Letter #121: Reece Duca (2014)

Founder of Investment Group of Santa Barbara | Why is English Important to Global Corporations?

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

Today’s letter is the transcript (and slides) of a presentation given by Reece Duca at TIRF’s (The International Research Foundation for English) 2010 TESOL (Teaching English to Speakers of Other Languages) Convention. In this presentation, Reece explains why English is important to global corporations by walking through the topics of globalization, technology, English, and the human network.

Reece Duca is the founder of the Investment Group of Santa Barbara (IGSB). He grew up in Palo Alto within ~5 miles of Shockley Semiconductor before moving to Santa Barbara to attend the University of California at Santa Barbara (UCSB).

One of Reece’s childhood neighbors and friends in Palo Alto, who also attended UCSB with him, is Silicon Valley legend Mark Bertelsen. Mark was a senior partner at Wilson Sonsini who is known for having been the effective COO of the firm, attracting and retaining companies such as Apple and ROLM, and helping underwrite companies including LSI, SGI, Cisco, and Amazon.

Attending UCSB was a transformative time for Reece, where he lived in Pine Hall and helped build a Homecoming float saluting the wine industry of California [1]. He made an immediate impact on campus, having served on the Freshman Class Council, the Special Events Committee (where he helped organize homecoming and spring sing), and as a Frosh Camp Staff member. He was also active in Greek Life, having rushed the fraternity Sigma Alpha Epsilon (SAE), who he helped win an intramural wrestling championship by winning his individual weight class. Representing SAE, Reece served on the Interfraternity Council as a delegate and Treasurer. But more than anything, he made life-long friends and found life-long partners there, including Terry Bliss [2], Bill Rauth [3], and Michael Cooney [4]. Reece, Bill, and Michael, along with Terry’s younger brother, Tim Bliss [5], and Luise Phelps [6], would make up the core of IGSB for several decades.

[1] Reece would later bond with famed Stanford Investing Professor Jack McDonald over wine, discussing pinot noir grapes, weather patterns, hills, oak groves, and more—in fact, Reece initially met Jack as “Jack from Zaca Mesa Winery.”

[2] Terry Bliss was a fellow SAE member who served as President of the fraternity, but more importantly, was the older brother of Tim Bliss and the one who convinced Reece to hire Tim.

[3] Bill Rauth was the President of the fraternity Sigma Phi Epsilon at UCSB and served on the Interfraternity Council with Reece and Terry. He played baseball with Michael Cooney. Bill later became a Partner of IGSB.

[4] Michael Cooney was the standout pitcher of the UCSB Gauchos’ freshman baseball team, where he played alongside Bill Rauth. Michael later became a Partner of IGSB.

[5] Tim Bliss was Terry’s younger brother. He joined Reece at Montecito Fund as a financial analyst before leaving for business school, only to return to join Reece at the newly-renamed IGSB. Tim later became a Partner of IGSB. Tim is also married to Reece’s sister-in-law, Virginia (Ginny), and the pair actually lived in the water tower on Reece’s property for a period of time.

[6] Luise Phelps is a relative of the Blisses (exact relationship unclear). She later became a Partner of IGSB and also served as President.

Immediately after graduating from UCSB, Reece moved back to Palo Alto to attend Stanford Business School (GSB). While there, he spent a significant amount of his time investing in the stock market (which was a hot IPO market at the time) by identifying great companies via rigorous fundamental analysis that included visiting the actual companies, and graduated with over $50,000. He used that money to seed the Montecito Fund, where he took a chance on future Partner Tim Bliss by hiring him as a financial analyst. After Tim left for Business School (also GSB), Reece renamed the fund Investment Group of Santa Barbara. He hired Tim back after he graduated, and immediately gave him the opportunity to manage a significant portfolio. Despite Tim getting off to a rocky start (his portfolio was down 20% and his salary slashed 20%), Reece saw his potential, and told him “I could use the write-off. Start over.” Rather than firing him, Reece gave Tim a “large chunk of money to run,” and “it was off to the races.” This was a major turning point not just for Tim, but also for Reece, who gained a lifelong friend and Partner who helped turn that initial $50k into several hundred million dollars (perhaps now billions) over the next few decades.

IGSB was able to find such great success partially because they were so different in so many ways from the beginning, including:

1) They’re based in Santa Barbara, which, while is hardly the finance hub that New York is, or the tech hub that Silicon Valley is, has allowed them to stay grounded and maintain an independent viewpoint (similar to why/how Warren Buffett is based on Omaha).

