Letter #54: George Roberts (1998)

Co-Founder of KKR | Corporate Governance and The Power of Ownership | 1998 Essay

Hi everyone! Due to popular request (and a few persistent individuals), I’ll be restarting this newsletter, but with a few changes. Most notably, rather than sending “A Letter a Day”, I’ll be sharing a letter or transcript twice a week, once on Tuesday afternoon (2:22pm) and once on Saturday morning (6:06am). Second, I’m expanding the scope of the newsletter to include a broader range of subjects, but still focused on thought-provoking investors (across venture, hedge funds, and private equity), founders (not just tech), and operators (sales, marketing, product, etc.). Lastly, I’ll be limiting my commentary so it’s a smoother reading experience and you can read the work as is. (If you’d like to see my notes or trade thoughts, shoot me a DM on Twitter!)

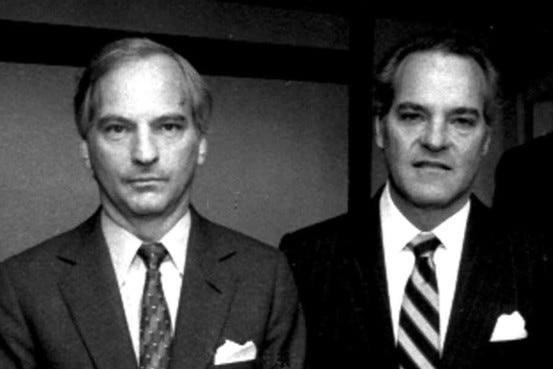

Today’s letter is an essay from George Roberts, one of the three co-founders of KKR. Roberts worked at Bear Stearns, where he became a Partner by the age of 29. There, alongside Jerome Kohlberg and Henry Kravis (his cousin), Roberts began a series of “bootstrap” investments, including Orkin Exterminating Company in 1964, which was one of the first significant LBOs. By 1976, tensions had built between the trio and the firm, and they left to form Kohlberg, Kravis, and Roberts (KKR). KKR raised the first institutional fund with investor commitments. It’s also perhaps best known for being the subject of the book (and movie) Barbarians at the Gate, which details KKR’s 1989 takeover of RJR Nabisco. The $31bn LBO was, at the time and for 17 years after, the largest LBO in history.

In this essay, Roberts discusses corporate governance and the power of ownership, sharing lessons that investors of all stages and asset classes would be wise to learn.

I hope you enjoy this essay as much as I did!

Letter

In my thirty-four years as a private equity investor, perceptions of mergers and acquisitions and their impact on profits, employment and long-term corporate health have changed dramatically. Once viewed with great concern and suspicion, takeovers are increasingly seen as a catalyst for productive transformation that can revitalize a company both from a financial standpoint and by other criteria.

New respect for the benefits of mergers and acquisitions is supported by the experiences of countless companies as well as statistics demonstrating that mergers and acquisitions can have a positive impact on hiring, research and development and capital spending.

Companies perform better when all important parties — management, employees and directors — have the incentive of ownership in the business. You take better care of a home you own than one you rent.

Over the past two decades, the acquisition and buyout arena has also been the breeding ground for new ideas about corporate governance. These have dramatically altered the way boards are constituted and their relationships with investors and management. My partners and I have been proud to see many of the practices we have instituted over the years duplicated at major companies throughout America.

These practices reflect our fundamental belief that companies perform better when all important parties to success — management, employees and directors — have the incentive of ownership in the business. Just as you are likely to take better care of a home you own versus one you rent, managers and boards with a financial commitment to their business are virtually always more effective in creating both short- and long-term value.

This is not really a new concept at all. However, for most of this century, it was all but buried by the country's romance with the professional manager. The concept of aligning the interests of the board and management with those of shareholders had its nexus in our country's very first U.S. merger wave at the beginning of the 20th century.

During the period between 1897 and 1904, roughly 4,277 American corporations were consolidated down to about 257 companies.

Most of these mergers were "horizontal" in nature, motivated by the need to be more efficient. Excess capacity in industries such as steel and railroading was weeded out and capital was effectively channeled to meaningful growth initiatives.

Driving these changes were a new breed of bankers, men such as Jacob Schiff, J.P. Morgan and George Baker. While in the 1970s and 1980s the kinds of buyouts being done — and the leverage employed — was believed to be of a size and scale heretofore unheard of, the activities of these gentlemen back at the turn of the century were perhaps even more remarkable in magnitude and importance.

