Today’s letter is an essay Altos Ventures Managing Director and Cofounder Ho Nam wrote about building conviction. In it, he discusses the most common questions he gets when lecturing, human biases, pro-rata investments being lazy, and the four simple questions he asks when thinking about doubling down.

Ho is a Managing Director of Altos Ventures, focusing on investments in the areas of software, mobile, and internet technologies. He led the firm’s prior investments in Axis Systems (Cadence), Enwisen (Infor), Evolve (Oracle), Immunet (Cisco), Lohika (Al tran), Listen.com (Real Networks), Nishan Systems (Brocade), Pixo (Sun) and SayNow (Google) Google), among others. Ho began his VC career at Trinity Ventures and began his professional career at Bain & Company, where he advised clients in technology and consumer products industries. Before cofounding Altos Ventures, Ho worked at Silicon Graphics and Octel Communications.

Relevant Resources:

Letter

"What gets us into trouble is not what we don't know. It's what we know for sure that just ain't so."

- Mark Twain

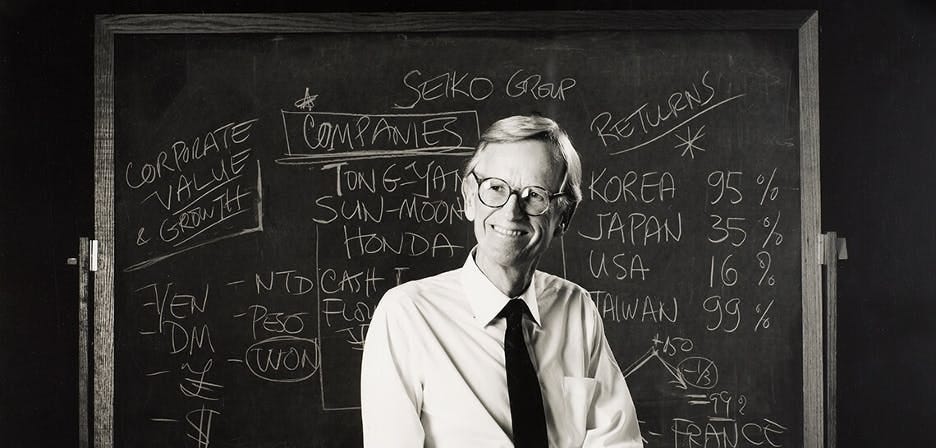

For more than a decade, we have been teaching an annual session of a legendary investment class taught by Professor Jack McDonald. While Jack is sadly no longer with us, we go back every year to answer questions posed by smart, curious, yet skeptical students who get to meet many top institutional investors representing different strategies across both private and public markets. The most prevalent questions tend to be a variation of “how do you know?” Some examples include:

How do you know that a new investment is going to generate great returns?

How do you know if a founder can grow to become a great leader?

How do you know, after a huge gain, if you should continue holding?

How do you know when to sell or double down?

The first two questions are most relevant at the time of the initial investment. The latter two are more relevant for follow-on investment decisions, which we think about as a decision to hold, sell or buy more (i.e. double or triple down).

We’ve been fortunate to have made some good decisions that may look prescient. The truth is, in the beginning, we never knew how things would turn out. We’ve also made countless mistakes and experienced venture capitalists should become more humble over time as the mistakes pile up. In the VC business, no matter how much due diligence is done, an initial investment is just the beginning of a journey, which Sequoia’s Mike Moritz has described as a “giant step into the unknown.”1

Even with the benefit of hindsight, it’s hard to know the truth due to cognitive biases such as hindsight bias and the narrative fallacy. According to Nassim Taleb, “human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.”

If we cannot be certain looking at the past, then it’s even more difficult to predict the future. All we can do is make decisions based on the information available at the time, and the outcome will be the outcome. The focus should be more on the journey rather than the destination.

That said, we can also focus on a few things that are within our control after we’ve already made the initial investment. So much has been written about how VCs make initial investments. The purpose of this post will be to focus on the neglected but critical follow-on investment decisions.

The follow-on investment questions may also be interesting to entrepreneurs who might wonder when to exit. Or keep going? LPs also ask these types of questions as they try to understand why we sell certain companies while doubling down on others.

The “lazy” option: Pro-Rata Investments

Most early stage angel or venture investors get their maximum ownership up front and get diluted over time if companies raise more money. If they have the money, they may try to protect their ownership interests by exercising pro-rata rights to invest in the later rounds.

However, we would never want to exercise our legal rights to force our way into a round. That would mean our relationship with the company is fundamentally broken. Such situations would not lead to satisfying or productive long term relationships.

Sometimes, existing investors do need to invest in a later round to show insider support in order to attract fresh capital. We feel a sense of responsibility in such situations and will be inclined to show some support. However, in general, we believe investing the pro-rata allocation is the “lazy” option, especially in our best companies. Why is that?

In great companies, financings tend to be oversubscribed. When there is a lot more demand for a stock than supply, insiders do not need to invest and may even be able to sell to later investors. In such situations, we may make a conscious decision to invest as little as possible or even sell, if the price is right.

