Letter #35: Stan Druckenmiller and Geoff Canada (2013)

Duquesne Founder and Harlem Children's Zone President | 2013 Bowdoin College Presentation | Generational Theft

Hi there! I go by KG, and I love studying the history of business and investing. I’ll be sharing some notes from one Investor/Shareholder letter per weekday (mostly from my compilations) here.

Today’s notes are on the 2013 Stan Druckenmiller and Geoff Canada presentation at Bowdoin College titled: Generational Theft. You can watch the entire thing here. These are my notes. Some additional thoughts/takeaways at the end.

*Note: This email is image-heavy. If you can’t see any charts, I recommend reading it on my actual substack website. You can also find it on my blog here.

Notes

Entitlements:

Webster’s: A right you have under the Law

Actual: A benefit that people have under the Law that they don’t have to provide a current service for

Income Supplement (lots of Press, but not really anything)

Unemployment insurance claims

Food stamps

Three Main Buckets (big big money) – Primarily for the Elderly

Medicaid: Income based (70% goes to elderly)

Social Security

Medicare

Druckenmiller started worrying about entitlements in 1994

In 2011, the baby boomers, the front end of what was going to turn 65, and there would be a huge surge in entitlement payments

Whats the demographic issue?

Chart 1: Federal Government Entitlement Transfers as a Percentage of Federal Budget Outlays

NATION OF TAKERS

Services/Benefits people get while not providing a current service

1960: 28% of Federal Outlays

2010: 68% of Federal Outlays

Used to be 1/3 of Defense, now much more

Biggest increase took place in Nixon, Ford, GWB admins (NOT a partisan increase)

Elderly taking a bigger and bigger share even BEFORE baby boomers reach that age

Chart 2: Benefit per oldster/GDP per capita

THE LEVEL OF GENEROSITY TO THE ELDERLY HAS ALMOST DOUBLED IN THE LAST 40 YEARS, UNSUSTAINABLE

Benefit/Oldster has grown MUCH quicker than GDP per capita since the 70s

1970: 41%

2010: 72%

Chart 3: Average Consumption by Age Group

YOUNG’S CONSUMPTION IS UP 38% IN 30 YEARS, WHILE THE OLDS CONSUMPTION IS UP 164%

People receiving outlays are about to explode

1960s: 20s consumed much more than people in their 70s

1990s: 70s consumer much much more than people in the 90s

AARP taking money from you and giving to the elderly

Chart 4: US Poverty Rates by Age Group

POVERTY RATE FOR THE ELDERLY HAVE COLLAPSED, NOT SO FOR CHILDREN

Elderly: 35% -> 9%

Children: 25% -> 21%

Minority Children: 31% -> 35%

Massive wealth transfer from young to elderly

Chart 5: Average Children per woman

FERTILITY RATES HAVE GONE DOWN DRAMATICALLY

Fertility Rates:

1950s: 3.7

2011: 2.06

In 1957, there were 100MM less people in the US, and they were having more babies than we are today

Those babies are about to become seniors, who have been taking more and more, and there are a lot of these babies about to become seniors

Chart 6: US Life Expectancy at Birth (Years)

US LIFE EXPECTANCY HAS GONE UP SHARPLY

1900 to Now

Men: 47.9 -> 74.9

Women: 50.7 -> 79.9

Not only will there be MORE oldsters, they will be around for a much longer period of time

Seniors:

A) Bigger Share

B) More of them

C) Taking for a longer period of time

Chart 7: Federal Spending by Entitlement’s Program (% of GDP)

THE ENTITLEMENTS PROBLEM IS JUST BEGINNING

Percentage of GDP

3 Buckets: MMSS

Now to 2050: 10% to >20%

Historically, tax revenues as % of GDP have a ceiling around 20%

Entire tax revenues will be going to people who don’t even provide a service

Chart 8: US Population Ratio: Working Age to 65 and Over

DEPENDENCY RATIO IS JUST STARTING TO FALL

By 2030, there will be HALF the amount of young to support the old

Working age: 18-64: Grow 17% from 2010-2050

Elders: 65+: Grow 102% from 2010-2050

4.8 workers supporting elders

2030: 2.9

2050: 2.4

Huge recipient pool, less people giving money to

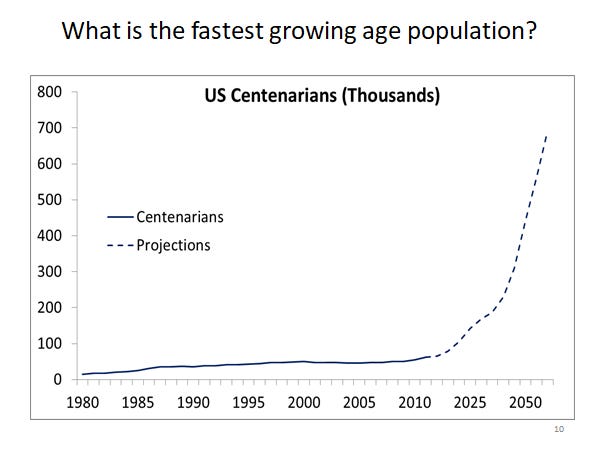

US Centenarians (Thousands) are the fastest growing age population

Oldsters growing at 102%

85+ growing at 343%

100+ growing at >1000%

Spend A LOT more on medicare than people in 60s and 70s

Chart 9: The True “Fiscal Gap”

