Today’s letter is an essay written by Jason Kilar in 2011 where he lays out his vision for the future of television. In it, he discusses the power of consumers, advertisers, and content owners in shaping that future, before diving into the opportunity for content owners, free, ad-supported services, and innovation and competing against incumbents.

Jason was mostly recently the CEO of WarnerMedia from 2020-2022. Before that, he was the Co-founder and CEO of Vessel (acq. by Verizon), a subscription video service that was backed by Benchmark, Greylock, and Bezos Expeditions. Jason was also the Founding CEO of Hulu, the online video joint venture of News Corp and NBC Universal. He joined the company after a decade of experience at Amazon, where he served in a variety of key leadership roles. There, he wrote the original business plan for Amazon’s entry into the video and DVD businesses, and was promoted to VP and GM of Amazon’s North America media businesses (incl. books, music, video, DVDs). He was then promoted again, to SVP, Worldwide Application Software, where he led an organization of hundreds of world class technologists and reported directly to Jeff Bezos. Jason started his career as an analyst at Disney.

I hope you enjoy this essay as much as I do!

Relevant Resources

Media

Letter

The Hulu team is often asked about our thoughts on the future of TV. The following represents our point of view, which has been materially influenced by our daily interactions with users, advertisers, and content owners. We are fortunate to have such meaningful interactions with these three customer sets, and we are relentlessly inventing better ways to serve them.

The future of TV.

Distributors will certainly play a role in the future of TV, but we believe that three potent forces will be far more powerful in shaping that future: consumers, advertisers and content owners.

Consumers have spoken emphatically as to what they want and what they do not want in their future television experience. What we’ve heard:

Traditional TV has too many ads. Users have demonstrated that they will go to great lengths to avoid the advertising load that traditional TV places upon them. Setting aside sports and other live event programming, consumers are increasingly moving to on-demand viewing, in part because of the lighter ad load (achieved via ad-skipping DVRs, traditional video on demand systems, and/or online viewing).

Consumers want TV to be more convenient for them. People want programs to start at a time that is convenient for their schedules, not at a time dictated to them. Consumption of original TV episodes will eventually mirror theatrical movie attendance: big opening Friday nights, but more consumption will be in the days and weeks afterward. Consumers also want the freedom to be able to watch TV on whatever screen is most convenient for them, be it a smartphone, a tablet, a PC, or, yes, a TV.

Consumers are demonstrating that they are the greatest marketing force a good television show or movie could ever have, given the powerful social media tools at consumers’ disposal. Consumers now also have the power to immediately tank a bad series, given how fast and broad consumer sentiment is disseminated. This is nothing short of a game-changer for content creators, owners, and distributors.

The above trends are a reality and we believe the wise move is to find ways to exploit these new trends and leverage them to build great businesses. History has shown that incumbents tend to fight trends that challenge established ways and, in the process, lose focus on what matters most: customers. Hulu is not burdened by that legacy.

Advertisers have weighed in heavily on the future of TV, with both their thoughts and their considerable wallets. Advertisers are increasingly expecting to present their advertising messages to just their desired audience…and not to anyone else. For over 60 years, video advertising could only be bought via a TV show’s projected audience, which served as a blunt proxy for a certain target audience. The result has been many wasted impressions and an often irrelevant experience for consumers. In the near future, advertisers will demand the ability to target their messages to people rather than targeting their messages to TV shows as proxies for people.

Content owners, the third factor in the future of TV, have been very clear: they as a group need to make a fair return on their significant investment in creating content. Content owners will license their best content in the best windows to those distributors that pay the most on a per-user per-month basis. Content owners will bundle their content to the degree customers will respond, simply because it is in the content owners’ economic interest to do so. If enough customers refuse to purchase their bundles, then the bundles will either be reduced in price/scope (possible) or dismantled (far less likely). Customers will ultimately make the decisions here.

With the above dynamics in mind, we believe that there is going to be tremendous near-term innovation in the pay TV distribution business. The internet has made it possible for new entrants to innovate quickly and materially. Consumers will have more choice and convenience going forward. This competition will drive prices and margins down in pay TV distribution. A greater percentage of the economic pie will flow back to content owners and creators. As mentioned before, advertisers will be able to target their messages to people, not to TV shows as proxies for people. Going forward, rapid innovation, low margins, and customer obsession will define the winners in pay TV distribution.

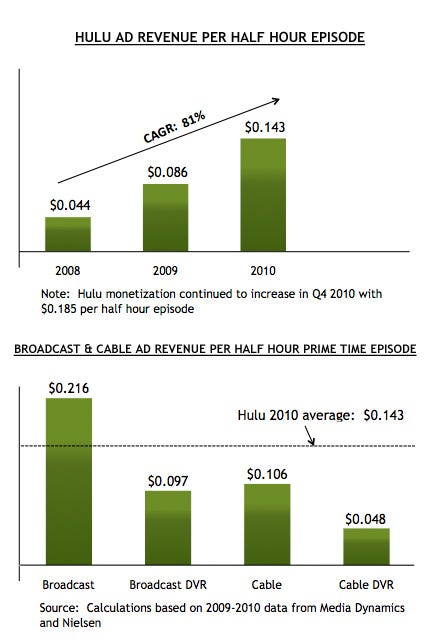

The above has influenced the path the Hulu team has taken to date. In 2007, we began the process of building what is now the leading online video advertising service. Based on metrics from Nielsen/IAG, Hulu’s video advertising service is roughly 2x as effective as traditional TV video advertising services. Our point of view since 2007 has been that if we become the most effective video advertising service, then we could earn higher advertising revenues (per hour of content consumed) than anyone else’s ad business. We also have been highly focused on the reality that advertising monetization during a DVR session is headed steadily downhill, which is a looming issue for content owners. And the answer is not adding a full broadcast ad load to the video-on-demand experience (that will just drive DVR viewing – and ad-skipping – further north). Our conviction remains that if we respect the customer and innovate effectively, we can pay content owners more from the ad side of the business than anyone else’s ad service can do (be that live/linear consumption or DVR viewing). The below chart compares how much revenue Hulu currently generates from advertising per half-hour tv episode versus the advertising revenue that traditional distribution generates.

