Letter #46: Michael Platt (2011)

Founder of BlueCrest Capital Management | 2011 Interview | Navigating the Euro Debt Crisis

Hi everyone! Due to popular request (and a few persistent individuals), I’ll be restarting this newsletter, but with a few changes. Most notably, rather than sending “A Letter a Day”, I’ll be sharing a letter or transcript twice a week, once on Tuesday afternoon (2:22pm) and once on Saturday morning (6:06am). Second, I’m expanding the scope of the newsletter to include a broader range of subjects, but still focused on thought-provoking investors (across venture, hedge funds, and private equity), founders (not just tech), and operators (sales, marketing, product, etc). Lastly, I’ll be limiting my commentary so it’s a smoother reading experience and you can read the work as is. (If you’d like to see my notes or trade thoughts, shoot me a DM on twitter!)

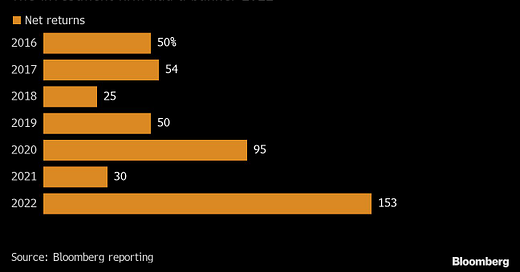

Today’s letter is a transcript of BlueCrest Capital Management Founder Michael Platt’s first live television interview on December 15, 2011, where he discussed Navigating the Euro Debt Crisis. That’s the same year George Soros approached him to manage $1bn of his money for 0.5% & 10%. Michael refused – why should he give up 90% of the upside? Less than 5 years later, on December 1, of 2015, he returned all outside capital and converted BlueCrest into a family office. His returns since then?

I hope you enjoy this conversation as much as I did!

(Transcription and all errors are mine).

Transcript

Eric Schatzker: Michael Platt is here with me and Stephanie this morning. Welcome, Michael. Stephanie, this is clearly a case where credit girl has to have the first question, don't you think?

Stephanie Ruhle: Credit girl, Canadian boy. Now, Michael, members of your JP Morgan training program said to us, "We knew this man was destined for greatness. He started by arbing the New York City subway hike." Two decades later, you're sitting on top of a $30 billion fund. Talk to us about Europe. You sit in Geneva, in the epicenter. What does this debt crisis look like to you?

Michael Platt: The level of concern that we have about what's going on in Europe is absolutely huge. I mean, you see evidence all over the markets these days that the pricing for the potential of a Eurozone breakup is distinctly nonzero, contrary to everything that is said by policymakers and by central bankers. We sort of distill it down to one really essential fact that we continue to focus on at BlueCrest Capital Management. And that is that if you look at the debt of, say, Italy, at 120% of GDP, which is increasing at a real rate of 5%, where they have to fund these days, and you look at the GDP, which now is forecast for next year to be declining at 0.5%, arithmetically, their debt is going to blow up. And we don't see anything that has been happening at the policy level that gives us any indication that there's anything that's going to convert this situation from where it is now to a much more substantial and real crisis in the future.

Eric Schatzker: Michael, what does that mean, in terms of what you anticipate and how your positioned? Do you expect that a blow up, so to speak, of Italy is going to force a serious breakup of the Eurozone where it's not just Greece and Portugal, but a number of other countries falling out and a much tighter group of...

Michael Platt: We need much more radical measures to prevent this happening. If Italy and Spain are forced to roll their debt over, which this year is going to be of the order of 600 billion euros, if they have to pay rates of between 5 and 7% for this, then the situation in Europe is unsustainable. We're not going to have, it seems, any Euro bonds. We're not going to have a full political and fiscal union where the transfers can take place. It seems that what we're going to have is an attempt to control the European situation through continued austerity, which is a process which is procyclical. Because as the economy slows down, we end up with more austerity, which creates more slowdown. We also have a requirement for banks to increase their capital, therefore, we're looking at a 3 trillion Euro takedown in European balance sheets. And there's basically nowhere I can see we're gonna get any growth from.