IF TAXES RATES AND THE LEVEL OF GENEROSITY IN ENTITLEMENTS PROGRAMS REMAIN THE SAME, WE HAVE A MASSIVE PROBLEM AHEAD. EITHER TAX RATES RISE OR GENEROSITY FALLS. THERE IS NO ALTERNATIVE

Total Debt (On the Books): 11Trillion

Fiscal Gap: 211Trillion

Expected tax revenues – present value of benefits promised

Labor: Pay a payroll tax: supposedly to pay social security and future medicare: but it doesn’t pay for you, it pays for the current elders

All you have is a promise you’ll have some

Deficit: 10% of GDP, actually 15% of GDP

Chart 10: Federal Taxes/Expenditures

THE COST OF WAITING IS ENORMOUS

The increase in federal taxes and expenditures needed to cover fiscal gap today is much lower than in 40 years

Increase in all federal taxes:

Today: 64%

20 years: 77%

40 years: 93%

Decrease in all federal expenditures (defense, entitlements, etc)

Today: 40%

20 years: 46%

40 years: 53%

Chart 11: Raising taxes on the rich is not the solution

10%, 1000bp Rise is Millionaire Tax Rate: $92B

2010 Deficit: 1.3Trillion (not including off balance sheet)

At 50%, every day you work until June 30th, all your income goes to someone else

You don’t get anything till July 1st

If you tax the rich, they:

Stop working

Move

Even if you get the money, it doesn’t move the needle

Chart 12: 2011 US Defense spending exceeded the 13 next highest defense budgets combined

USA: 711B

China: 130B

Entitlements growing MORE than 711B, so if you cut 100%, still screwed

Chart 13: Net worth by age of household head in 2007

LOWER CAPITAL GAINS AND DIVIDENDS IS A DIRECT TRANSFER FROM YOUNG TO OLD

20-34: 100K

65-74: 1MM

Chart 14: US Consumption by age (ratio to labor income ages 30-49)

THE BIASED GROWTH OF THE WELFARE STATE

1960:

X-axis: Age

Y-axis: What the average 30-49yr old makes in

90yr old is spending 138% what 40 year olds makes

Spending 2x what 30 year olds spend

Lots to keep elders alive an extra 5 days

Chart 15: National Health Spending across countries

AN ADDITIONAL PROBLEM OF INEFFICIENCY. US not even close to any other country

US: 17.6

Average: 9.5

Chart 16: Despite spending 2x average country, health outcomes are bad

Spending the most, yet near the bottom for health outcomes

Why? Screwed up system: Malpractice insurance scam of an industry

Lawyers taking a bigger bite from physician income – NOT the biggest problems

Incentivizes hospitals to run insane (10-15 tests) that studies have shown don’t actually make an impact on end result

CYA policy (cover your ass)

Medical bills all done through insurance – people have no idea what they pay

HAVE TO force people to shop (aka know the prices), otherwise things won’t improve

Chart 17: US National Saving and Domestic Investment Rates (%)

AGING HAS COME WITH MORE CONSUMPTION AND LESS INVESTMENT

Some Additional Thoughts:

As of this post, it has been 6 (7 for substack readers) years since Druckenmiller went on his college campus tour. Unfortunately, it appears that he was unable to inspire the youth to go out and fight for their future.

Interestingly, the Medicare and Medicaid have been core issues that politicians have been campaigning around. However, there has yet to be a convincing payment proposal. The wealth tax in particular has been a central focus for the Democratic Party in the run-up to the 2020 election.

It is increasingly clear that the ElderTech market will be far bigger than anyone imagined. However, there has yet to be a majorly-funded ElderTech startup, nor the establishment of any ElderTech venture capital funds/teams.

Historically, America has hidden (or solved, depending on who you ask) its demographic issues by taking in immigrants. However, since the 2016 US Presidential Election, relying on immigrants is becoming less and less likely, whether that be for blue collar jobs or white collar jobs.

America’s demographics seem to be following in the footsteps of Japan, Korea, the Scandinavian countries, and many other countries: less babies, less immigration. Will this lead to a stagnating US economy?

Given the increasing Elder population and shrinking Youth population, it is more important now than ever to invest in our children. Currently seeking out children/education-focused startups.

Note: Thought of the Malthusian Trap and a running out of resources. Similar to the industrial revolution, the implementation of AI will likely increase human productivity by leaps and bounds. But will it be enough?

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

Please DM or email me any time — to share non-obvious intel, views and correct or solicit mine. I appreciate your continued support and partnership :D.

All compilations here.

Support

As many of you know, making compilations and this newsletter is a (very time consuming) passion project for me. Multiple people have reached out about how they can support me so that I continue, so I set up with a few ways:

1) Patreon

2) Bitcoin: 3NMAiprwVj5513FSqHUNycor6itT55atpo

Thank you!