Letter #209: David Weiden (2024)

Khosla Ventures Founding Partner & Managing Director | Success, Failure & Numbers

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Today’s letter is the transcript of a talk and accompanying slides by David Weiden titled Success, Failure & Numbers. In this keynote, David shares why most businesses fail and how founders can use numbers to better tell their story and increase their odds for success. Throughout the presentation, he uses concrete examples including comparing DoorDash and WeWork, stories from his time at Netscape, and examples slides from portfolio companies. He shares how founders can leverage numbers for success, how to layer quantitative analysis on top of intuition and why doing that is important, and how quantitative frameworks improve targeting, before diving into the importance for founders to know their real business economics and present and substantiate their financials and forecasts. He then walks through several real examples of how to present and how not to present their financials and forecasts, before closing with a few quotes from Thomas Edison, Warren Buffett, and Bill Campbell. After his keynote, he answers a question on focusing on Revenue vs ARR.

David Weiden is a Founding Partner and Managing Director at Khosla Ventures. Prior to founding Khosla, David spent five years at Tellme Networks (acquired by Microsoft for >$700mn) as VP of marketing and business development, where he helped grow revenue to >$100mn. Before joining Tellme, David led AOL’s communications, community, and instant messaging product divisions as they surpassed 50mn users worldwide. He joined AOL via its acquisition of Netscape (where he worked with Marc Andreessen and Ben Horowitz), which he joined from Morgan Stanley. David started his career in door to door sales, where one sales pitch led to a new career in technology with McCaw Cellular (acquired by AT&T).

I hope you enjoy this keynote as much as I did!

[Transcript and any errors are mine.]

Related Resources

Khosla Ventures

Netscape

Other

Transcript + Slides

So I had this talk all ready to go this morning, and then Keith gave me the advice that I shouldn't be boring. And that threw everything up in the air. But the good news is, I think that you all are running businesses, and the business either succeeding or failing, there's nothing boring about that.

And prior to doing this job, I worked in startups, and this talk is inspired by what I went through at a company that ended up being acquired by Microsoft for close to $1bn, which, 20 years ago, was a lot of money. And before it got to that, at the time it was acquired, the company was doing $150mn in revenue and $30mn in profit, in actual cash flow.

But before then, the company went through a period where it didn't look like we were going to make it at all. We were burning $5mn a month, which, again, at that time, was an astronomical amount of money. And we really didn't have traction. And the management team really didn't know what to do.

And so the lessons in this talk are what got us through that period. And I have no doubt that for some of you in the audience, it's at least possible to take things away from this talk, either that change what you're doing, or change the way you work with other people on your team, that can be the difference between your business succeeding or failing.

So let's dive in.

Part of what focuses the -- some of the lessons we're going to look at, is that most businesses, most of you, will make a product that works. You won't fail due to technology risk. You'll get on the other side of that. And you'll have customers -- that like the product. And when you sell the product, you'll make money -- at least you'll have positive gross margins. And it's important to internalize this. This is true at the vast majority of companies that are VC-backed -- end up accomplishing all three of these things.

But most businesses end up failing. Most VC-backed businesses, including many in this room, will accomplish what was on the prior slide, but then they struggle. Why?

In my experience, there's two failure scenarios that the company ends up encountering. And if people understand these, and it sort of instrument the business to avoid these two problems, your odds of success go up significantly. So these two problems are: there's initial traction -- lots of logos, lots of pilots, lots of things seeming to go well at the beginning -- but then those weren't the right seeds to have planted. Or another problem is: as the business scales, the cost of reaching customers, not early adopters, but mainstream customers, is too high. And these might seem like subtle, boring problems, but again, the business failing over these problems, that's nothing boring about that. So let's not be those businesses.

Now, it helps me to understand -- and sort of to advise you to look at -- what are you all great at? And then we'll look at some things that you could maybe complement yourself with.

