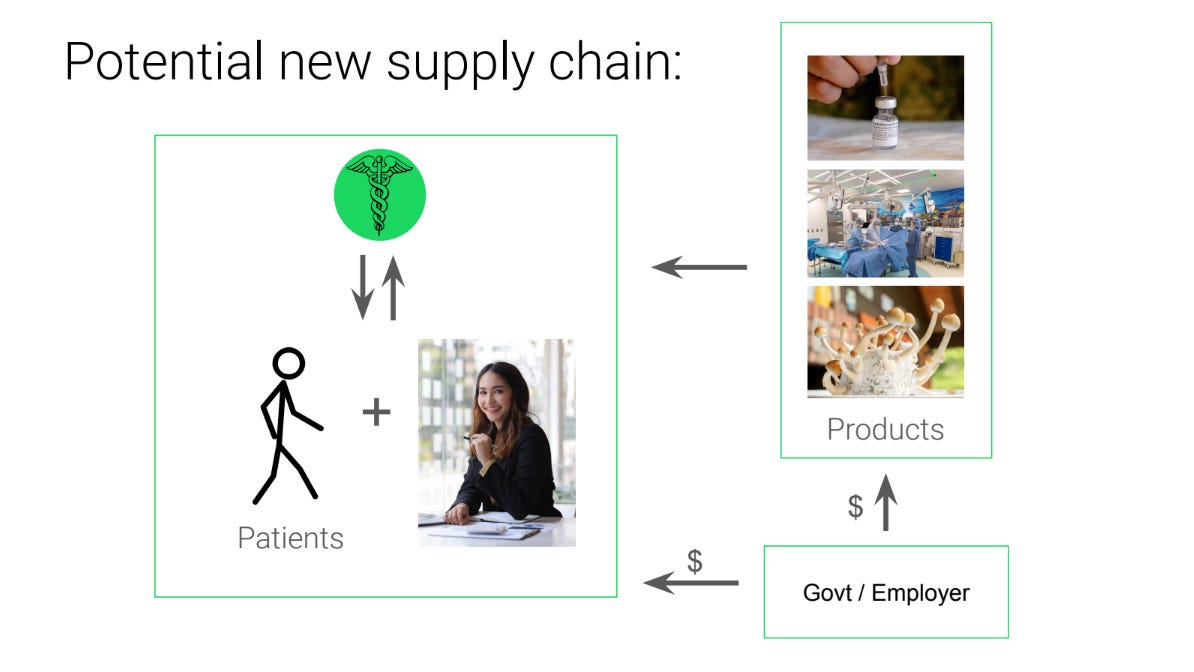

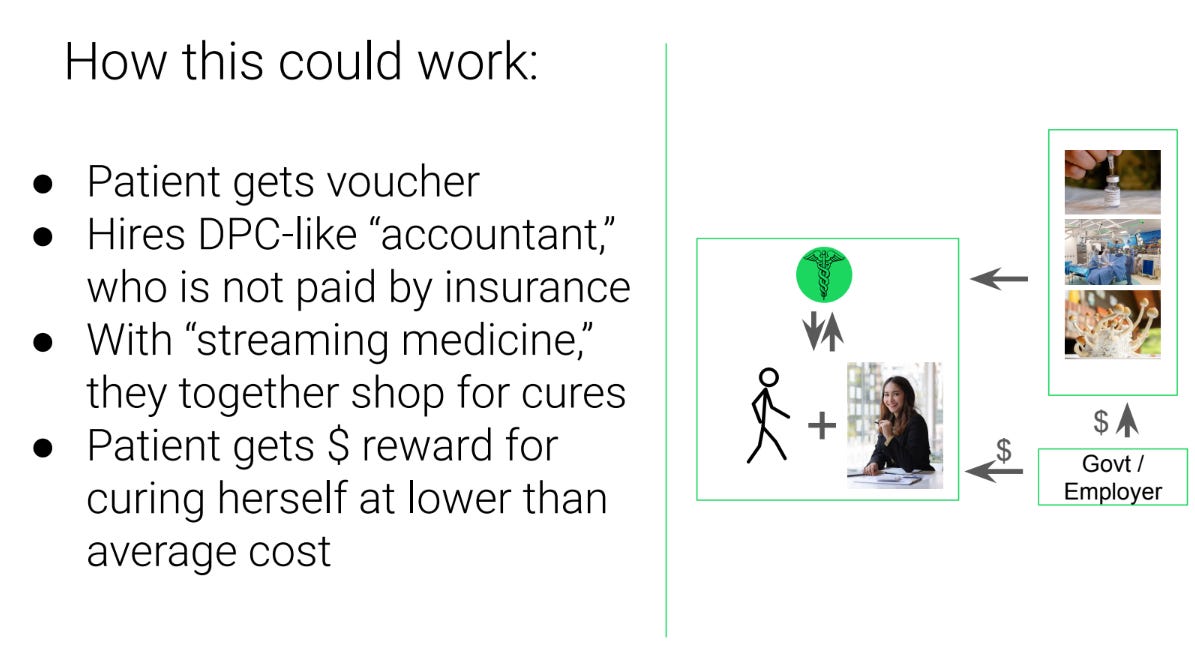

And I think there are a million potential configurations of how those sorts of professionals could fit into something like streaming medicine to deliver better care, but this is just one kind of spitball-y idea I came up with: imagine that patients get a voucher to spend on choosing a sort of primary care navigator, and then hire this person.

This is again, like the sort of health care accountant character. And they're paid directly by this voucher, not by insurance. Take primary care out of insurance, put them entirely on the side of the patient. And then this team, the patient, their care professional, working with streaming medicine, can navigate the system and choose the best products and services to cure them. And then align cost savings with patients. Let them capture the savings that they generate by navigating their own care in a thoughtful and cost effective way.

Again, apologies to CVS and Johns Hopkins. But a couple of weeks ago, we learned Walmart is not going to save us. And I don't think that this is a particularly exciting future either.

I would be shocked if 100 years from now, the way we're doing medicine is in minute clinics and huge buildings.

And fortunately, in my day job, we get to see amazing entrepreneurs coming up with all the little seeds of this future that I'm outlining.

And we're not investors in all or even most of these companies, but I think they're really promising. And I would invite any of you who are working on this, who sort of believe in blowing up the system and starting from a blank sheet of paper, to reach out to us. We're super excited to engage in entrepreneurs who are thinking really big.

I appreciate your time. Thank you.

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.