Stephanie Ruhle: To you, then, this is all about economics? It's not about the cultural divide between these countries and politics? It's just economics?

Michael Platt: Absolutely it's about the flip of the cultural and political divide. The reality is that there is no willingness within the Eurozone to share wealth. In the United States, money flows between different areas. If California is having a very difficult time, the rest of the United States will send money to California. This is not the case in Europe. There is no willingness to transfer money across boundaries in a long term and sustainable way.

Eric Schatzker: But do you believe that willingness will show up at some point? Or are you effectively betting on a breakup of the Eurozone?

Michael Platt: I want to make something very clear. The market prices the probability of a Euro breakup to be distinctly nonzero, despite what the politicians say. I believe that the eventuality of a European breakup is so awful that more and more drastic measures will be taken as time goes by. The ECB is probably the only institution that can tackle this problem. It doesn't have a mandate to do so. It's security mark-to-market purchase program, which is currently at up to 200 billion Euros, seems to be capped somewhere in the region of 250, 300, which just isn't enough to do the job for the rest of the year. So as time goes by, my view is that what's required is a radical change of policy from the European Central Bank to tackle this problem.

Eric Schatzker: But does that probability, does the pricing of that probability, which you put at nonzero, rise? In other words, is there an opportunity to, so to speak, to make money between here and there? In other words, it's going to get worse before it gets better?

Michael Platt: The probability that the market is putting on a Eurozone breakup, in my opinion, and the evidence that I see from option pricing across the different markets, is steadily rising.

Stephanie Ruhle: Then would you say this situation is going to be contained, or are we going into 2012 and it's only going to get worse?

Michael Platt: We're going into 2012, and in our opinion, it's only going to get worse.

Stephanie Ruhle: Then why haven't more hedge fund managers had grand slam years? So many people all year long have said, "I'm bearish. Europe's in big trouble." But no one's having this Paulson 2000, 2008 knockdown drag out amazing year.

Michael Platt: The problem is, with this trade, it's been a remarkably low Sharpe ratio bet. We've seen substantial, [we've even had a] 30% rally of Euro stocks off the ground from 1975 up to 2500. So the actual process that this has been unfolding over, which is now, by March to May, will be around two years this process has been unfolding. It's been extremely gradual. And there's been a lot of optimism in the markets that some kind of solution will be found. But unfortunately, the inexorable process of bond markets selling off and driving funding costs higher for governments has just been absolutely continual. And now, of course, as debt rates go up to 7%, it becomes a self fulfilling prophecy.

Eric Schatzker: Where do you drive the wedge, so to speak, Michael? Is it on the Italian bond yield? Or is it somewhere else in Europe? Have we not seen maybe, this end game play out? Is it going to be in German bunds?

Michael Platt: I don't think it's going to be in German bunds. I think there's definitely a bit of German bunds driven by the fact that if the Eurozone were to break up, people hoped that they would end up with Deutsche Marks. So the German bund yields in two years are now substantially below 30 basis points, and I think, actually still probably represent some sort of value based on the fact you might get a currency conversion. But the problem with Europe is that almost every part of it has gone wrong now. The banks are undercapitalized, there's a sensible argument that you shouldn't price any whole loan at a tighter credit spread than where the government trades because the government has the ability to remove assets from corporates, ultimately, and put them on their own balance sheet. So if banks were hedge funds, and you might want to mark it properly, I would say that probably most of them are insolvent.

Eric Schatzker: Most of the banks in Europe are insolvent right now?

Michael Platt: If they were marked like I am, at a hedge fund, yeah.

Stephanie Ruhle: Well then, has your relationship with banks changed dramatically? How do you feel about them as counterparties?

Michael Platt: I don't take any exposure to banks at all, if I can avoid it. All the money in BlueCrest Capital Management is in 2-year US government debt, 2-year German debt. We have segregated accounts with all of our counterparties. And yeah, we're absolutely, radically concerned about the credit quality of our counterparties.

