Letter #255: Yen Liow (2020)

Managing Director at ZBI Equities, Principal of Ziff Brothers Investments, and Founder of Aravt Global | Framework Investing and the Case Study Methodology

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Yen Liow was the Founder and Managing Partner of Aravt Global. Prior to founding Aravt, Yen spent over a decade at Ziff Brothers Investments (ZBI), where he left as a Managing Director at ZBI Equities and a Principal of Ziff Brothers Investments. Before joining ZBI, Yen was a consultant at Bain & Co. across its San Francisco, Sydney, Singapore, and Beijing offices.

Today’s letter is the transcript + slides of a talk given by Yen to students around framework investing and the case study methodology. In this talk, Yen stresses the importance of frameworks for developing pattern recognition skills and identifying opportunities as the single most important area of their R&D, before sharing goals and lessons on maximizing return on time, learning quickly, studying compounders, identifying the right tail and dissecting the left tail, and understanding historical patterns to exploit them in the present. He then shares their case study methodology, starting with the goals of the methodology, the elements of a great case study, and a short mantra around the process, highlighting the importance of actually applying knowledge when it comes to investing. Next, he actually walks through a case study that was prepared as part of a Columbia Business School class, showcasing the depth of research conducted by sophisticated investors.

I hope you enjoy this talk as much as I do! ZBI was one of my favorite funds, and I’ve learned a tremendous amount from the people there. Furthermore, most investors speak only very generally about their ideas publicly, and this talk is a rare opportunity to see the kind of work that investors at a firm such as ZBI conducted (yes, this case was prepared by students, but it was led, and chosen to present, by Yen).

On a personal note, this video was one of the inspirations for me starting Speedwell Research. I found myself sharing it with a number of friends, colleagues, and high school/college students who were looking to learn how to (better) diligence companies. And it highlighted the lack of quality, fundamental research available for anyone from college students to even professional investors. Granted, we at Speedwell prefer longform memos over presentations, with each of our reports ranging between 50-150 pages.

[Transcript and any errors are mine.]

Related Resources

Rainwater Model

Ziff Brothers

Bass Brothers

MSD

Transcript + Slides

Hi, my name is Yen Liow. I'm the Founder and Portfolio manager of Aravt Global. In this short video, I'd like to explain how we train, but specifically around our case study methodology.

Before reviewing the rest of this video, please read this disclaimer.

Thank you.

So frameworks is the most important area of our research and development. We believe they're a critical part of refining great judgment on pretty much anything.

Good judgment is a function of mental models or frameworks. If you come across anyone who you deem to have great judgment, understanding their framework of thought is a critical part in understanding their decision making.

We believe mental models can help you see opportunity as it helps to iterate towards refined judgment.

Once you develop frameworks, and best done as soon as you can in your career, we believe that 80% of all decisions are actually generic.

Once you've created these mental models, that saves a tremendous amount of time and energy and allows your focus to be used only on critical areas and help reduce error rate.

From a pattern recognition perspective, the key question was: How do you systematically break down this vast universe of investment opportunities into a finite set of ideas that give you a fighting chance of creating sustainable superior returns?

At our firm, this is taking a global stock universe of over 3000 securities and narrowing it to less than a few hundred. From a focus perspective, the key question is: How do you maximize your return on time? Time is by far the most scarce commodity for us as investors.

So how fast can you learn?

Judgment and insight is not a function of time. It's actually a function of repetitions within a framework of thought. Functions of exposure to decision points in a data set to condition that pattern recognition and then help refine your judgment. We believe this is a controllable variable.

Pattern recognition is exposure to statistically significant data sets which enable you to form causal relationships.

And then judgment is exposure to enough decisions and feedback loops to refine within a mental model or framework of thought.

So the goal is to learn in dog years. To accelerate your pattern recognition and judgment. And the laws of compounding say if you can do it as early as possible and then unleash time.

And so our mantra here is to code, simplify, execute and refine. But in framework formation, it's really trying to isolate the first two steps of that mantra.

The alternative here is learning in real time loops, which we think is extremely slow in compounding of knowledge, as it requires the number of decisions and then sufficient time to refine judgment in that feedback loop.

What we have sought to create in our case study methodology is effectively like a flight simulator where we can dramatically increase repetitions and learn from history to decode and then simplify what we're seeing in patterns of value creation and value capture.

The alternative here is the equivalent of putting fighter pilots in the air and only waiting for bullets to fly before they learn. We think that's an absurd proposition in both the military and in investing.

So we started studying these. We started breaking down what we thought were the compounders and two other frameworks on the right tail of equity markets and similar number on the left tail. And so we started studying them across all different industries and time sets, trying to deepen our understanding and building up our case study library.

We are a long short fund, so we also—we're trying to dissect the left tail of how to short these, or avoid these on the long side, or what took these formerly good or great business models and broke them. And these were patterns that we were trying to decode as clusters in our case studies.