So, many of you in this room, nearly all of you, are great at this mix of things. You're leaders, you have vision, you tell a story, you're courageous, you build things. This is great. You can't start a company, you can't have a company keep going without these things.

There’s a but.

There's a few things that, in general, founders are not -- they either don't like doing, or they're not as good at doing. And it's often these things. Most founders don't say, I love doing quantitative analysis, or I love financials. And that's okay. But, if you don't want to fail, you either need to make yourself better at some of these things, or at least understand what they are, and get others on your team really elevated to a level where it changes how you're running the company.

So let's look at that in more detail.

So let's look at that in more detail. One inspiration for this is -- there's two companies -- there's lots of things that we could look at, but one we'll look at is -- two companies, each in the year they were getting to $1bn in revenue. One company then went on to build $40bn in value, and the other company destroyed $20bn in value. And I don't mean it had a market cap decline of $20bn. I mean it took $20bn in capital -- cash -- and went to zero.

So these two companies are DoorDash and WeWork. And this slide tells a subtle story about the difference between what was happening with these companies. Both of them had plenty of revenue. If they'd had less revenue, either of them, in the year they were going to over $1bn, it would have been fine.

Both of them -- and the other chart, it's not looking at cash flow. Neither of these companies was profitable right now. That's okay. That's why venture capital exists, growth capital, IPOs.

Sometimes when I give this kind of perspective, people think I'm over-focused on being profitable. Again, this isn't about being profitable. This is about having a business that makes sense, and accelerating into that business, sort of what Keith was referring to as "lift." If you don't have lift, and you accelerate, you crash.

So this other bar here, it's looking at what was contribution margin less the cost of sales. And notice for DoorDash, as it accelerated, even though it was burning money, which isn't on this chart, its customer economics made sense. Whereas with WeWork, it didn't make sense.

And what's really important for all of you to think about is: I knew people at WeWork. People at WeWork were not stupid. There was never a point in time at WeWork where they said, Let's light $20 billion on fire. They were using metrics like Community-adjusted EBITDA. And it sounds funny now to say that, but it was just an adjusted EBITDA measure. Everybody uses adjusted EBITDA measures.

And nobody thinks to themselves: I'm doing something silly. So if you think to yourself, I'm not like WeWork, it's important to -- basically, I'd say to traumatize yourselves, that the fact that you think your numbers make sense, or that you have the right numbers, that in and of itself shouldn't be reassuring.

You should take a step back and look at some of the things we're about to look at.

Okay, we're going to look at three different ways to use numbers to increase your odds of being more like DoorDash and less like WeWork.

The first area we're going to look at is targeting. This is targeting markets, targeting customers. Because if you don't have the right target, and then you go spin up a lot of activity, you're actually making things worse, not better.

The next thing we're going to look at is what are what I'm calling your real business economics? What are the right numbers to look at to make sure you're building a DoorDash and not a WeWork?

And then the last is some subtle things you can do to use numbers to make it much more likely that you'll be successful fundraising. We're going to start looking at customer and market targeting.

So the macro theme here is, you all have a lot of intuition. And often, founders think, Well, I'm the founder. I need to trust my intuition. And I'm special. And I would say, You are special. And I think founder-led companies are dramatically more successful than when founders don't lead the company.

But, if you overlay quantitative analysis on your intuition, it is better than your intuition.

I said this comment before about Don't confuse activity with accomplishment, and I wanted to circle back to one of the things Keith said in his talk about Reid Hoffman. I thought it was a -- brilliant of what Reid was doing, and a great thing that Keith called out, which is, he said, Reid knew that for that business, for LinkedIn, it needed its CAC, its customer acquisition cost, to be zero. And it didn't make sense to go get a lot of customers and pay for them. That would have been more activity, more bookings, more revenue, more customers, but it wouldn't have been accomplishing anything. It was more important to slow down, for that company, and figure out changing the product to get viral acquisition to work. And then that was where they could start accomplishing things in scale. That's kind of the lesson here.