Eric Schatzker: Michael, just a few moments ago, you were telling us--let's remind everybody, you manage $30 billion, and you were saying, you've got to put your money somewhere. Right now, a lot of it is in short term treasuries, and German bonds. Is that to say that you are afraid of taking risk right now?

Michael Platt: Absolutely. I mean, the main thing that's driving our decision about where to lend money or where to place our funds under management, $30 billion, we put, the vast majority of it is dollars, so we keep it 2-year notes. And we have a chunk of Euros, which we keep in German 2-year paper. But we're not interested in taking any peripheral debt risk at all. And we're not interested in taking any bank credit risk right now.

Stephanie Ruhle: But do you feel good about the US or Germany? Or they're just the best of the bunch here?

Michael Platt: I think they're the best of the bunch. I feel pretty good about the United States. I don't have an issue because I think that the control, the complete control that the authorities have, particularly because of the Fed, and their bond buying program, we don't have any issues about having money in 2-year securities in the United States. In Europe, you've got to put your Euro somewhere. It's a much more difficult place to make a decision, but 2-year Germany to us feels like a reasonably safe bet right now, certainly compared to anything.

Eric Schatzker: Michael, why is it that you are concerned about taking risk? If I divine what that means, you're looking for all of the potential opportunities out there in the world, not to perform, whether it's according to your expectations or according to somebody else's expectations, which is to say that the safest place is just to be in what effectively amounts to cash?

Michael Platt: Look, this where we keep the actual cash. We take risk in financial instruments such as futures and options and swaps. However, I think the most important thing to remember about crises is that you don't make your money going into the crisis. Because when you go into a crisis, such as 2008, markets trade against positions, okay, and if people have positions on, and people need to get risk off, okay, so, all the things that people thought were a good idea start going into reverse. The big money that you make in trading is more in the aftermath of a crisis. In 2009, we made 60% with no down months on our master fund, my $10 billion Capital International Fund.

Stephanie Ruhle: Now, is this BlueCrest's special sauce? It sounds like you're saying: "We're not investors, we're traders."

Michael Platt: Oh, we are absolutely traders. To me, an investment is a short term trade that's gone wrong.

Eric Schatzker: So yes, you've got your money in treasuries, short term treasuries, short term bunds, you are willing to take some risk in certain places. But what kinds of securities appeal to you? Are you looking like some other people are looking at illiquid investments? For example, you hear a lot of hedge fund managers saying, Man, my goodness, there's a lot of money, a lot of yield to be had in some of these illiquid products.

Michael Platt: I wouldn't touch an illiquid product with a barge pole, to be quite honest. We're going into an environment where banks need to delever. Illiquid assets are going to be coming out onto the street everywhere, alright? The price of liquidity, in my opinion, is going to go up. I don't want to own any illiquid assets whatsoever. The strategy of BlueCrest is to be in super liquid products, super liquid futures, options, government securities, things that basically can be turned around in a day.

Stephanie Ruhle: But you're not tempted? Just as you're saying banks are shedding assets, we're hearing from many investors saying, "This stuff is too cheap to ignore. It might be liquid, but I've got the cash. I'll sit on it." You don't feel that way?

Michael Platt: No. It would have been the end of my business in 2008 if I'd done such a thing. Anybody who had illiquid positions within their hedge funds, there were runs on those hedge funds because people wanted to get the cash out and not be side-pocketed with the illiquids. In 2008, I paid out $9.5B to the street, because I was the only hedge fund that was up a lot and completely liquid.

Eric Schatzker: Michael, do you expect that we're going to see a repeat of 2008? There's going to be something akin to a credit crunch and anybody who's holding illiquid assets is going to get crushed the same way they were three years ago?

Michael Platt: That's what I think, yeah, I think so. This is, in my opinion, what's going on now is significantly worse than 2008.

