Letter #177: Nazar Yasin (2018)

Director at Tiger Global and Founder of Rise Capital | Silicon Dragon HK Keynote Talk

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Today’s letter is the transcript of a talk given by Nazar Yasin for Silicon Dragon HK. In this talk, Nazar outlines emerging markets and investment opportunities outside of Asia, discusses the rapid growth of Chinese tech companies, internet sector growth in emerging markets, global venture capital investment disparities, the impact of startups on economies, and more!

Nazar Yasin is the Founder and Managing Partner of Rise Capital. Prior to founding Rise Capital, Nazar was a Director at Tiger Global, where he led more than a dozen investments for the firm in China, Africa, Latin America and Russia. Before Tiger, he was the CEO of Forticom, the largest social networking company in Eastern Europe and Russia, which he grew to become one of the world’s first “unicorns” outside of the United States and sold to Mail.ru (LSE: MAIL). Nazar started his career at Goldman Sachs, where he became the Co-head of Goldman Sachs’ Internet investment banking activities in the EMEA region.

[Transcript and any errors are mine.]

Related Resources

Tiger Ecosystem

Tiger

Cubs

Transcript

Hello. My name Nazar Yasin. I'm the Founder of Rise Capital. We're a San Francisco-based VC that invests in emerging markets. So even though we're surrounded by a number of startups in San Francisco, we like to make life difficult for ourselves and get on planes and go find startups elsewhere. So that's what we do.

Rebecca asked me to speak to you all today about what's going on in emerging markets. And it's only fitting that I should be discussing emerging markets here at a Silicon Dragon event, as many of you know, Rebecca has been one of the foremost voices in talking about what's going on outside Silicon Valley, from a technology perspective, over the years.

And it's only appropriate that this takes place here in Hong Kong, because this is really where the first unicorn to come out of China listed. Tencent went public here, originally, many years ago. And today, it's very easy to think about China as a very emerged economy. Tencent, Alibaba, Baidu, Didi. The list goes on and on, of these massive technology companies that have come out of China.

But just 10 years ago, there was almost nothing. There was almost no publicly traded companies in China. Tencent, Alibaba, Baidu, were mere startups. And only five years ago, the internet landscape looked very, very different than it does today.

So what you see up here is actually a representation of the global market cap of the internet sector just five years ago versus today. Only five years ago, the total market cap of internet companies in the world was only $600bn. That's the market cap of Tencent today. And that was the entire Internet. This was Amazon, Google, you name it, all together.

So the internet sector has exploded globally. It's now over $3.5tn. And a lot of that growth has come from emerging market companies. Over $1tn of that growth has come from emerging markets.

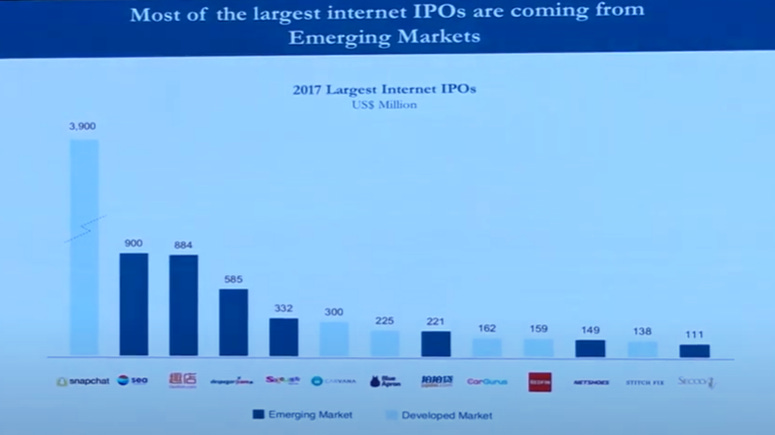

What's interesting is that this trend is accelerating. This explosion of market cap from emerging market. So if you look at 2017, for the first time ever, more of the largest IPOs in the internet sector globally were emerging market companies rather than US or developed market companies. That's never happened before. And in fact, that trend has continued into 2018.