So we're going to look at now, How can you know? How can you instrument things so that you've got something second guessing yourself that's better than just your intuition?

So one way to do that is what I call a quantitative framework.

So a quantitative framework is basically trying to simplify your business down to some atomic units. We could be in the financial services vertical or the healthcare vertical. We could be selling to North America or USA only. We could expand internationally with the same type of customer, or we could add different types of customers just in the US. How do we decide? There's another point on here which is very important, which is, not only does quantifying and making these kinds of decisions explicit, not only does it improve the way you make decisions, but it can also get the whole company behind the decision so everyone understands Why are we doing this? Which can really increase how you execute -- how successful you execute against the strategy.

So we're going to look at an example in the company that I worked at, which is, we were selling -- we were an early SaaS company selling phone automation software. And one of our key target markets was financial services. It's a big market, but we had little traction in the market.

We knew the market was big, we knew it was about half a billion dollars in size, give or take. It didn't really matter if it was $200mn or $800mn. We were little, it was big, and we weren't getting traction.

So the first thing we did is try to segment this market, because we needed to figure out what was the right beachhead. One thing that we did there, that I would encourage all of you to do, is to think about what is your actual revenue opportunity. Moving from big to specifically how much money can you get, whether in a market segment or a particular customer, is really good idea.

So this chart is just showing by area, how much revenue is there by type of market. And this might, at first glance, look like it's intuitive, like, Well of course retail banks and credit cards are big. This doesn't correspond at all to the revenue of these companies.

These narrow bars on the right, these are huge financial services companies: Goldman, Sachs, Morgan, Stanley, Merrill, Lynch, AIG. They're actually bigger than the companies on the left. But for what we were selling at this company, it didn't work that way.

And just pointing yourself in the direction of where there's more money, just if you take away one thing from this presentation, that's a good thing to take away. But we can do better than that.

So let's look at how we got better targeting at this company.

We had about five different criteria. And let me explain.

Let's start with the things on the bottom. This buying cycle. This is relatively intuitive, at the bottom. This is basically just saying we made a scale that, in this case, went from -5 to 8, of did the customer -- were they ready to buy what we were selling?

That sounds pretty intuitive, like, What's the point in doing this? Well, I would point out things like, Look at the difference between the bottom two: 4 and 8. What we were -- we were, what I said, an early SaaS company. Most customers were not ready to buy -- they didn't know what SaaS was. And people didn't even use the word SaaS. They called it "hosted" then.

So one thing we had learned is that [if] the customer had already crystallized this buying criteria, that wasn't good, because it wasn't going to have crystallized around what we were selling. So we needed to get to the customer before they defined their buying criteria. And that was a big deal.

Now sometimes when I show people this, they say, Well, how did you know if it should be a four or five? And I say, We didn't. It doesn't -- again, we're just trying to get it approximately right. And it turned out it was about twice as good to get to the customer before they'd started an RFP process for what we were selling. We couldn't win once they defined the criteria anywhere near as well as if we got there before.

That may not be true with you. The point isn't exactly what the framework criteria are, it's to use a framework like this.

The other thing I want to show is, Let's look at the top half.

At that time, what we were selling, we needed to go through their long distance network. And at the time, the two big long distance networks were AT&T and MCI. And again, one might think, Well, it's as simple as if they're on AT&T, that's good, and if they're on MCI, that's bad.

But it turned out it's more complicated than that. They could be on AT&T in a way where it was almost impossible for us to work with them, or they could be on AT&T in a way that was good.

So that difference -- we've all heard the expression, "You want to make something as simple as possible, but no simpler." So this was it.

These five criteria above, this was sort of the atomic unit of thinking about how to sell to them. And notice the different weighting here. There was a way they could be on MCI where it was so bad we were giving it the score of -10, where it was just not going to be a qualified customer.

Now what was so important about that is, we, when we looked at why were we struggling, we could do things like win a pilot, deploy the pilot. The customer could think they could deploy with us. And only after we'd incurred the full cost of sales and actually building an app for them, then did we find out we couldn't deploy. Which was, obviously, in retrospect, terrible.

