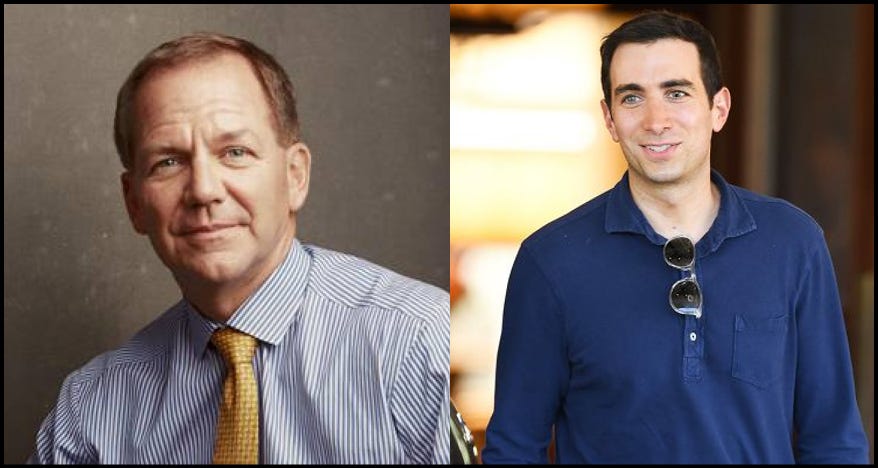

Letter #231: Paul Tudor Jones and Andrew Ross Sorkin (2024)

Founder of Tudor Investment Corporation and Co-anchor of Squawk Box & Co-creator of Billions

Hi there! Welcome to A Letter a Day. If you want to know more about this newsletter, see "The Archive.” At a high level, you can expect to receive a memo/essay or speech/presentation transcript from an investor, founder, or entrepreneur (IFO) each edition. More here. If you find yourself interested in any of these IFOs and wanting to learn more, shoot me a DM or email and I’m happy to point you to more or similar resources.

If you like this piece, please consider tapping the ❤️ above or subscribing below! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Paul Tudor Jones is the Founder and CEO of Tudor Investment Corporation, best known for tripling his money during the events of Black Monday in 1987. That year, he reportedly returned 125.9% after fees, earning an estimated $100mn. Prior to founding Tudor Investment Corporation, Paul was a commodities broker for E.F. Hutton & Co. Paul started his career working for famed commodity broker Eli Tullis, who mentored him in trading cotton futures at the New York Cotton Exchange.

Andrew Ross Sorkin is a financial columnist for The New York Times, a co-anchor for Squawk Box, and the Founder and editor-at-large of Dealbook. He is also the author of Too Big to Fail: How Wall Street and Washington Fought to Save the Financial Systems — and Themselves, which was adapted as a movie for HBO that was nominated for 11 Emmy Awards, as well the co-creator of the hit tv show Billions. He started his career writing for The New York Times while still in high school.

Today’s letter is the transcript of a conversation between Paul Tudor Jones and Andrew Ross Sorkin. In this conversation, Paul and Andrew discuss the upcoming US Presidential election, Stan Druckenmiller and Dan Loeb, what the market says about the election, how Paul is positioned for the election, tax cuts, the treasury market, buying bonds from the US vs internationally, bonds vs equities, Vince McMahon, an economic kayfabe, betting on a Minsky Moment, and the importance of a strong Treasury Secretary. Paul then dives deeper into tax rates and regulatory freedom, shares why he won’t publicly endorse a candidate, his view of tax cuts, the importance of stabilizing debt/GDP and what that will do to jobs, the need to increase individual tax rates, the Robin Hood Foundation, inflation, and more.

I hope you enjoy this conversation as much as I did!

[Transcript and any errors are mine.]

Related Resources

Tudor Investment Corporation

Macro Investors

George Soros Compilation - 880 pages

Transcript

Andrew Ross Sorkin: We are here in Downtown Soho, joined by a very special guest this morning. Paul Tudor Jones is here. He's the founder, chief investment officer of Tudor Investment Corporation. Of course, he is also the founder of the Robin Hood Foundation, which is hosting its annual investor conference in partnership with JP Morgan right here, that's going to begin tomorrow. And we're thrilled to have you on the program.

Paul Tudor Jones: So good to see you again.

Andrew Ross Sorkin: So good to see you. We got to talk about a lot of things, because we are now 14 days away from the election, and I think everyone is trying to make sense of this market and where things are headed, and where things are going, and maybe, depending on who you think is going to win the presidency, how that's going to impact this. So where are we?

Paul Tudor Jones: For me, and in the hedge fund world, this is kind of the macro Super Bowl coming up on November 5. And I think this one--some elections are not that binary--this one is binary not so much because of which which candidate wins, but it's binary in the sense that what is the market's response going to be to either candidate if they win. And so we can either continue down the path we've been on, which I'm going to kind of frame here in a second, or we may have that point of recognition where all of a sudden the markets have different ideas than what the candidates have been espousing.

Andrew Ross Sorkin: Before you lay out where you think that piece of it is, let me ask you this: Stan Druckenmiller said that he's convinced by market indicators right now that Trump will win. And I'm curious if you agree with that thesis. Part of it is that he's looking at Poly market and the betting markets. Part of it is he's looking at the shares of DJT. Part of it he's looking at Bitcoin.

Paul Tudor Jones: Yeah, certainly the markets are saying he's going to win. I think they're heavily skewed by Republicans. So I don't know if I necessarily believe the betting markets, but I don't have any great insights. I really don't. I just would be more skeptical of them than I would normally. It's the same way--look in football betting. You can get a huge home bias where the line doesn't reflect reality. So yeah, I know what they're saying, and I respect him.