So, at Aravt Global, what we were trying to work out was:

What exactly were these historical patterns?

And then how could we try to exploit these patterns under current market conditions?

This has been my journey since August of 2006.

So, case study methodology is letting history be your guide. It's radically increasing the repetitions to help you develop pattern recognition and to see opportunity and to endure the bumps.

It starts by picking the right genre to study, isolating the exact type of investing that you're trying to study.

And so from a patent recognition perspective, is having enough data to tease out the value creation and then value capture.

From a judgment perspective, it's putting yourself in a position to make judgments where there's enough time and enough data to watch it unfold. That is the flight simulator component to this.

And then finally, it's just to accelerate your experience curve.

Case studies can focus on one or the other of pattern recognition and judgment. Sometimes they do both.

So I'm gonna show you a case in a minute. But some elements of a great case study.

The first is just understanding how an industry and company evolve.

And then having the sufficient data to assess and exactly understand how it has evolved.

The detail around the decision points, and then feedback loops thereafter.

And then contrasting it to other companies in the industry to help tease out the differences or counterfactuals. It's very difficult to see it when you're only comparing a company to itself longitudinally. It's a lot more insightful when you can contrast it with other companies going through the same experience.

The structuring of the debrief is absolutely critical. We actually think this is more important than the case itself. We try to involve management teams and or experienced investors or analysts who actually invested through those periods with those companies to help bring the conversation and insights alive.

And then finally, nothing is more important to us than actually applying knowledge. Knowledge for its own sake is important, but not particularly useful in investing. The whole point of this is to find knowledge that you can apply to current market conditions.

And then finally, the mantra again here is: decode, simplify, execute, and refine.

The focus for case study methodology is to first decode what the actual patterns are, simplify them so that you can execute them, and then refine your judgment under current market conditions.

A few contacts to follow me as we post some more details, but let's dive into the case.

So this is a case on O'Reilly auto parts, one of the most powerful compounders over the past three decades. We're going to go through this case very quickly. These cases are usually presented in about 30 minutes in a pre recorded video. We don't do these live anymore. The debriefs are where we spend all of our time live, which take between 75 and 90 minutes each.

This case was prepared in a Columbia Business School Class of 2013. This was one of over a dozen cases that we prepared with students over the course of two semesters. We debriefed actually six cases across industries within the same investment genre at the same time as O'Reilly. And this was done with the assistance of one TA per student.

This one is slightly more detailed than normal. Our cases in general last between 40 and 60 pages. This one is 59 pages. This took about 100 to 120 hours of effort. The second or third rounds, once you get used to this, is around 80 to 90 hours.

The framework here is horses. It's a type of compounder which is core to our strategy at Aravt Global. And this cohort was focused on the stage of moving out of proof of concept into the replication phase of the natural lifecycle of a business, or the earlier stages of the compounding of a horse.

So this is O'Reilly, and as I mentioned before, one of the most successful compounders over the past three decades. O'Reilly actually compounded at 21% from its IPO in 1993 through to the point we studied this in 2013. And that was a 40x in that timeframe.

This is one of what we call a cluster horse. And what we mean by that is there were several companies in the same industry that were all incredible investments. O'Reilly is an automotive aftermarket supplier in North America. It competed against AutoZone, Advanced Auto Parts, and Napa. All four of them were fabulous investors.

Again, I'm not going to walk through this deck in tremendous detail. I just want to give you some highlights to get a sense of how to do it. The point is, I just want to share you a broad understanding of the approach.

So let's take a quick tour.

First part is just laying out the different times longitudinally of this. There's different stages of it. We want to do a market overview and a company overview early, and then just walk through chronologically how the story unfolded.

So just start with a little bit of overview on what were the drivers of the stock and some basic KPI's.

