Welcome to the first Free Friday! Today’s post is a repost of Letter #1. You’ll notice that the format is quite different—that’s because while this newsletter was always about highlighting interesting IFOs and sharing some of the things I’ve been reading, the format itself wasn’t refined until much later on. I had considered starting the reposts with the first “current format” letter, but I think that a lot of the earlier letters highlighted interesting people and are worth reading, and is thus worth resharing. (For the hardcore fans/readers, it’ll be fun to see the early issues and subsequent evolution of this newsletter.)

And remember, “A Letter a Day is both a tasting menu and a launchpad. You can expect a letter from a different IFO each edition, which will help you learn more about individual IFOs, but also (I hope) serve as an inspiration to dig deeper into IFOs that resonate with you.”

So while these early letters aren’t in the current format, I hope you’re able to learn (more) about some individual IFOs and get inspired to dig deeper into any that resonate with you. As always, feel free to reach out if any do and you’d like some recommendations.

Letter #1: Henry Singleton (1961)

Hi there! I go by KG, and I love studying the history of business and investing. I’ll be sharing some notes from one Investor/Shareholder letter per weekday (mostly from my compilations) here.

Today’s notes are on Henry Singleton’s 1961 Teledyne Shareholder Letter. I’m still playing around with the format here, but today’s format is a tweetstorm + book recommendation. The original tweetstorm can be found here.

I’ll be uploading previous tweetstorms for the first few days as I figure out what kind of format I want: tweetstorms, annotated tweetstorms, essays, write-ups, or maybe something else. I’m not sure yet.

If you have any thoughts on what you’d like to see, let me know!

Notes

1/ Reading through the very first Teledyne report… have no doubt @wolfejosh and @peterthiel (and maybe @zebulgar) would have been salivating over this company (and something @joe_philleo would build). It’s a good thing they’ve got a modern-day version in @anduriltech

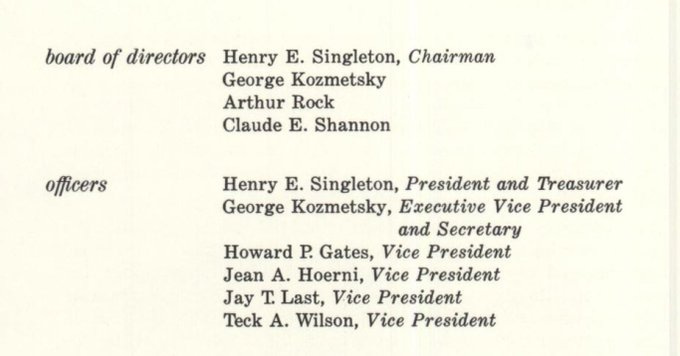

2/ Look at that Board of Directors: Henry Singleton (Feynman teammate, Putnam winner), George Kozmetsky (purple heart, CMU prof, Navy airborne computing system), Arthur Rock (helped Traitorous Eight w/ Fairchild, early in Apple), Claude Shannon (Father of Information Theory)

3/ First year of business and they were profitable. Revenues around $4.5MM, earnings of 33c/share, and backlog of $10MM. Key focuses were 1) “establishment of profitable and expanding operating base” and 2) “assembly and effective utilization of a strong R&D organization”

4/ Operating base expanded steadily through combo of acquisitions and internal growth (Singleton didn’t joke around when it came to capital allocation), doubling employment in first year.

5/ Acquired prime and subcontracts in the fields of “electronic communications, data processing, computers, and automatic control equipment.” Some for advanced R&D, others for production of advanced equipment.

6a/ Programs included: navigation systems for carrier-based antisubmarine aircraft, data processors for satellites, design of space communication antennas, an adaptive (learning) computer for simulating neural networks, air defense study, and antisubmarine warfare study

6b/ They say early is wrong... well these things are only now getting hot... and yet Teledyne was able to make money and not only survive, but thrive, for over 30 years before being acquired and then restructured (still going strong as Teledyne Technologies today)

7/ Received $5MM contract (remember their revenue was $4.5MM at the time) for production of FADAS digital computers for the Army’s new artillery fire direction centers. Super competitive contract at the time... and it went to a 1yr old company

8/ Opened its Electron Devices Division with the objective of developing proprietary manufacturing processes for the direct application of solid state technology to the manufacture of electronic systems and equipment

9/ Financial highlights: CA: $2.4MM. PPE: $650k. Total Assets: $3.7MM. CL: $750k. Debt: $500k. Capital and Stock Surplus: $2.5MM. Sales $4.5MM. GP: $600k. Income: $133k. Additional income of subsidiary brings it to $175k.

10/ First year, they completed 5(!!) acquisitions/asset purchases through a mix of cash, debt, and equity. Ok, starting to think Singleton had a sixth sense for capital allocation. I can see why Buffett and Cooperman are such big fans

11/ Amazing that they IPO’d in year 1… surprised they would want to share so much info given they were defense focused. Consumer companies today are staying private for 10+ years. These guys were truly ahead of their time.

12/ Tl;dr: Experienced, accomplished team, capital efficient, big market, profitable, defense space, electronics, advanced tech, contracts, R&D… it’s not that long of a tweetstorm, just read it.

End/ Still working on the compilation (missing a few key years), but until then, you can check out my other compilations here: 12mv2.com/compilations

Book Recommendations

Distant Force, by George A. Roberts

Roberts was Singleton’s roommate at the Naval Academy, and served as Teledyne’s President and later CEO for ~27 years.

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

All compilations here.

In the one of the best business books ever written, "The Outsiders," author William N. Thorndike, Jr. tells the story of the 8 iconoclastic CEOs who had, over long periods of time, far and away the best investment return performance in modern US history. They blew away the S&P 500, their peers and even soard above Jack Welch's 20 year performance at GE. The best of the 8 was Henry Singleton.

One of the most interesting things about these 8 CEOs is that none of them fit the traditional or consensus mold of what great CEOs are like. This book including Henry Singleton's story, is a great example of how the consensus does not have the full or right story.