However, depending on the company, we may also make the opposite decision to invest more than pro-rata, and perhaps take the entire round. Either way, the default of investing pro-rata is not how we approach follow-on investments in our best companies, where we generate the vast majority of our returns.

Like most early stage VCs, we typically reserve one dollar for every dollar invested in the initial round. In practice, however, across 100+ companies over 20+ years, we’ve ended up investing far less than the amount reserved (about 60 cents to the dollar, or 0.6x the initial investment, on average).

However, averages do not tell the whole story when analyzing venture portfolios. When one of our companies starts to become a compounding machine, we may commit a lot more money as well as time to let the compounding make a difference.

We have committed 5 to 10x, and, in a couple of cases, more than 100x our initial investment (rather than 0.6x). We may invest across multiple funds and through SPVs that may be larger than entire funds, just to invest in a single round.

Some people might think that is nuts. Given the history of bubbles and crashes in the venture industry, paper gains are viewed with great suspicion. For LPs, what counts is “the moolah in the coolah.” So why would we not take some money off the table, return capital to LPs, and increase DPI?

To answer, we go back to the questions of “how do you know” when to hold, sell, or double down?

Four Simple Questions

When initial VC investments are made, no one knows what will happen. However, over time, the answers to four or five very basic questions inform our yet-to-be-made decisions on whether or not to lean-in with larger investments or sell or simply hold.

1. Does the company generate cash?

If you watch HBO’s Silicon Valley or follow the venture ecosystem in the press, you might think that VC-backed companies don’t need to make money. Growth trumps profits. Blitzscaling, or “go big or go home,” are common mantras (except during crashes).

Having survived multiple economic downturns, we prefer to take a different path. High burn rates make us nervous. After our investment, over time, if we do not see capital efficiency and a path to control our own destiny (through positive cash flow), the company would fail this first simple test.

As the coronavirus sends shock waves through the economy, our best companies, those with strong balance sheets and profitable business models, will emerge much stronger. Many weak companies will not survive and that is capitalism. Difficult times are when the best companies separate from the pack.

2. What is the moat (or competitive advantages)?

Building a business that generates significant profits and free cash flow is not good enough. Capitalism can be cruel and creative destruction is common, especially in the tech industry. More important than profitability is defensibility which enables sustainability. What is the moat around your economic castle? If you don’t have one, marauders will take over and the compounding will stop.

Examples of moats are network effects, IP, distribution, brand and/or other competitive advantages. However, the most important moats often turn out to be secrets discovered along the way. This is one of the reasons that we do not (and cannot) know which companies will succeed ex ante.

A company that passes this second test becomes a much more interesting candidate to become a long term hold or what some VCs call a long buy. If we do not see a great moat, or if we see it eroding, the company would no longer qualify to be a longer-term hold.

3. How do we feel about the relationship?

The third question is the most subjective as well as the most difficult to answer in the beginning. In early-stage investing, there are no good metrics (yet) so the people are paramount to the initial investment decision.

For follow-on investments, there will be more business metrics and operating history to analyze. However, paradoxically, we’ve learned that the people and our relationship with them may end up being the most important factor, even at the later stages.

When we evaluate the relationship, we don’t just look at how we are treated. We observe and learn from the type of relationships with other stakeholders. How do they treat employees and customers? Is there trust? What is the employee turnover and customer churn?

We might ask, will management call us to talk about an important problem? We certainly do not require them to have us on speed dial but if the relationship is not great, we will not know what is really going on. We would be like any other investor — an outsider looking in.

We will become increasingly uncomfortable holding onto an outsized, concentrated position in a company where we have little knowledge or influence. Therefore, any company with which we do not have a great relationship would no longer qualify to be a long-term hold.

4. How much liquidity do you need? How much liquidity do you want?

The fourth key question becomes relevant only after a company becomes somewhat successful. Only then, can we ask the question, “how much liquidity do you need?”

The answer often depends on the lifestyle and personal needs of employees. We would want key people to have enough liquidity to reduce financial stress so that they can focus on the long term success of the business. Great private companies should be able to provide interim liquidity through secondary transactions and even dividends and stock buybacks, long before IPO or an M&A exit.

If a company continues to do well, at some point, we might ask the next logical question — “how much liquidity do you want?”

This is where it gets interesting. If the amount of “want” starts to exceed a certain level, it may be time to call it a day. By the time a company reaches this level, entrepreneurs have worked hard for a long time. If they want to do something else with their lives, maybe we should fully exit and part ways as friends?

However, every once in a while, we come across entrepreneurs for whom it’s no longer about the money. It’s about loving the work itself, making a difference, and fulfilling a mission. Such entrepreneurs (who we have called Hedgehogs), always feel like they are just getting started.

So, the next time you wonder “how do you know?” The answer is simple. We may not know in the beginning. But over time, we learn and make adjustments, sometimes dramatic, to the capital we allocate across the companies in our portfolio. Rather than trying our luck at venture lotto, we prefer to commit our time and money in companies where we have the most conviction, which also tend to be where we develop the best and most enduring relationships.

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Copart, Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.

VC: An American History by Tom Nicholas

I need to go check on my "moolah in the coolah" 😁