Letter #87: Jack McDonald (2011)

The Stanford Investors Professor | Commentary on Dodd-Frank Rule

Today’s letter is a letter written from Jack McDonald to the SEC with regards to a proposed Rule that defines a venture fund for use in conjunction with implementing the Dodd-Frank Act. While most philosophical letters are higher level, this letter stands out for its practicality. It’s also a masterclass in persuasion. Jack begins by establishing his credibility, explaining the impact and importance of the asset class, acknowledging his counterparty’s intent, suggesting modifications that address potential risks, and proposing concrete amendments that could substantially improve the quality of the proposed regulation without losing the spirit of intent or impairing potential future impact.

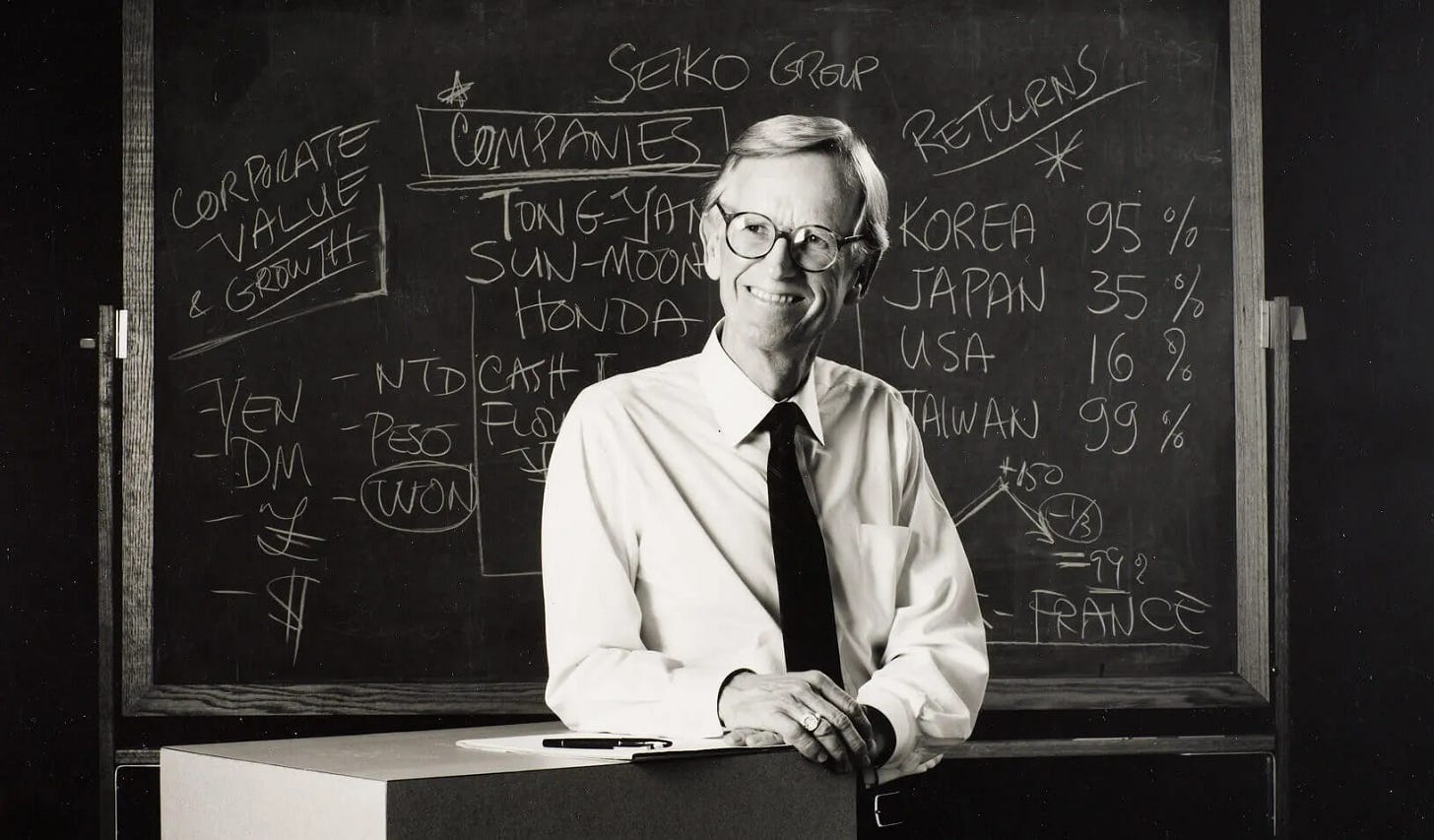

Jack was The Stanford Investors Professor in the Graduate School of Business at Stanford University, where he taught over 10,000 MBA and Executive Education students over 50 years, including Andreas Halvorsen, Tim Bliss, Jim Coulter, Bill Oberndorf, Tom Russo, Charles Schwab, Frank Quattrone, Ho Nam, and many more. He remained heavily involved in and supportive of his students’ careers even after they graduated, including having paired up Reece Duca and Tim Bliss in the early days of the Investment Group of Santa Barbara, serving as a special advisor to Altos Ventures, and much more. He was a recognized expert in private and public equity investing and served as the Vice Chairman of the Board of Governors for the National Association of Securities Dealers (NASD), which operated the NASDAQ Stock Market and was the predecessor to the Financial Industry Regulatory Authority (FINRA).