But we couldn't get everyone focused until we had these explicit criteria.

So now let's come back to how we use the criteria. This was the market by size.

This was the market after we ran these criteria. And you can see -- most of the market was invalidated. And you can see why it was invalidated. What was left was the customers at the bottom.

And then this is now zooming into those customers by size. Now we knew exactly where we were targeted. And we had the full resources of the company just calling on these customers. Any other customers -- what we told the salesforce was, You can sell to them, but there's no commission.

And then this is what happened. This might not look like a lot of green, but this was over the course of two years. We added $20mn in ARR just in this segment, and it swung the whole company from a loss to a profit. This company didn't succeed because of what you just saw, but we would have failed without what you just saw.

Let's look at a couple other examples. When I say Know your real business economics, be more like LinkedIn, more like DoorDash, less like WeWork. At a high level, let's look at what I'm talking about.

You should always know your revenue, your cash flow, and your cash. My advice to you as CEOs is this should not be delegated. And revenue means your GAAP revenue in some period of time, like 2024. Things like ARR and bookings and CAR, that's fine, but it's an input to these three numbers.

You, the CEO, should always know these numbers. But there's more.

I would urge you all to also know all of these numbers.

Don't just know your gross margin and your revenue, know your contribution margin. For the sake of time, I won't go into contribution margin, but it basically just means when you sell something, how much money do you actually make when you sell it before looking at the cost of sales?

Then when you look at cost of sales, this has some complicated sub-bullets, and we don't have enough time to go into this in detail, but I want to get across a basic concept here.

90% of companies, including ones that I work with, they'll think about cost of sales as the average cost of sales. So this includes who you get through PR, who you know through your own network -- and they'll look at that as the cost of sales. Or who you can sell to, yourself, as the founder. And that's okay to know. That's what I call blended CAC, blended cost of sales. That's blending what people call organic cost of sales, like that just comes in the door, and paid.

But that's not the most important way to run your business. You really want to learn to run your business on these other three things here in the sub-bullet. It's much more important to know: How much does it cost -- not when I, the founder, does a one off heroic sale, but when I hire Joe Salesperson, just some average person. How much does it cost to recruit them, train them, deal with attrition in the salesforce, support them, and have them get the sale. That's what's actually going on in your business.

Or if you're buying ads on Facebook, and 50% of your customers come organic from some cool TechCrunch article you got, and 50% come from buying ads on Facebook, run your business off of just the 50% that you're buying on Facebook.

And then these other concepts are very important: marginal CAC and CAC as you scale. These are not things for your growth marketing team to understand. These are things for you to understand as the CEO.

If you're buying ads on Facebook, the last dollars you spend are going to be more expensive than the first dollars, because the first dollars are better targeted. You have to grow. Anyone in this room, you have to be growing.

So the most important number to run your business on is, What is the cost for the last dollar you're spending? And then if you're going to raise more money and grow faster, what is the CAC? What's the customer acquisition cost when you're spending 2-10x as much on Facebook? Or you're hiring 10x as many salespeople, and they will not be as good as the first salespeople you hired. Ignore all that at your peril.

The last thing is this CAC payback metric. Almost every business should know this number. And you should calculate it not based on revenue or gross margin or blended CAC. You should calculate it using the CAC -- you should calculate it on contribution margin and on these ways of calculating customer acquisition cost on the margin.

If you do this, and you instrument your business this way, you're much more likely to succeed.

An example of a business that's doing it this way, if you look at this chart, this is a business that won't for sure succeed, but has way above average chance of success.

This comes from a portfolio company's board deck. If you just look at the green line, this is saying that their CAC payback started out at 75 months, which doesn't work at all, and even in the more recent time, it's close to 20 months, which isn't great, but the trend line's positive. And that they're tracking it, and not hiding these numbers.

This company has a way higher chance of succeeding than the average company. Do this.