So in 2018, the largest IPOs--many of you might be thinking of names like Spotify and Dropbox--those companies raised less than $1bn in their IPOs. You know what the largest IPOs of 2018 are? PagSeguro, in Brazil. They raised $2.25bn. iQiyi, in China, raised $2.25bn. So we continue to see that most of the large exits in the internet sector, globally, are continuing to come from emerging markets.

In fact, if you look at where the future IPOs are coming from, what you see here is a list of the largest late stage internet financings globally. The dark ones are the ones in emerging markets, the light ones are the ones in developed markets.

There are only three light blue colored companies that raised large internet financing rounds last year: Uber, Lyft, and Airbnb. Everybody else was a company from Southeast Asia or India or Latin America or China.

So quite clearly, the future--and by the way, these are the future IPOs--these companies are gonna be going public in the next couple years. So quite clearly, the future of market cap growth in the internet sector, globally, belongs to emerging markets.

And when you look at the macro trends behind this, it's obvious why. Most of the GDP growth in the world, which is the left hand side of the slide, is coming from emerging markets. And that also happens to be where most of the internet users in the world are.

Those internet users are increasingly using devices in their pockets, like the ones that you have--their smartphones--to do all of their economic activities: education, paying for utilities, shopping, consuming media, you name it. So it's only logical that a disproportionate share of that GDP growth, in those markets, is going to go to internet companies serving consumers in those markets. In other words, this trend isn't going away. We're gonna see a lot more market cap coming from companies based in emerging markets addressing those markets.

Now what's shocking about all this is: if you believe even half of what I just put up here, on the prior slides, this slide should be shocking to you. Because what you see up here is a global map of where venture capital dollars are going.

So every year, there's about $125bn invested in startups. About $90bn of that goes to developed markets. That's the US, Israel, and Europe. About $30bn goes to China. The entire rest of the world--this is India, plus Southeast Asia, plus Africa, plus the Middle East, plus Latin America--this is where 6bn people live, and about $30tn of GDP exists.

There's only about $6bn of venture capital that goes into those markets. And in fact, most of that venture capital's pretty late stage capital--Series C and beyond. So if you look at Series A and Series B, there's only about $1bn going into all the startups in India plus Southeast Asia plus Latin America plus Africa plus the Middle East, combined. It is a tremendously under invested asset class, in other words.

But this is about more than just capital. So if you're a startup in these markets, and you're trying to grow your business, it's a little bit like trying to grow a plant in a desert. If you're in Silicon Valley, it's like trying to grow a plant in a lush, beautiful forest. You have wonderful infrastructure, you have infinite water for your plants in the form of risk capital, you have infinite good soil for your plants in the form of good advice on the ground from VCs who've been there before and built big businesses and exited and they can tell you what to do. If you're in Africa, it's like trying to grow a plant in a desert. There is not good infrastructure, there is very little capital, and there's very little good advice that you can get as a founder on the ground.

This is an ecosystem problem. And so that's why events like today are so important. Events like today bring people together, from around the world, to talk about this topic, to share information, to share best practices, to make connections. And I believe that this is about more than just an ecosystem. This is about the chance to do something really meaningful in life.

So, maybe as a venture capitalist, I'm a little bit biased on this, but if you look at what VC has done, for economies, globally, it has had a profound impact. And so what you see up here is, venture capital backed companies as a share of the US economy. Venture capital in the US is an older industry than it is in China, or in other emerging markets. Venture capital in the US is about 40 years old, 40 or 50 years old. But if you look at the profound impact it's had on the US economy, it's pretty remarkable.

So, venture capital backed companies today account for 43% of all publicly traded companies in the United States. That accounts for about 57% of the total market capitalization, United States. Accounts for about 38% of total employment, United States. And about 82% of total research and development spending.

In other words, without these VC backed companies like Amazon and Google and Facebook and others, the US economy would be less than half its current size. Think about that.

You're seeing the same thing occur in China. And so today, Chinese internet companies account for over 10% of China's GDP, and that's just the publicly traded ones. Include the private ones, it's more like 15%. This is only a 15 year old story, China. So, impact of startups, and the ability of startups to really contribute to economies, is pretty profound. And you're all a part of that story, by being here today.

So thank you for inviting me to speak here today to this audience, and hope you enjoy the rest of the day.

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.