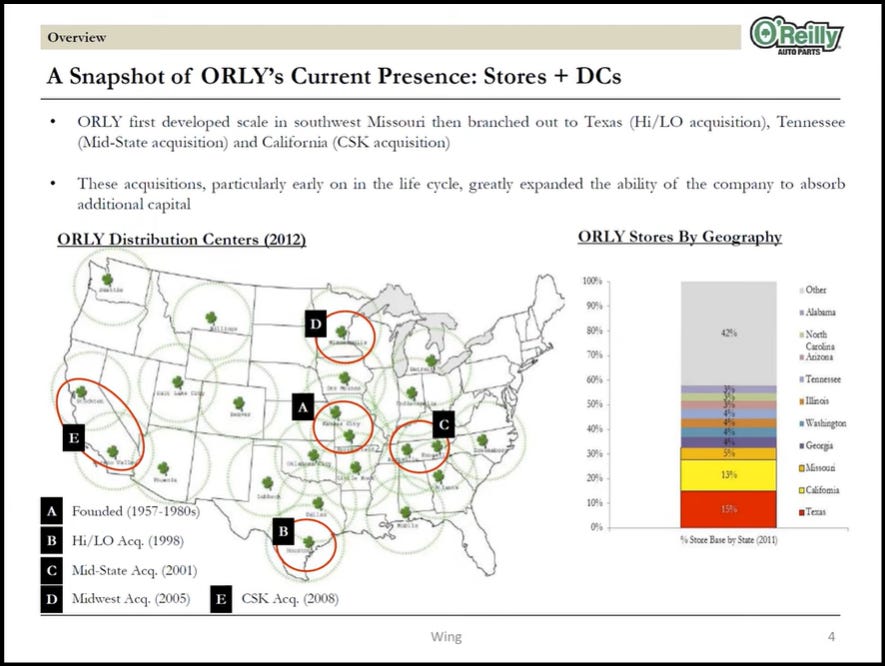

Explain a little bit about the geographic mix of O'Reilly and where it grew its business. It started in Missouri and expanded regionally before nationally.

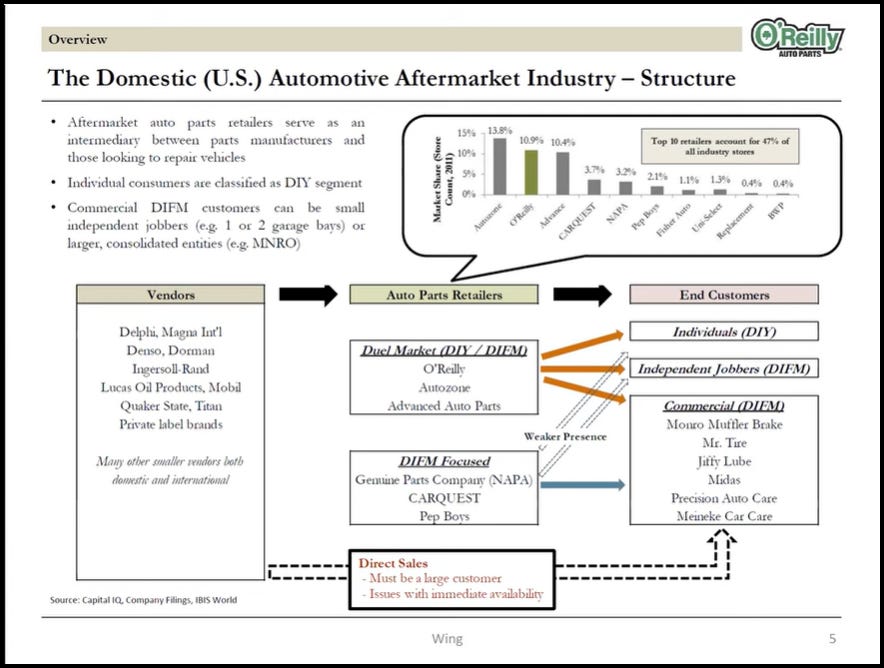

An industry map is a very important part of what we do, making sure that we understand how the company fits within the context of its industry and its supply chain and its customer setting.

And then now just understanding broader markets. So this is operating in the DIY and DIFM for auto market aftermarket. DIY stands for do it yourself, where you're buying the auto parts and you're fixing your own car. Do it for me is the garages where they literally do it for you.

So this is starting to understand the different mix of their competitors. So O'Reilly competed against AutoZone, Advanced Auto Parts, and GPC, which is Napa. Just to understand the size and scope of these companies and the composition of DIY and DIFM, and then take a look at a little bit in their margin structures and what occurred over the life of this case.

Now this is starting to go into the first stages of this in breaking down the three stages as this student looked at it.