Last set of ideas. Fundraising. The vast majority of companies both don't present financials -- or if they present financials, they present them the wrong way. And I'll show you what people do.

My advice is to do -- is to understand the points on this slide.

If you want people to invest, especially as you get to be later stage, you're going to be raising money from people that are more like me than Vinod. That care about numbers. That care about financials.

But most founders don't like showing their financials. And you got all kinds of reasons why you're not showing the financials -- they're not good reasons. Usually it's because there's some set of problems with your financials.

My advice to you is, It's okay. You've got to get those problems out in your first meeting and deal with them proactively. That's what I mean by substantiate the forecast. And don't dodge the problems. Just own the problems. Like that last slide. CAC payback was bad, but it's trending the right way and we're managing it. That's the formula for success, both in managing the business and in raising money.

So what are financials? Something like this slide? No, this is what I put: TLDR. This has financials in dollars, which is crazy. Never put it in dollars. Too many numbers. And if you look at the very bottom, it's got some non-financial metrics, like how many customers. Don't do that. And then it's got all this explanation on the right. Don't do that either. Way too much information.

Something like this -- this is not financials. This is more like an assertion. You're asserting. This is what my -- what I call my forward bookings number -- is going to be. And that's okay. But this isn't financials.

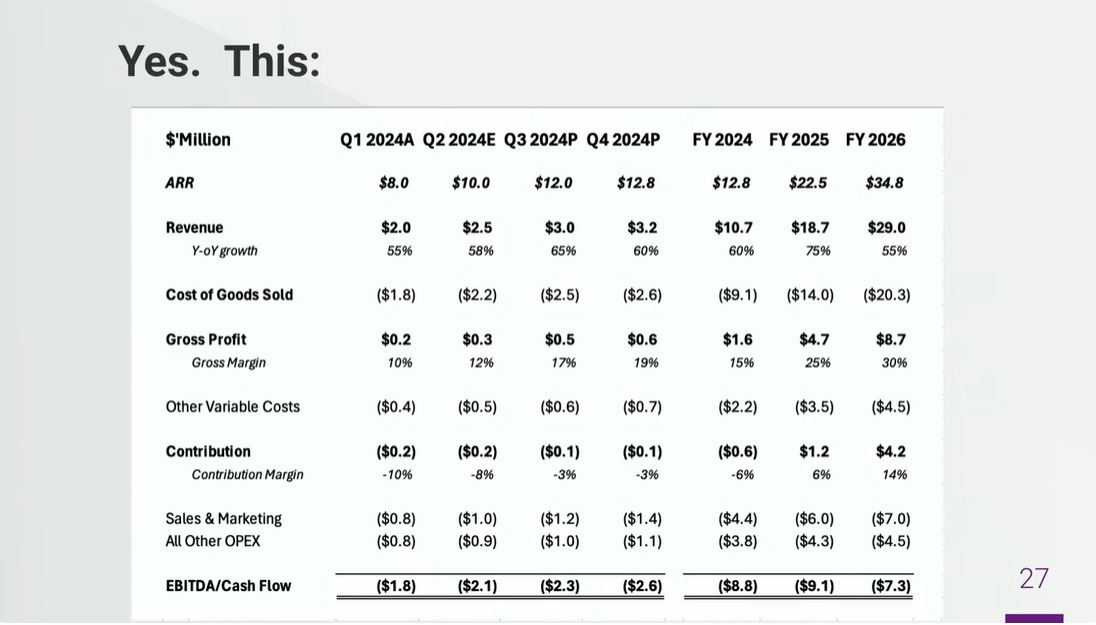

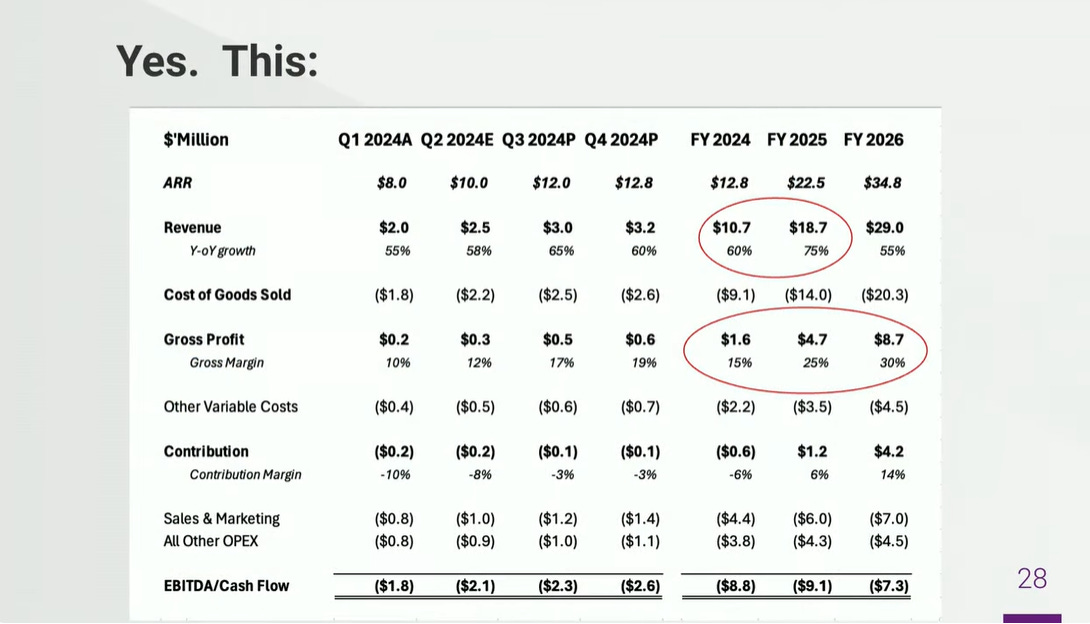

This is financials. Numbers in millions, to one decimal point, we can see it. I know there's nothing I'm going to tell you guys that's going to make you not have ARR there, so fine -- put ARR at the top. But then say what the revenue is, and then get down to -- and you'll notice I put EBITDA/cash flow. You can only have EBITDA if it's about the same as cash flow, otherwise the EBITDA doesn't matter. Cash flow. Easy to see. Got to have this page.