In the near to mid term, we anticipate being able to generate higher advertising returns than any traditional channel can from their advertising service, for any type of content. We’ve invented patentable technology that has enabled us to deliver much more relevant video advertising and to do so in a manner that generates much higher recall and purchase intent than other video advertising services. The market is responding: we expect to approach half a billion in total revenues (advertising and subscription combined) in 2011, up from $263 million in 2010, which was up from $108 million in 2009.

But advertising is only part of the equation. The other part is subscription. We officially launched Hulu Plus on November 17, 2010, 11 weeks ago. Hulu Plus is a dual revenue stream subscription service; one revenue stream from the subscription fee, the other from a modest amount of advertising (half the advertising that you’ll see on traditional TV). Hulu Plus includes full current season access to many of TV’s top programs, on an array of internet connected devices, available anytime in an unlimited fashion, for $7.99/month. Our subscriber count will pass 1 million this year, to our knowledge the fastest start of any online video subscription service. In the fall, we expect Hulu Plus as a business will have a revenue run rate north of $200 million. A key element of Hulu Plus is that we are able to compensate content owners more per-user per-month than anyone else for the same body of content. We are able to do this because of the subscription fee, our unusually effective and market-leading advertising service, and our tolerance for thin margins.

The opportunity for content owners.

We believe content owners are in a strong position to make higher returns from TV content distribution in the future than they have historically. If studios and networks license their content to distributors with per-user per-month economics as the model (as opposed to a fixed fee model), then they will be able to extract a higher portion of the total economics their content will generate. We state this given our belief that the majority of the US population (and a material percent of the globe) will be subscribers to some flavor of digital premium content service going forward. We also believe that any number of digital distribution companies have the ability to quickly get to scale; getting to scale is not the hard part about this business. Over the past 4 years, studios and networks have not always insisted on per-user per-month economics in their digital licensing agreements, which has resulted in a regretted underpricing of their content to digital distributors. That said, we believe that all studios and networks will recognize that it is in their economic interest to insist on per-user per-month pricing in all their distribution relationships (library content and current content). Given the above future, we see strong upside for content owners that are laser-focused on the per-user per-month economics. A greater percentage of the pie should flow to content owners and creators in the future.

Free, ad-supported services.

Given all this talk of dual revenue streams, what becomes of free, ad-supported services like the original Hulu service? We think content owners will pursue one of two paths for each individual piece of content, each for valid reasons:

A portion of content will leverage free, ad-supported services aggressively, given a digital service like Hulu provides unusually high ad monetization when compared to DVR sessions and even the bulk of live linear ad monetization. For a substantial body of content, we suspect that Hulu’s ad supported free service will provide the best financial return available to those content owners/creators. We expect significant experimentation will continue as it relates to windowing, as we have seen these past 3 years.

Another portion of content will only be available to users that either subscribe directly to a digital service or, alternatively, authenticate that they already have a traditional pay TV subscription. Once a user is recognized as a pay TV service subscriber, the user will be able to watch a specified body of content.

Hulu’s responsibility is to deliver the world’s leading dual revenue stream service and to deliver the world’s leading free, ad-supported service. We expect the free Hulu service to be a core part of our business for years to come, and one that will continue to earn enthusiasm from our users. The stronger the returns we can drive in our free, ad-supported service, the more content will show up in that service. The same goes for our Hulu Plus dual revenue stream service. Clearly, content owners will decide which distribution channels are best for them. As we deliver leading services, Hulu will pay content owners and creators more per-user per-month than anyone else. At the same time, we will be able to price our services for consumers lower than anyone else offering the same body of content, given our market-leading ad service and our tolerance for low margins.

The relentless pursuit of better ways.

It is clear to us that — because of the internet and the increased competition/innovation it brings — the future of TV is going to be very good to users, advertisers and content owners/creators. Users will have convenient access to much more content. We also expect to see lower consumer prices, which will be a function of a marked increase in distribution competition. Advertisers will be able to efficiently and effectively target their messages to just their desired audience, thanks to the internet medium. And content owners will have the opportunity to make higher financial returns, which will be a function of disciplined per-user per-month licensing strategies, along with the benefits that come with intensified distribution competition.

Our journey at Hulu involves significant risk. That is the nature of innovation, particularly the business of re-inventing television. A number of you that are reading this might be thinking that we’d have to be crazy to think that our small team can actually re-invent television and compete effectively against a landscape of distribution giants like cable companies, satellite companies, and huge online companies. We are crazy. All entrepreneurs need to be. If it was easy, everyone would be doing it and there would be no naysayers. We are nothing if not a team that believes in the value of convictions, thoughtful stubbornness, and the relentless pursuit of better ways.

Jason Kilar

Hulu CEO

jason@hulu.com

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta (Facebook) and interesting new frameworks like the Consumer’s Hierarchy of Preferences.

Cloud Valley — Beautifully written, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “An international treasure”.

Memos — A selection of some of my favorite investor memos.

Bookshelves — Collection of recommended booklists.