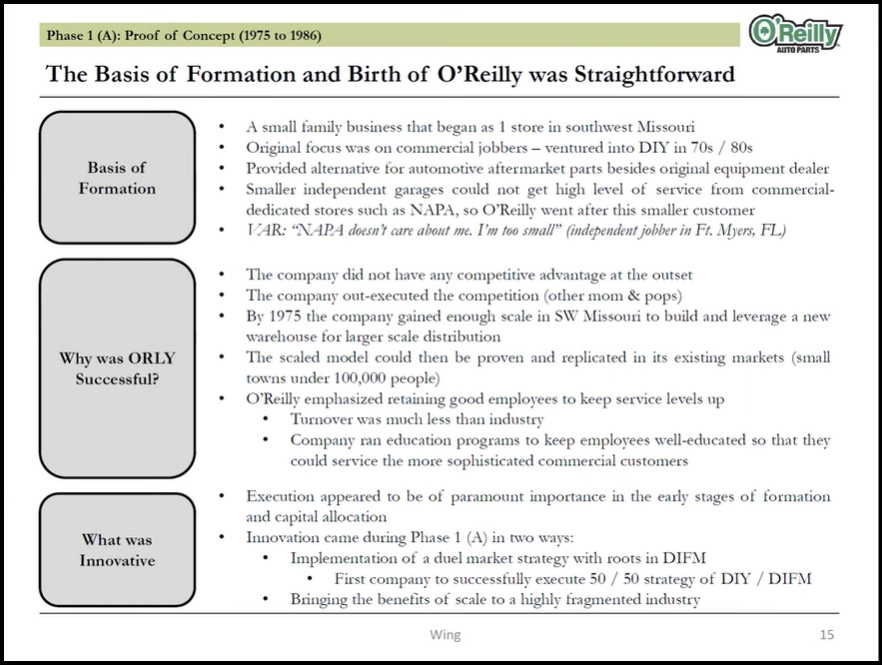

The first was really understanding it as a company pre-IPO, and frankly, even when it first started, why was it created?

The second stage is around the IPO, which is still on the regional basis.

And then the last part here, which is really super regional and national replication, which is when the stock really took off, and trying to understand when it de-risked, and could we decode that earlier?

So the first and most important thing in preparing a case is making sure you understand what exactly is the question here. And the focus of all of these cases was horses that were de-risking from proof of concept stage to replication.

We think there are three natural stages in the lifecycle of a business: proof of concept, replication, maturation. This was trying to understand when it transitioned between proof of concept and replication.

Very quickly, an overview here is just understanding what drove the stock performance and then a framework for actually de-risking.

Four factors here the student was really focused on. One is understanding when unit economics were proven, understand the growth trajectory and was it sustainable, understanding any other analogs within the competitive frame in the industry or around it, and then finally understanding its true TAM.

So the first stage here was proof of concept. This is when it was a private company and still very small prior to its IPO.

A quick chronology of how it was evolved. This was a Missouri only company from 1957 when it was formed, through to 83 at the 25th year.

And this is looking back through some historical analysis.

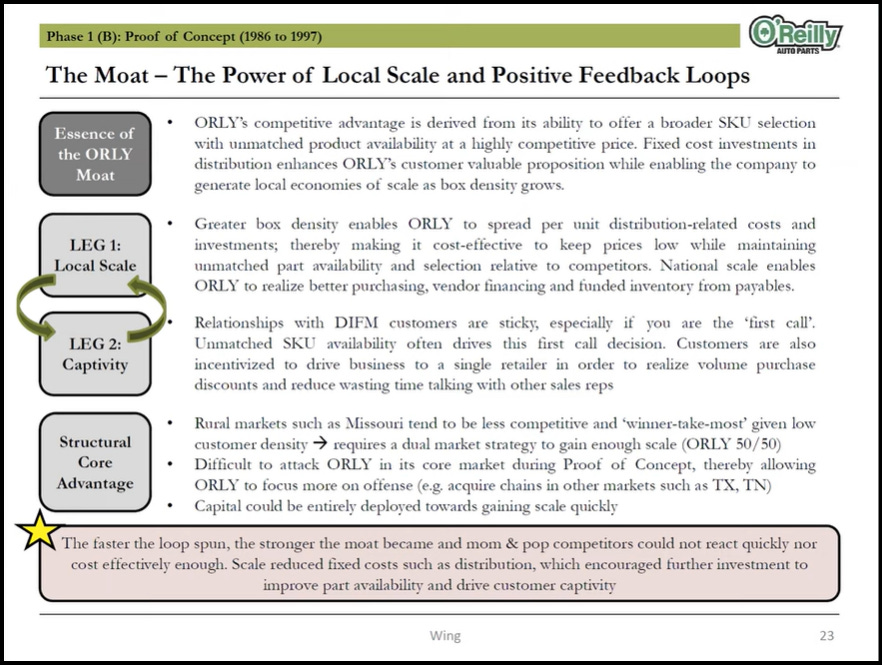

Why was this company and why was it so successful? Just to very quickly on this, when it competes against mom and pops, do it for me and DIY aftermarket is a very SKU-intensive business. It's a very distribution-intensive business. So there are lots of parts, and timeliness of parts matters a lot in this business model.

When a car is broken, the parts aren't fungible. It's very specific to that particular model, make and year. And so what is important, it's a key success factor in this business model, is parts availability and service level delivery. And so it's very distribution and skew intensive. And what O'Reilly worked out early in its life was those are the key success factors, and heavy densification of part availability and route density is what were the key drivers of this business model.

This is again, focused on what the actual market is and what the size of the TAM was.