Eric Schatzker: Significantly worse. Explain. I think people need to understand why you see the world this way.

Michael Platt: Because the European debt situation is fundamentally, completely unstable. The process of refinancing your debt to the real rate of 5 while you have negative GDP growth, and we are heading into a recession in Europe, is arithmetically going to make--arithmetically can turn all of the countries of Europe, given enough time, into Greece.

Eric Schatzker: You were just saying that the European situation is bad enough, potentially, to turn or at least make every country in Europe look more like Greece, which in and of itself, is a pretty extraordinary view of the future. But what does that, and clearly, that has disastrous implications for Europe, what does it mean for the rest of the world? What does it mean, say, for the US economy? How closely tied, in your opinion, are America's futures and the potential for investment here, to what's happening in Europe?

Michael Platt: Oh, clearly, it will be a huge drag on the US economy. I mean, what we're talking about in Europe is, we're talking about a situation of instability driven by procyclical policy, removing the ability of banks to invest in sovereign debt, which has been done by the European Banking Association requiring capital buffers for banks. We're talking about procyclical policy of governments not being able to deficit spend, by law. So not only we're talking about existing deficits that need to be closed. And we're talking about an increase in the amount that governments are gonna have to find when they are forced to refinance their rolling over paper this year, at real rates of interest, which are way beyond anything they'll ever be able to achieve in terms of growth.

Stephanie Ruhle: So you're making it abundantly clear that we have bad news ahead? How do you continue to raise money through this?

Michael Platt: I think the track record that--I mean because we are traders, and because we don't take any credit risk, and we are super liquid, and in the time that BlueCrest has been around, we've made $17 billion of trading profits for our investors. If you look at BlueCrest Capital International, in the course of making 350% for our investors, we've had a maximum drawdown of 4% over an 11 year history with no down years. And so in an environment like this, where we are a very, very secure trading strategy, taking no credit risk, not buying anything illiquid, not buying anything--no buy and hold, "I'll see whether I'm right in the end" kind of trades. That's the kind of thing that investors frankly, really want to hear from someone like me.

Stephanie Ruhle: And they're willing to pay fees, even if you're not actually engaging the market?

Michael Platt: Oh, we are engaging in the market. I mean, this year, we've made 10%. The history of Capital International is 15%, 20 gross IRR since it started. This year, we've made 10% for the investors, on a gross level.

Eric Schatzker: Michael, how are you expressing this view? I mean what, and it has to be in liquid markets, so we can't talk about some of the credit strategies that other people find appealing.

Michael Platt: I think at the moment, as I said earlier, I think that the major opportunities will come post the blow up. I think that for the time being, you want to keep it quite simple, you don't want to take any credit risk. I think that the volatility in certain markets is very underpriced compared to what's potentially about to happen. I think that if we go into a crisis scenario, things like German bunds could become significantly more expensive than they are now, just because there's a possibility, if you move to an environment where people consider a breakup of the Eurozone, then they want to be in assets that might be re-denominated into Deutsche Marks. I think that as the crisis intensifies, just through the process of governments refinancing and deficits becoming more unstable, and growth deteriorating in particular, I think that those kinds of trades will play out in the market and be profitable.

Stephanie Ruhle: Now what's the future hold for London as a financial hub? You picked up BlueCrest and moved your headquarters to Geneva.

Michael Platt: I didn't really want to be exposed to the Eurozone. I don't really want to be exposed to regulation that might come out of the Eurozone, short selling bans, bans on selling government securities, potential CDS bans, potential interest in instantiating financial transaction taxes. I just wanted to put my business into a place--most of my clients come from the United States, so I'm not really marketing that much to the Eurozone, anyway. So it didn't make much sense for me to be in the euro zone anymore, I felt, as a business.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta (Facebook) and interesting new frameworks like the Consumer’s Hierarchy of Preferences.

Cloud Valley — Beautifully written, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “An international treasure”.

Memos — A selection of some of my favorite investor memos.

Bookshelves — Collection of recommended booklists.