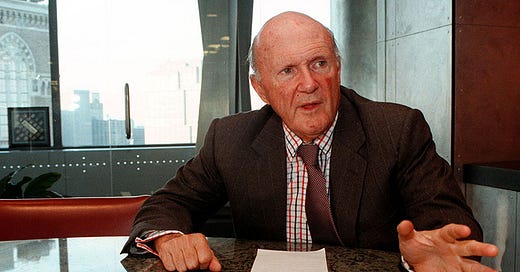

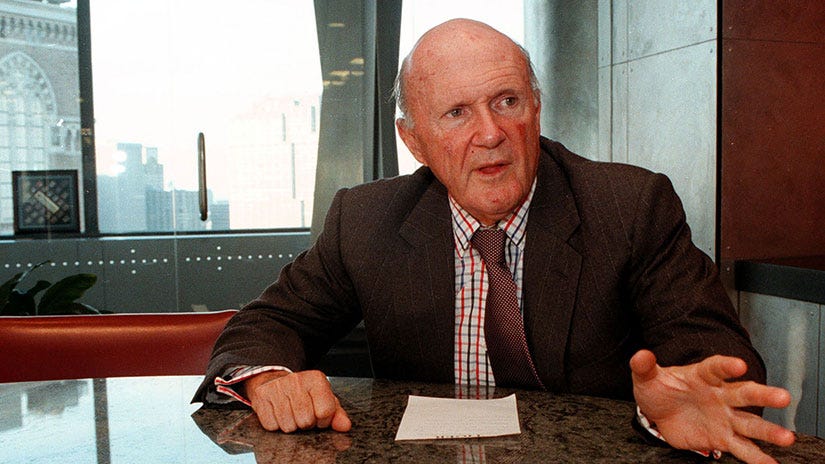

Letter #78: Julian Robertson (2000)

Founder of Tiger Management | Tiger Management Closing Letter to Investors

43 years ago this month (May 1980), Julian Robertson founded Tiger Management with Thorpe McKenzie. They had $8.8mn to invest, and 18 years later, were managing $21bn. Their compound rate of return to partners after all fees was 31.7% (compared to 12.7% for the S&P500 over the same period). However, over the following two years, from 1998-2000, their performance greatly stumbled, investors withdrew ~$7.7bn from the fund, and Julian decided to shut down the fund.

Today’s letter is the letter Julian sent his LPs in March of 2000 announcing his intention to wind down Tiger. It was the end of a 20 year run that saw tremendous returns, large drawdowns, multiple bubbles, a series of bear markets, the acceleration of an industry, and the creation of a generation of stock-picking talent (many of whom I will cover in future letters).

In this letter, he discusses Tiger’s origins, their performance, the keys to their success, rational vs irrational markets, timing the markets, and his decision to shutter the fund.

I hope you enjoy this letter as much as I did!

Relevant Resources (To be updated when published):

Tiger Cubs

Lee Ainslie

Chase Coleman

John Griffin

Andreas Halvorsen

Stephen Mandel

Philippe Laffont

The Letter

This letter concerns your relationship with Tiger Management LLC. It is important that you read it and the enclosures carefully and thoroughly.

In May of 1980, Thorpe McKenzie and I started the Tiger funds with total capital of 8.8 million dollars. Eighteen years later, the 8.8 million had grown to 21 billion, and increase of over 259,000%.

Our compound rate of return to partners during this period after all fees was 31.7%. No one had a better record.

Since August of 1998, the Tiger funds have stumbled badly and Tiger investors have voted strongly negatively with their pocketbooks, understandably so.

During that period, Tiger investors withdrew some 7.7 billion dollars of funds. The result of the demise of value investing and investor withdrawals has been financial erosion, stressful to us all. And there is no real indication that a quick end is in sight.

And what do I mean by, ”there is no quick end in sight”? What is ”end” the end of? ”End” is the end of the bear market in value stocks.

It is the recognition that equities with cash-on-cash returns of 15 to 25% regardless of their short-term market performance are great investments.

”End” in this case means a beginning by investors overall to put aside momentum and potential short-term gains in highly speculative stocks to take the more assured, yet still historically high returns available in out-of-favor equities.

There is a lot of talk now about the New Economy (meaning Internet, technology and telecom). Certainly the Internet is changing the world and the advances from biotechnology will be equally amazing.

Technology and telecommunications bring us opportunities none of us have dreamed of. ”Avoid the Old Economy and invest in the New and forget about price,” proclaim the pundits. And in truth, that has been the way to invest over the last eighteen months.

As you have heard me say on many occasions, the key to Tiger’s success over the years has been a steady commitment to buying the best stocks and shorting the worst.

In a rational environment, this strategy functions well. But in an irrational market, where earnings and price considerations take a back seat to mouse clicks and momentum, such logic, as we have learned, does not count for much.

The current technology, Internet and telecom craze, fueled by the performance desires of investors, money managers and even financial buyers, is unwittingly creating a Ponzi pyramid destined for collapse.

The tragedy is, however, that the only way to generate short-term performance in the current environment is to buy these stocks. That makes the process self-perpetuating until the pyramid eventually collapses under its own excess.

I have great faith though that, ”this, too, will pass.” We have seen manic periods like this before and I remain confident that despite the current disfavor in which it is held, value investing remains the best course.

There is just too much reward in certain mundane, Old Economy stocks to ignore. This is not the first time that value stocks have taken a licking. Many of the great value investors produced terrible returns from 1970 through 1975 and from 1980 to 1981 but then they came back in spades.

The difficulty is predicting when this change will occur and in this regard I have no advantage. What I do know is that there is no point in subjecting our investors to risk in a market which I frankly do not understand.

Consequently, after thorough consideration, I have decided to return all capital to our investors, effectively bringing down the curtain on the Tiger funds. We have already largely liquefied the portfolio and plan to return assets as outlined in the attached plan.

No one wishes more than I that I had taken this course earlier. Regardless, it has been an enjoyable and rewarding twenty years. The triumphs have by no means been totally diminished by the recent setbacks.

Since inception, an investment in Tiger has grown eighty-fivefold net of fees; more than three times the average of the S&P 500 and five-and-a half times that of the Morgan Stanley Capital International World Index.

The best part by far has been the opportunity to work closely with a unique cadre of coworkers and investors.

For every minute of it, the good times and the bad, the victories and the defeats, I speak for myself and a multitude of Tigers past and present who thank you from the bottom of our hearts.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.

🐅🐯 "Grrrrrr"