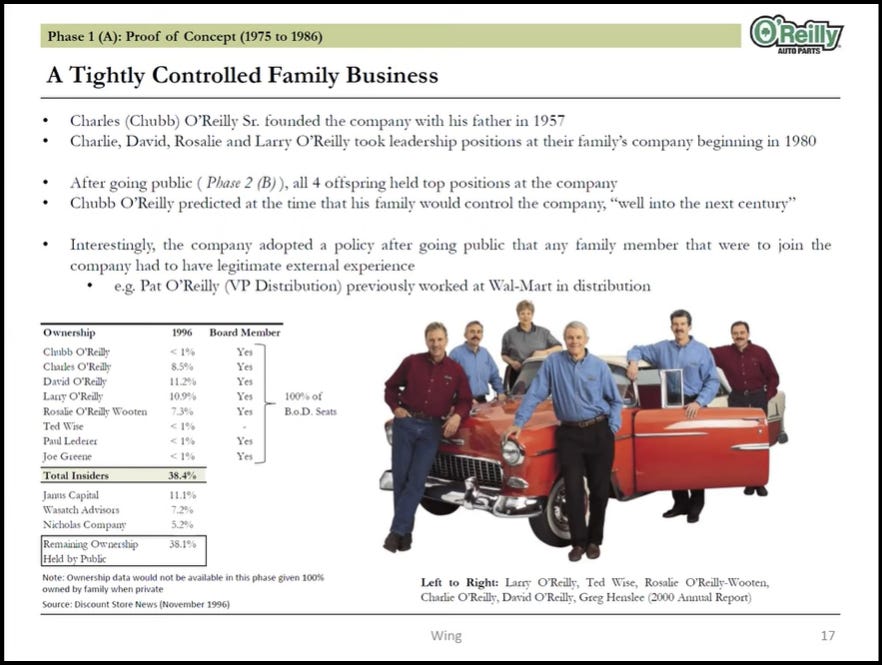

If you're going to invest alongside a business for decades, or even over a five year period, culture matters a lot. This is a family-run business. The O'Reilly family, at the time of the IPO, owned almost 40% of the company. Understanding them in depth was an important part of what we did.

Now it's going into the proof of concept stage, which is really around the IPO, and coming out of its private stage, where it was still building up regional scale.