For example, J.P. Morgan bought and merged eight steel companies to form U.S. Steel for a total purchase price, including financing, of $1.2 billion — a whopping seven percent of the country's gross national product at that time. Incidentally, the company had a fairly aggressive capital structure, financed with $550 million of seven percent convertible preferred stock, $550 million of common stock, and $304 million of five percent gold bonds, to establish a debt-to-capital structure of about 61 percent.

In establishing a board to oversee this formidable enterprise, Morgan looked to his partners who were fellow investors in and financiers of the business. Morgan saw the sense of aligning the interests of the company's management and board with those of its shareholders. Over the course of the next forty or fifty years, however, that alignment was torn apart, with grave consequences.

The divergence of shareholder and management interests began fairly innocuously in the early part of the century, in a growing economy with a tremendous need for capital. As smaller investors came into the market, board composition changed, with large shareholders no longer as formidable a force.

Managerial capitalism enjoyed its heyday through the 1950s and much of the 1960s. The United States grew in power — militarily and politically as well as economically — at its peak representing a full 50 percent of the world market. By the late 1960s and early 1970s, however, U.S. economic growth began to slow and social costs began to escalate, with the introduction of Lyndon Johnson's Great Society, among other things. Oil shocks in the 1970s, inflation and foreign competition all began to take their toll.

As the economy became more difficult and competitive, costs of managerial capitalism, such as production inefficiencies and lack of focus became apparent. It was at this time when my partners and I started KKR.

The lack of efficiency and meaningful direction at many companies created opportunity for good investments where value could be increased through the imposition of sound management disciplines. Consistently, we learned that the most effective way to establish the commitment and focus required to revitalize corporate performance was to bring an ownership mentality back to the boardroom and the management suite.

The CEO of an acquisition target objected "I have no real money invested in the company [so] if the stock goes down, I don't lose." We did not acquire the company.

We demanded that our management teams invest alongside of the limited partners in our funds — state and corporate pension funds, foundations, educational institutions. They too would then benefit from any growth in value, and share the burden of any reversals. In this way, we sought to reunite the focus and goals of the managers of our companies with those of the owners.

For KKR, management's willingness to align its interests with those of shareholders was and continues to be a prerequisite to investment in any business.

Back in the 1970s, after spending countless days and weeks exploring a merger opportunity, I had a meeting with the company's CEO who had other ideas. "George," he said, "I think you have a great concept in this transaction, but I just can't bring myself to do it. I make a million dollars a year and I've got stock options. If the stock goes up they have value but since I have no real money invested in the company if the stock goes down I don't lose. You're going to require me to invest money in the deal that we do. If the stock goes up, I'll make just as much on my options, risk free."

He added: "I've got 12 people on my board of directors, four of whom I went to school with. A couple of the others are CEOs on whose boards I sit, and they all pretty much leave me alone. If I do a deal with you, I'm going to have five directors and they're going to look over my shoulder all the time. They're going to demand that we perform."

"Besides, I have an airplane that I really enjoy that the corporation pays for," he said, "and I bet you're going to make me get rid of that too." While I respected and continue to respect the gentleman's candor, we did not acquire the company.

Even today, there are some managers who feel very similar to the executive I met in the 1970s. The good news is that shareholders of all sizes have recognized the importance of aligning the interests of their managers and shareholders. We believe that our commitment to these ends, by creating optimal governance structures, has been at the heart of the very solid returns we have generated for our partners over the past three and a half decades. We find evidence of this fact in the returns we have achieved, which have contrasted sharply with the erosion of value at many of America's largest corporations in the 1980s and early 1990s which forced dramatic asset sales, layoffs, and management changes.

The toll of tolerating inefficiency and poor performance can be grave not only to the shareholders and a company, but to the economy in general. For example, over the course of two decades America's auto companies gave up about 30 percent of the U.S. auto market to foreign competition, in large measure due to some very bad and sloppy practices that nobody watched or monitored. Hundreds of thousands of jobs were lost.

When you consider that each share point of the U.S. automobile market is worth $10 billion to the economy, the serious ramifications of allowing these governance practices to exist is more than apparent.

Often correcting this kind of inattention and neglect means taking very hard actions, but we have seen that very often these actions are necessary to save a company. We found this all too true in the case of an investment we made in Safeway, the large California-based supermarket retailer. We purchased Safeway as a white knight when the company was being pursued by the Hafts.