2) They have a tight-knit team that was anchored by five partners (Reece, Tim, Bill, Mike, and Luise) who are tied together by decades of shared experiences including schooling, family, and sports, which has allowed them to build a long-lasting partnership based on a culture of trust and fun.

3) They manage no outside money—the fund was seeded with Reece’s stock market proceeds and they never took on outside clients, shareholders, or limited partners. They did use debt in the early days, but they have been debt free since the late 70s. Managing no outside money has 1) allowed them to be true principal investors and take on true long-term views and positions, and 2) allowed them to be flexible and invest where their interests take them (i.e., in the early days, IGSB was more focused on public equities, but have since moved more toward venture capital and company-building).

4) They mix diversification and concentration. They are diversified across stage and asset class, having invested in both public markets (i.e., Autodesk, FedEx, Mercado Libre, ToysRUs, Williams-Sonoma) and private markets (i.e., Advent, AirBnB, AppFolio, Facebook, The Learning Company), and even started a few (i.e., GlobalEnglish). However, they are concentrated in their investing, having 1) focused exclusively on best-in-class B2B software over the past few decades (i.e., VMS for real estate and farming) and 2) doubled down when they saw success (i.e., when AppFolio IPOed, IGSB owned more than 1/3 of the company).

5) They give new investors immediate responsibility, runway to grow, and a path to promotion. When Tim Bliss started at IGSB, Reece gave him a $500k portfolio to manage. He made Partner within 5 years. Today, Tim leads Partners Fund, which he started with several of his IGSB Partners. When Marc Stad first joined IGSB, he was given a $1mn portfolio to manage. He made Partner and was in charge of the firm’s Hong Kong office within 5 years. Today, Marc leads Dragoneer, which he started in 2012 and has grown into a ~$25bn fund.

Apart from founding IGSB, Reece is best known for having been the Chairman of the Board for The Learning Company [1], the Chairman of the Board for Advent Software [2], and the Founder and Chairman of the Board for GlobalEnglish [3]. All in all, Reece has been a Founder or Co-founder and lead investor in ~14 companies over the past 30 years. Seven of those companies became publicly traded, and seven of them merged with public corporations.

[1] The Learning Company was an education software company founded in 1980. It went public in 1992 and achieved 16 consecutive quarters of revenues and profits growth, never experiencing a single down year or even quarter. However, it 1995, it was acquired in a hostile takeover by Shark Tank star Kevin O’Leary’s Softkey International for ~$600mn. Softkey then took on the name The Learning Company, before itself being acquired by Mattel for $4.2bn).

[2] Advent Software was a leading provider of software and services for the global investment management industry. It founded in 1983 and went public in 1995 before being acquired by SS&C in 2015 for $2.7bn. At the time of acquisition, SS&C’s market cap was ~$6bn. Today, it’s ~$15bn.

[3] GlobalEnglish was founded in 1997 as an internet-based edtech company whose cloud-based software taught English to business users. They became cashflow positive in 2006 and were acquired by Pearson in 2013 for ~$90mn. Pearson later sold them to Learnship in 2019 for an undisclosed sum.

Given his extensive experience as the founder, investor, and operator in multiple successful edtech companies, as well as his involvement with top-tier education institutions like UCSB and Stanford, Reece has a unique perspective into the education industry. There are few, if any, better people to talk about the intersection between education and business.

I hope you enjoy this presentation as much as I did! It’s a fascinating look into the mind of one of the greatest investors and company builders of all time.

(Transcription and any errors are mine.)