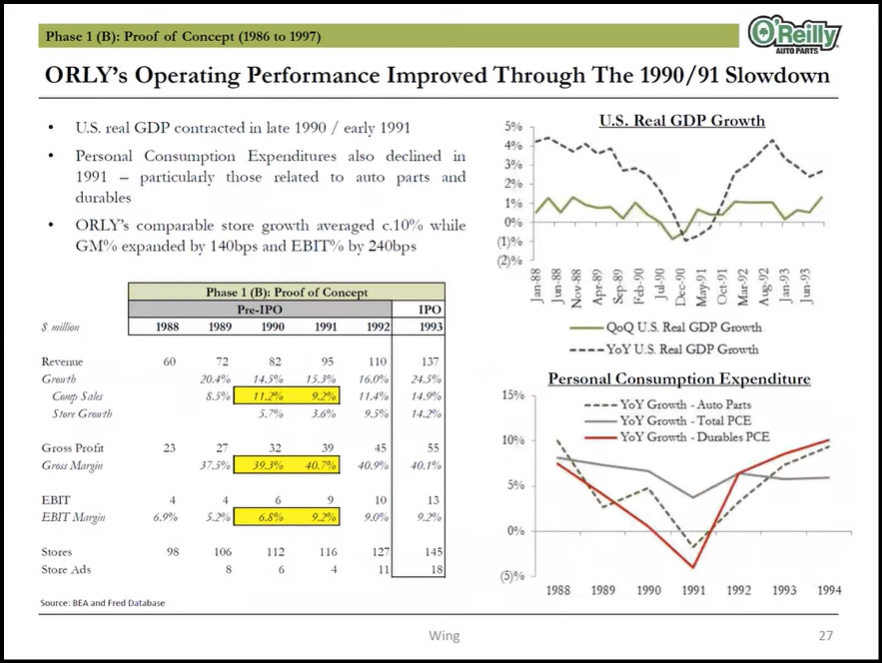

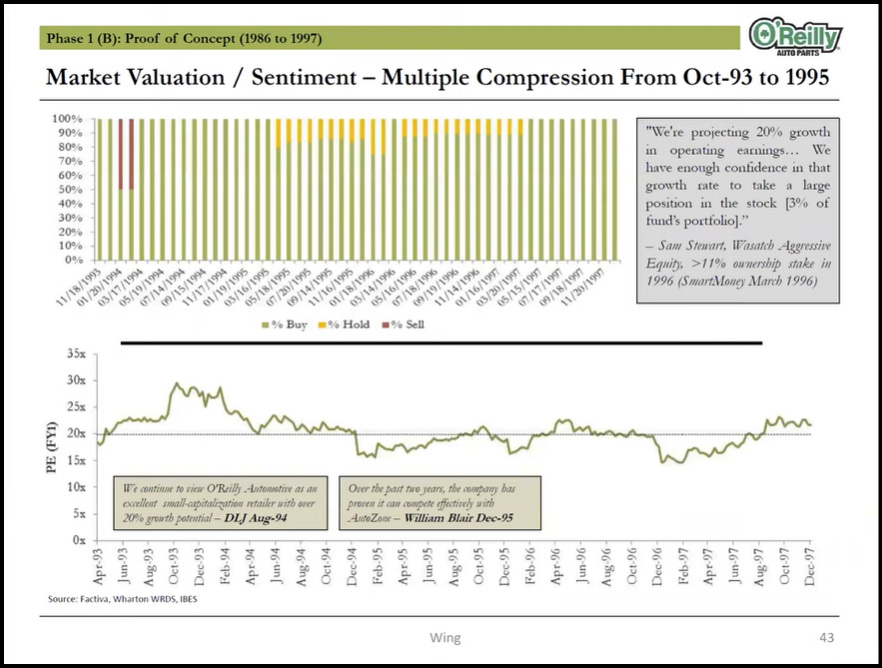

The stock performance here was moderate. It was up 170 odd percent from 93 through to 97, so the first four years of its life. But against the S&P, that was 122% up in that time period. Solid alpha, but nothing extraordinary.

Now, this is an important part of what we do, is setting out some key financial metrics to understand the drivers of value creation. Nothing complicated in this. It's again just laying out the data sets so that you can actually see it all in one place, and watch the company evolve and try to learn those patterns.

The company started accelerating its growth, and started to go outside of Missouri for the first time in 93. Going into three other states, it realized that densification, but hyperlocal, was an important part of this, but it was scalable once you got into that local density.

And so now it was hyper dependent on local scale economics, because you're competing at the local level, but you could procure at a regional or almost a national level.

And so the first leg of this story, or the TAM one, was hyperlocal, the second was national, or at least pan-regional. And understanding captivity, or customer captivity, was an important part of this business model.

It was a very, very sticky product. Once you got the trust of the garages, it's rare that they actually ever sourced outside of you, as it wasn't really a price sensitive industry. It was much more, again, parts availability and service level that mattered.

So what happened?

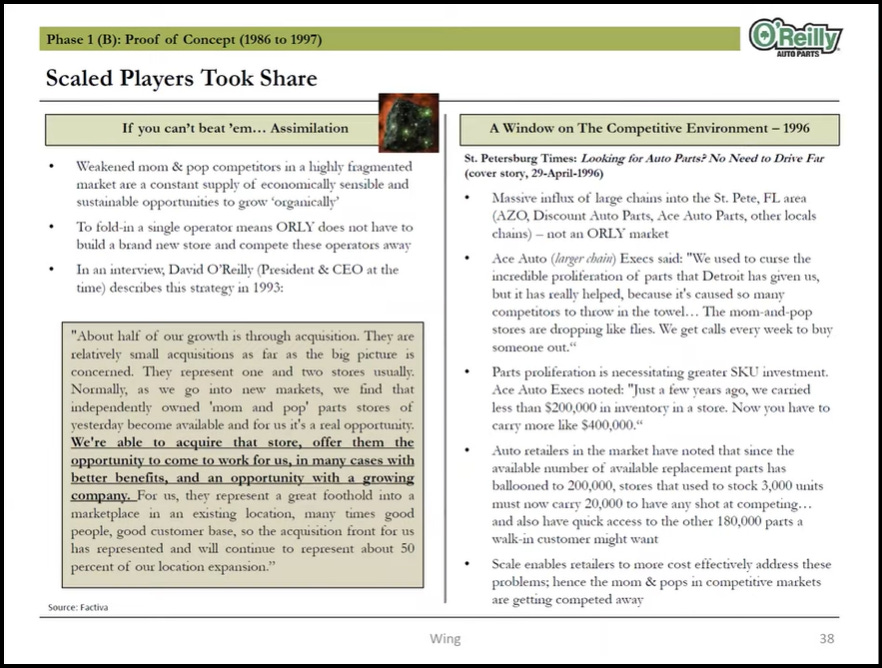

It was a hyper fragmented TAM. They started moving into adjacent markets, and they had very, very strong local share that forced mom and pops out of their regions, because they were clearly outcompeted once O'Reilly got to scale. And they learned this at a regional level.

Now as we transcend a little bit further, trying to understand what the total addressable market and the opportunity set here is at a local and a national level.

And this is one of the few areas, in this case, it wasn't designed to be a decision point case. This was more designed to actually work out what happened and form more patterns of causality.

But this is an example of if we positioned you in 1995 and tried to estimate what risk reward skew is with the available TAM, this was actually projecting out seven years to 2002, and trying to understand what did we need to underwrite to generate very healthy returns, and would we have had the information at hand to make it?

Other parts here, understanding unit economics and comparisons to other business models. It was a very powerful unit, even within its industry. But the cluster was powerful against other types of retail replication stories.