As a 100 percent unionized company, Safeway performed extremely well in markets where competitors were unionized, only fairly in markets where Safeway competed with both unionized and non-unionized companies, and extremely badly in markets with limited unionized competition.

As owners who exercised oversight from the board, we were motivated to fix businesses with hope of a turnaround, and provide them with the means to stay competitive.

We were owners who exercised oversight from the board, with a management team that had invested a substantial portion of their net worth in the company. This motivated us to get out of businesses that had no hope of ever making money, fix problems in businesses with prospects of a turnaround, and provide our good businesses with the means to maintain their competitive position in their markets.

Safeway ultimately sold roughly $2 billion of businesses, and used the proceeds—equivalent to about a 100 times earnings—to pay down debt and re-invest in operations.

This process came with its share of pain. For example, almost 9,000 unionized employees were affected by a hard decision we made to shut down Safeway’s Dallas operation due to an impasse with the unions.

The company subsequently went public and raised more money to pay down more debt. Soon, though, management fell back into bad habits. They ignored the consumer, raised prices to show better profits and get their stock price up, without consideration for the long-term consequences. The company’s strategy failed.

Fortunately, as active directors we were able to act quickly to stave off severe problems. We brought in Steve Burd, with whom we had worked for seven years. Steve was incentivized as a shareholder. He saw that too much expense remained in the business, including in-store costs that were not productive or visible to the consumer. He pared expenses, but instead of keeping the savings, remodeled stores, improved service, lowered prices, and trained employees in areas that mattered to the consumer. In other words, he reinvested the cost savings back into the business. Safeway is now a dominant player in markets where it has real strength to grow and create jobs.

While not all deals work, this particular transaction shows how a commitment to aligning shareholder and management interests not only created value, but also saved a company.

How, in an era of widespread stock ownership, can companies assure that their management and board interests are fully aligned with those of shareholders? Over the years, I have had a chance to teach at Stanford Law School and consider this question. I believe there are five measures companies can institute that can help assure that shareholders are effectively served by their boards and managers.

Directors should be paid in stock, not cash, and their investments in the company should be meaningful.

We have several independent directors on many of our boards and we want them all to invest. We will give them options, we will loan them money to buy stock. We want them to do well and we want them to be in the same boat with other shareholders when there are hard times so they are motivated to make improvements.

The size of corporate boards should be limited.

More gets done with five to seven outside directors in a room than with 12, 15, or more. Management representation should be limited to the chief executive.

Boards should have the ability to pick up the phone at any time and call the chief financial officer to monitor how the company is doing and to get information.

This should not be considered “going around the CEO,” and it is essential that directors are able to talk freely to people that are intimately involved with the financials and a lot of the other issues of the corporation.

The information the typical director gets in a big public corporation is not sufficient to determine how well a business is doing.

Directors need to be given more than just the routine corporate filings and quarter’s press releases to know what is going on, act to head off problems or seize opportunities.

Directors should have breakdowns of sales and earnings and return on investment by product line. They need detailed knowledge of how a company is doing compared to its competitors and against internal forecasts.

Finally, and perhaps most controversially, each year the board should have an outsider come in to review and discuss what strategic alternatives are available to the corporation.

The board should understand the value of the company if sold to a third party, and how value could be increased if a division were sold and the capital reinvested.

This is an extremely controversial, but important, point. Critics often think that in conducting this kind of review a company is just putting a “for sale” sign on itself. At the same time, how can a company’s directors really know if management is following the right strategies unless they have the measures and alternatives to which to compare them, and the opportunity to weigh the pros and cons of other courses of action?

Willingness to take steps such as these helps assure that directors are committed to living up to their duties to their shareholders. More and more companies throughout America are adopting some or all of these ideas, and shareholders are increasingly judging companies, boards and managements on their willingness to institute such practices.

We have enjoyed a very long period of prosperity and excellent profits in this country over the past decade. This has been extended in part by increased focus on governance issues and scrutiny of the duties owed by managers and boards to shareholders. Continued progress on the governance front will go a long way to helping our companies — and America — weather the inevitable down cycles in our economy with our market position and long-term prospects intact.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta (Facebook) and interesting new frameworks like the Consumer’s Hierarchy of Preferences.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.

Really great essay by George Roberts. I could not agree more regarding is view of corporate governance.