Relevant Resources

Transcript + Slides

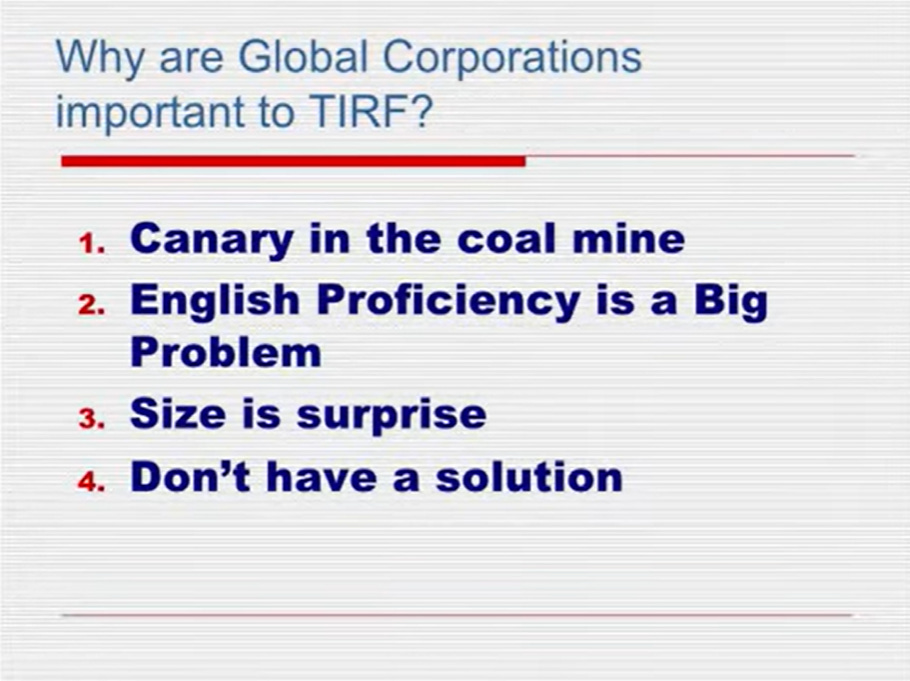

Why are global corporations important to TIRF? Well, I think it is a little bit that it's the canary in the coal mine. If you understand what's taking place with global corporations, because of their ubiquity, they're in every country doing everything imaginable in this global era, you also understand what's taking place with small companies, and what are the workforce issues.

English proficiency is a big problem. The magnitude of the challenge has pretty much taken everyone by surprise. And they don't have a solution. And that's why TIRF is focused on this with Key Question Initiative, British Council is focusing on this, and many organizations who realize that the solution is imperative, and in fact, a whole suite of solutions.

I'm going to talk a little bit about what the problem is and what caused it, through the eyes of somebody who kind of is a student of international business. And let me kind of go back a little bit and kind of talk about focuses of global corporations over the last 1, 2, 3, 4, 5 decades.

Global organizations try to leverage whatever their intellectual property is, and whatever their brand is. But if there's a thread that goes through the strategy of every global corporation, it's to do everything in their power to improve the efficiency and productivity of their workforce. It's absolutely crucial. They understand if they do these things, they create more sustainable businesses and higher profit margins.

So if you look at kind of the things that have happened over the last, again, 2, 3, 4, 5 decades, what you see is they focused on bringing things into their organizations, and proliferating through their organization, to make these organizations more efficient, and particularly with respect to the flow of information. All of you kind of know a little bit about CRMs and ERPs and network managers, so forth. These are tools where corporations today spend, in some cases, hundreds of billions of dollars a year supporting these tools to make their organizations more efficient.

Well, what's the piece of the puzzle that's missing? And that's the question for TIRF and others. There is no such thing as a communication management tool...ELRP, or English language resource planner or resource manager. But there's going to be. They're going to come in pieces. There's going to be a first generation and a second generation, because organizations absolutely will need these in dealing with problems. Not only if they're going to happen in the future, but the problems they have today, and really, for the last decade.

I'll talk about these issues, and I'll talk about within the context of what I call this human global network, because that, in fact, is what we have today. And if you look at the world before globalization, and I'm a great fan of the term globalization, because it means different things to different people, but what it really had was 700-800mn people participating in free markets.

You had a number of points of connections, but you didn't have points of connections that overloaded the capacities of those corporations to function efficiently.

So if you look at after globalization, all of a sudden, what you're seeing is, you've gone from about 700-800mn people participating in free markets to about 3bn people participating, 3bn of the 6bn, so half of the people in the world, are participating in free markets. You've opened up [Eastern Europe, free markets], obviously, China, India, Southeast Asia, most points in Latin America. And this is what it looks like. And the truth is, if you took the points of contact in every one of these cities, you have literally covered the entire map. So there's an extraordinary number of points of presence. And the most important thing, with respect to this particular slide, is the statistics. If you look at global corporations, again, the canary in the coal mine, if you look at global 1000 corporations in 1996, 30% of the employees were non-native English speakers. 2006: 50%. Next year: 70%. So what you have is organizations where 70% of people are non native English speakers. And they are interacting, literally, every single day, every week, with other non native English speakers in non English countries. And that's how these organizations have to function today. And yet they're functioning, in many cases, with limited English proficiency by a great percentage of the employees.