Now, when you have a page like this, there's problems. For this set of financials, the problems are in the red circles.

Look at the growth rate in revenue. It's supposed to -- it's doing this, what I call the mythical hockey stick. After the investor invests, then the growth is going to accelerate -- which almost never happens. And it's going to accelerate its growth, but it's going to have declining losses. That almost never happens.

And when you go Why is that going to happen? It’s because gross margin is supposed to double. So, okay, this is a problem. Sell it -- to convince people that these numbers are true. But that's all the more reason to get these numbers out and internalize this in your own mind, and then convince people, way before they get to this financial slide, that the tricky things are going to happen.

So how do you do that?

A great example that came from a portfolio company, someone that's in this room, if we just look first at substantiating revenue, is something like this. They're showing that for this year, their revenue is already booked. And for next year, they've already identified way more credible sources of revenue than they're forecasting.

Now you may not be able to make this slide, but then you can work with people like your folks at KV, and we can help you think about what have you got to work with. But the weaker your story is, the more you want to figure out what's the best way to tell it. You don't want to dodge this issue.

This slide is looking at a stair step of why -- how's margin increasing? The solid on the left are -- these are margin increases that have already happened. And then forecasted is on the right. Just by showing it this way builds a lot of credibility that the forecast may actually happen, because they're specifically identified and there's a track record of improving margins. This example I showed before in running the business, it's also great slide for fundraising. Because the trend lines are positive.

I think you've got the summary.

And then I wanted to close with a few quotes. Which is, again, you guys are great at vision. And that's great. Without vision and courage, nothing would get started. But if you just have vision, and you don't have this quantitative frameworks, then it's Adam Neumann at WeWork. You don't want to do that.