Letter

Subject: Release No. IA-3111; File No S7-37-10, Exemptions for Advisers to Venture Capital Funds, Private Fund Advisers With Less Than $150 Million in Assets Under Management, and Foreign Private Advisers (the Proposed Rules)

The Venture Capital community together with their venture-backed entrepreneurial portfolio companies represent a crowning achievement of our American system. I would like to provide comments on the SEC's proposed Rule that defines a Venture Capital Fund ["VCF"] for use in conjunction with implementing the Dodd-Frank Act.

I am the Stanford Investors Professor in Stanford’s Graduate School of Business, in Silicon Valley, CA. 2011 marks my 44th year of teaching Investment Management and Entrepreneurial Finance, an MBA course on fundamental investing in public and private equity markets. I also have experience on the regulatory side of the securities industry, having been the vice chairman of the Board of Governors of the NASD.

Venture Capital Funds have been a major, long-term positive force for the growth of the U.S. economy and the creation of jobs. VCFs are not a systemic risk to our country. VCFs generally do not rely heavily on borrowed money to 'leverage' their investments. VCFs make long-term investments in young, privately-held innovative companies using the long-term capital commitments from investors. The majority of these investors are sophisticated institutions that can accept the illiquidity and risk inherent with these investments.

I believe that it is important that the proposed Rule be modified to capture more fully how VCFs currently operate. Without these suggested changes, I am concerned that a significant percentage of the venture capital funds would be compelled to become Registrants, which I understand was not Congress's intent. I believe that the suggested modifications that I describe will not impose material risk to our economy or to investors. I also believe that the alternative is unattractive: If VCFs change how they normally conduct business to be in 100% compliance with the proposed Rule, they may not be as productive as they have been historically, which would be a detriment to our country's economy.

The venture capital industry is dynamic and diversified. I believe that my suggestions will better provide the flexibility needed to accommodate the range of venture capital practices without undue additional risk.

My five specific suggestions are:

1. Allow a VCF to buy stock from their portfolio companies even after the companies become public, provided that the VCF still owns a majority of the investment that it made while the company was still privately held. If this is not a "qualifying activity", many portfolio companies will not be able to grow or survive because additional rounds of public financing often require the participation of existing major shareholders, such as VCFs. The capital markets like this show of support and alignment of interests. This is a modest change in the proposed Rule.

2. Allow a VCF to be compliant with the Rule if a substantial majority [e.g. 85%] -- instead of 100% -- of its committed capital is used for "qualifying activities". This would allow for some needed, but limited, flexibility in VCF operations with no detriment to the financial markets. This is consistent with the basic intention of the Dodd-Frank Act.

3. Allow a VCF to support the growth and attractiveness of its portfolio companies by requiring that at least a substantial majority [e.g. 80%] of the VCF's committed capital be used to purchase stock directly from its portfolio companies. This would allow a minority (e.g. up to 20%) of the VCF's total committed capital to be paid to selling shareholders -- usually the founders and employees of a company that is not yet public. This benefits the portfolio company's recruiting efforts for high-quality employees by providing limited liquidity. I believe that this test would be made on the basis of the fund's total committed capital rather than on the proposed company-by-company basis, which would be unnecessarily restrictive without any significant offsetting benefits.

4. I find the following to be an acceptable restriction on the borrowing activity by a VCF’s portfolio company: The fund may not invest in portfolio companies that borrow, where the proceeds of such borrowing are required by the fund to be used to buy out shareholder stock or return capital to the fund. A portfolio company needs to be able to borrow in the normal course of business, while not threatening the VCF's status under the proposed Rule.

5. Continue to classify non-US investments as a "qualifying activity" for a VCF. In our global economy, global investment flexibility is essential while investors do not need any unique protection solely based on the geographic location of a VCF's investments. This is in reply to your question as to whether such non-US investments should be “non-qualifying.”

I respectively submit that the above modifications to the proposed Rule would substantially improve the quality of the Rule.

Sincerely,

John G. McDonald

The Stanford Investors Professor

Stanford University

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Copart, Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.