So if you look at kind of what's happened, how does all this unfold, most of you kind of understand this. But basically, you have this explosion of free markets, you have a true global economy, borders really don't matter anymore to most organizations in the world. The global demand is leveraged by exports and imports. Basically, it's competitive. Whatever lower competitive advantage is. And the rules have changed this. This has become crucially important to create the backdrop for what we see. The rules of law have become acceptable in most countries for global organizations to work. And consequently, capital flows into these countries. And because the emerging countries have grown so rapidly, have huge savings rate--the savings rates are the things that fund the small and mid sized businesses which have symbiotic relationships with global corporations. So as you look at this global human network, it's not just the global corporations, it's those corporations and the symbiosis with the small and midsize businesses that feed them. I'll talk about the digital connectivity kind of as a driver in the neighborhood, but it really ties the whole thing together. It's kind of the second [tectonic] piece of the puzzle...sheer number of connections point to point around the world.

So if you look back, because we think we, since World War Two, have understood what a global [economy] is, but the reality is...go back now, with hindsight...between the 50s 60s and 70s, a global corporation was really a bunch of regional offices. And there was autonomy in the offices. The offices ran as if they were local companies. And local languages, and all those things. In the 80s and 90s, because of some of the tools that I talked about, you began to see more integration between countries as these global organizations realized there were ways to increase the efficiency. And English became slightly more than really important...but really imperative. And then you had an explosion, and explosion was not planned. It basically was an accident of technology, and happened in 1995. It was the browser. That made corporations make the decision they were going to link everybody with a browser. They had no idea what the implications were for communication within their organization, between organizations. Nobody did great studies. McKinsey never put this under a microscope. The browser arrived, all of a sudden you have emails arriving of people [who had] never had an email in their life. And then you have one a day, then you have two a day. Then a couple of years later they threw this thing called WebEx or GoToMeeting, and all of a sudden you have to walk into a room and you're talking to somebody in Sao Paulo and Seoul, or somewhere else. And so the technology essentially changed the landscape. And for applied linguists, this is a defining period. This is, in my opinion, it has to be the most interesting period in the history of the world, where you have a global economy coalescing around a common communication tool.

And if you look kind of from a tipping point standpoint, and this is interesting, the requirement for English skills was always low in the 50s, 60s, 70s, 80s, and 90s. So the tolerance for poor English skills was high, the red line at the top. Corporations just didn't care a lot, because it didn't make a lot of difference if English language skills weren't highly proficient. But as soon as you create the connectivity, what happened was, you have these two curves bend. The skill requirement bent up. And then the tolerance curve bent down. And it intersected in the period we're in now, where we're trying to figure out how this global human network really works.

And we've done 10s of 1000s of surveys. Each year, we'll do 10, 20, 30 thousand surveys. But now we have about six or seven years. And every year, it looks about the same. About 90% of respondents, these are employees in the workforce of global corporations, indicate English is important or imperative to their job responsibility. Yet, less than 10% in self assessment, and assessment by their managers, would indicate that their level of English proficiency is sufficient for their job. So you'd have this huge gap. And every year, what's interesting, it's not like the gap is closing, because the thing that's happening is--and also, we can look at the proficiency. We see that there is slightly rising increase in proficiency in global corporations. But the problem is, the threshold of expectation is going up at the same rate. So as far as the employee is concerned, each year, they feel as deficient in their language skills as they did the previous year.

So if you then look at it from the standpoint of the emerging countries, emerging markets, and look at how most people define what they're looking for, these local knowledge workers, and they describe three things: 1) knowledge in their domain, which corporations can find. You can find people with great knowledge in domain. 2) Ability to solve problems. And it's really important, they have to be smart, because you're going to have to retrain them every couple of years to do something. 3) And the third piece of the puzzle is the ability to communicate. And without the communication, the system doesn't work.

So you have this perfect storm. The 90. The 10. Everybody understands, whether you're an employee, whether you're a manager, whether you're a corporation, the global winners, 5, 10, 20, 30 years, are going to be the companies and individuals who have really dealt with this issue in the most productive, creative, and successful way. And the things they're looking at, and this is why it's important as the British Council and TIRF and [CAL] and other organizations try to put some heat on this is, they need things that are scalable, because the problem is a global problem. They want a global solution. So things have to be measured, or can be measured, on a global basis, can be deployed rapidly and cost effectively.

And with that, I just conclude by saying this: English language, going forward for every kid in the world, it's going to be an imperative to function in the world. And organizations like TIRF and British Council and others are best suited to be the people who are out there, and the leadership are tackling the problem and and helping organizations. Thank you.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Copart, Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.