And when you're starting a company, things like this middle quote, the Warren Buffett quotes not that cool. But over time, this gets to be cool. The numbers. So up-level it in your mind, in thinking about as you build a team, which leads to this last idea.

And Bill Campbell was the lead director at Apple and the CEO of Intuit. And was also very involved with Google. To Bill, marketing was about being quantitative. And I like this quote, because he's acknowledging that it's not a numbers person that would make an iPhone, or a Macintosh -- that's someone like Steve Jobs.

But Steve Jobs was not a great CEO until the last decade, and his last go round at being CEO. And what made him a great CEO then is he learned to surround himself and listen to people like Tim Cook and Fred Anderson, his CFO. Prior to that, Apple was near the verge of bankruptcy multiple times. After that, Apple became the most valuable company in the world.

That's what I got. I think we have time for one question, and then I'll send you to break. So who wants to ask the one question?

Audience Member: Can you explain your reason behind revenue versus ARR given everybody else is accepting of ARR? What's the rationale behind tracking revenue vs ARR?

David Weiden: Good question. I would say the distinction between revenue and ARR itself is not a big deal. Because ARR, since it's just current revenue x12, is -- you do want to know what your revenue is, especially your revenue for some period.

And what you don't really want to do is be mixing different numbers in a way that is essentially what I call subconscious cherry picking, where -- you don't want to look at an a revenue number like a forward ARR number, but then match it against what your burn is for some period. It's just a better way to run the business. Think about I have money coming in for this period and money going out for this period, and that's more real. But the difference between those numbers isn't that big a deal.

It gets more divergent when you start looking at something like CAR, where CAR is just more -- CAR stands for committed annual revenue. That's where you start to get a much bigger divergence between what is your cash and what are your expenses? And if you're using it as what I call a vanity fundraising metric, that is not a great idea, but it's okay.

Where it gets to be a real problem, where you get into what I call the WeWork express train, is where you just start to live in a world of CAR and Community-adjusted EBITDA. And again, it sounds funny, but nobody, while they're doing it, they don't think that way. And one way to be sure you're not doing that is just to know what's your revenue, what's your cash flow. Then you are not living in that world.

I put up the Warren Buffet quote -- Charlie Munger as a quote. He says, Anytime I see EBITDA, I just think bullshit. And so the closer you are to what's going on with cash and cash flow -- and it's not about being cash flow positive today. That's why -- DoorDash, when I put up its success, it was not cash flow positive. But its customer economics were positive. So I think you just want to be as close to the source of truth as possible. And as you get farther from that, the danger increases.

So you can know what your ARR is, but I would say ARR is no more important than something like that coverage ratio on that slide. There's a lot -- it's a way of predicting what is the cash coming in the door, but it still is a step abstracted from what is the cash coming in the door.

The last thing I'd say is, and this -- I love this quote, Don't confuse activity with accomplishment. I would encourage all of you, Don't over-focus on revenue. Think about what Keith said, what was happening at LinkedIn. Think more about, Am I building a business that is set up to scale?

So many companies, they raise a Series A, they raise a Series B, and then they're too focused on chasing revenue. And ARR is another way of, on the margin, how can I get the most increase in revenue the fastest? And you just want to down-weight that.

Most CEOs are -- that is the metric of success. How much ARR do I have? And you want to think more like how Keith was saying Reid was thinking, which is more like, What do I need to be to be successful in three and five years? It's almost never about the amount of revenue you have.

You could vary the -- WeWork didn't fail because it didn't have enough revenue. And LinkedIn had a slow revenue ramp. But LinkedIn sold for $20bn. So that would be my -- it's not -- the problem isn't with ARR itself. The problem is you want to just think about: What is my North Star?

And your North Star is not ARR. It's building a scalable, successful business with these real underlying customer economics.

Okay. Next up is the break. Thank you, and we'll see you in a half hour.

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.