Now we start looking at distribution and logistics. A very important part of any growth story is the company's ability to actually execute it.

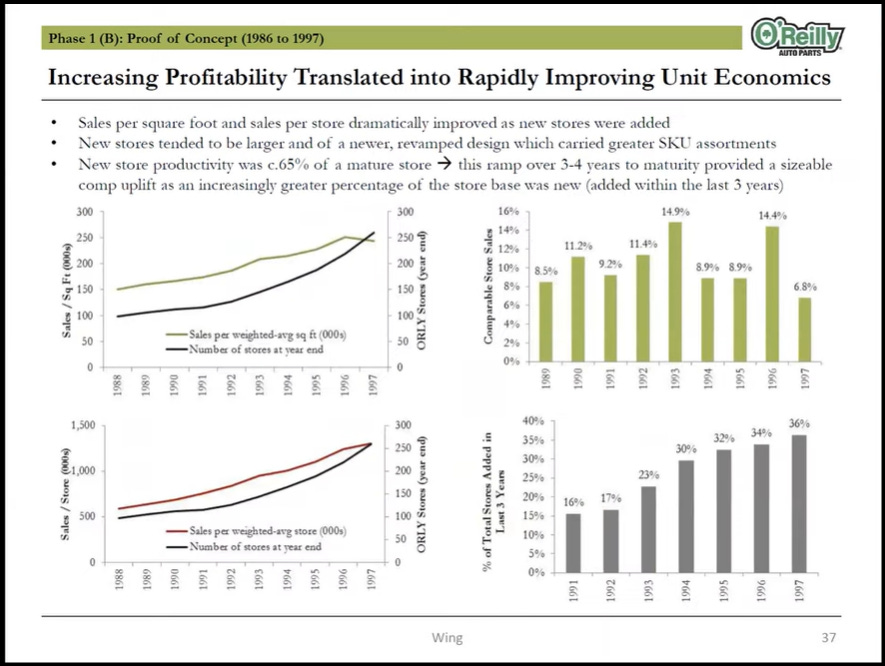

Again, watching how the story is unfolding and understanding the unit economics as they have been evolving in this company.

And then what it was for O'Reilly in aggregate versus mom and pops. At a unit level, it was very clear that mom and pops couldn't compete against O'Reilly on a multiple of dimensions, and that was being evident in their competitive win rate.

So what we push forward a little bit further here.

It's very important to understand the bear case at various stages around decisions. Understand the tension. You can pull that from sell side reports as well as literature searches from back then.

Understanding their capital allocation.

Understanding market sentiment. Early in its life, there was more bearish settings. You can understand the valuation history of the whole company. It was actually fairly moderately valued for a 20% compounder that 40xed over this time period. It traded around 20x the entire ride, so this is one of the rare compounders that sustained highly, highly durable, long dated growth, but never was that expensive.

And now we move into the major transition. The act one is local. The act two here is national.

And that required a different level of underwriting.

And so coming back again to what we were trying to de-risk on these four dimensions and what we observed, I'll come back to that.

And so now we're going into that act two on a national and at least super-regional basis.

This is when the stock exploded. And so O'Reilly went up 14x from 97 through February of 2013, against the S& P at 50%. And so this was dramatic outperformance. And what we were trying to understand is why.

And so here it is just getting, again, understanding unit level economics, which were clearly scaling. Profitability was scaling as the company got bigger. This is another one that's rare. And that's something that we study for, where the benefits to scale are accruing to the business. It's clear it gets stronger as it was getting bigger.

And it was also starting to acquire assets and integrate those assets extremely well. Again, another example here, just making sure we can see all the numbers in one place so we can dissect the patterns for ourselves.

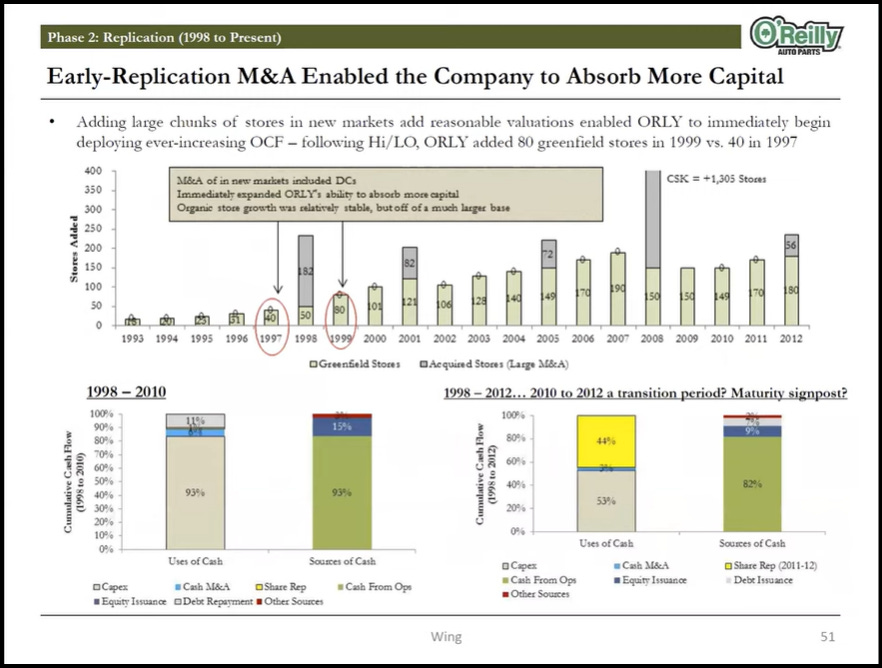

This is their capital allocation from both Greenfield and now M&A, and trying to understand if it was productive M&A or not.

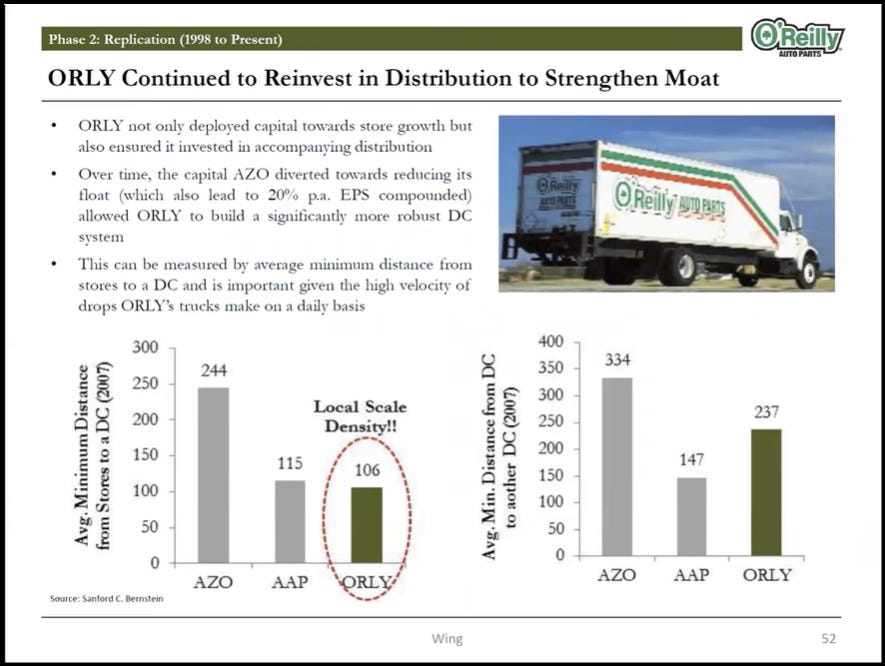

Distribution was a very, very, very important part of this model. It's an important part of almost all analog business models.

Anyway, cutting a long story short, this strategy was super consistent from day one. You could read it in all the K's, Q's, and their analyst presentations. Hyperlocal market domination and densification was an important part of the story.

Finally, in takeaways, this is, again, just for the purposes of O'Reilly itself, we're trying to understand what we learned from the company and from the stock. And this is talking about elements of the moat, the TAM, how the company replicated, evidence of the company's ability to execute, some of the drawdowns, what was going on.

Before we leave this, the one thing that I do want to stress is, so this was a story in its first phase of local replication from 93 through 97, and what could we observe to actually assess it? And then the second was this transition to national and pan regional. The two things that we're really trying to get from this is understand the drivers of growth. So get the whole story.

Where was all the value created and how was it captured? And then the second part of this is understanding risk reward, and what was knowable in those trade offs during the ride of this investment, and hopefully try to punctuate it with little decision points.

But the last part that I think I really want to stress in case studies is this case is a example of a very high quality piece of work by the student, but more importantly, it was one of six in that debrief and one of twelve of that year that helped us step back and tease out what were the right questions, what were the enduring patterns across multiple companies that created similar value in a similar genre. And it was the debrief with other investors and or the management teams that let us tease it out and create texture, and then go hunt one with that.

I hope this was helpful. I look forward to any of your questions, and good luck hunting. Thanks for your time.

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta (Facebook) and interesting new frameworks like the Consumer’s Hierarchy of Preferences.

Cloud Valley — Beautifully written, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “An international treasure”

Memos — A selection of some of my favorite investor memos

Bookshelves — Collection of recommended booklists.

Mr Liow's fund had high staff turnover and poor returns. According to the Wall Street Journal, his "hedge fund lost 8.5% in 2021 and was down by double digits this year through February (2022)," after which he abruptly shut it down.

KG. This was excellent. The pattern recognition element is not a muscle that even the pros exercise.