Andrew Ross Sorkin: What about other investors? Dan Loeb recently came out with a report to his investors saying that he's positioning, or repositioning, his portfolio around the thesis that President Trump will become the president.

Paul Tudor Jones: And I have also, if I'm being honest--primarily because I see the polling numbers, have clearly moved in this direction--

Andrew Ross Sorkin: You say also meaning you've repositioned as if when President Trump.

Paul Tudor Jones: Yes, I have moved in that direction. For sure.

Andrew Ross Sorkin: And what does that mean?

Paul Tudor Jones: It just means more inflation trades, which I'd love to get to, but I think it's really important that we frame where we are right now. And where we are is an incredible moment in US history. And what I really want to talk about is the debt trajectory that we're on. So we've gone, in the space of 25 short years, from debt/GDP at the federal level, from about 40% to almost 100%. 60% in 25 years. And if you look at what our trajectory, what CBO projects our trajectory to be, as well as what we see is--and we're going to project further than CBO. So CBO says that we go from 98 to 122, I think 124. That's very conservative over the next 10 years. If you extrapolate that 30 years, you get to 200% debt/GDP. And so that's something, obviously, something that can't go on forever--won't. And the question is, after this election, will there be some point of recognition, particularly with all the the tax cuts that are being promised by both sides and the spending plans--I mean, they're handing out tax cuts like their Mardi Gras beads. We're doing tax cuts on everything from tips to toucans. So it's crazy what's being promised. After the election, I think the fact that you've got 7-8% budget deficits, as far as the eye can see--the question is, Will the markets allow either candidate--I think under Trump the deficit goes up by $500bn per year. Under Harris' plan, it goes up by an additional $600bn plan per year. I have a feeling all those are just pipe dreams. I think the chances of any of those being enacted are--

Andrew Ross Sorkin: You mean that the tax cuts that they're putting on the table during the campaign--

Paul Tudor Jones: Those have zero chance of being enacted in my mind. I think the markets will unequivocally--debt markets for sure. The Treasury market won't tolerate it.

Andrew Ross Sorkin: Why do you think that the Treasury market continues to tolerate it now?

Paul Tudor Jones: Well, it's so funny, because financial crises percolate for years, but they blow up in weeks. That's kind of the history of them. And so for me, this election becomes one of those seminal points where all of a sudden, Hmm, let me really think whether this proposition that the US government is making me is something that I actually want to participate in. And I just want to try to frame, in layman's terms--let's assume that I'm making $100,000 a year. You've lent me, because we're such great friends, $700,000. That's what you've lent me. And I come to you and say, Okay Andrew, I'm gonna pay all that back to you in 30 years. But between now and when I ultimately pay you back, I wanna borrow $40,000 every year for the next 30 years. And then at the end of 30 years, I'm gonna pay the whole thing back. Would you lend me that money?

Andrew Ross Sorkin: Unlikely.

Paul Tudor Jones: You son of a bitch. I thought you were my friend!

Andrew Ross Sorkin: Well, this is the problem that we have.

Paul Tudor Jones: Okay, so that's actually the proposition that the US government makes to every bondholder today. That's the exact same proposition. So think about this. We owe $35tn. Our tax take is $5tn. So we owe 7x what our tax take will be this year--our revenues will be this year. And our deficit is $2tn, and is $2tn right now, as far as the eye can see. That is literally the proposition that the US government is making to someone who buys a 30 year bond.

Andrew Ross Sorkin: I'm not disagreeing with you. The question is, life is relative, so some people would say, Sure, you can either buy bonds from the US, or you could buy bonds from some other country that has an even worse situation.

Paul Tudor Jones: Or you can not buy bonds. So anyway, I was watching this Vince McMahon documentary, and in it--and I love wrestling, particularly when Stone Cold and The Rock, and all of them--and in it, there's a term that I'd never heard of, called kayfabe. And in wrestling parlance, that represents the unspoken, unwritten, tacit agreement between the wrestlers and the fans about the illusion that's going on in the ring--the suspension of disbelief that was going on the ring is actually--we know it's scripted, and we know it's a performance, but they ask us to think it's genuine and real. And so we're in an economic kayfabe right now. And it's not just the United States. We're in it in the in the UK and France, Greece, Italy, Japan--Japan being the biggest of all. It's this economic kayfabe, and the question is, after this election, will we have a Minsky moment here in the United States and US debt markets? Will we have a Minsky moment where all of a sudden there's a point of recognition that what's going to happen--or what they're talking about--is actually fiscally impossible, financially impossible.

Andrew Ross Sorkin: So are you betting on a Minsky moment?

Paul Tudor Jones: I am clearly not going to own any fixed income, and I'm going to be short the backend of fixed income, because it's just completely the wrong price. But I just want to add one more thing, and this is why this election, I think, is so--I find it so interesting because the candidates and the parties are so interested in winning this election. But if you look at it, certainly from a fiscal standpoint, you're winning the booby prize. And let me just make this a little more complicated. In addition to the problems that we have fiscally, the United States has a net international investment position that is -80% of GDP. And so -80% of GDP is roughly over $20tn, and that traces the history of our net international investment position. So let me define that real quick. It means foreigners own $20tn more of US assets than we own of foreign assets. That's how you get to the -80% or the $20tn. How did we get there? It's actually a good thing. Why do we have so many of our assets owned by the rest of the world? Because we're the leader in technology. We're the greatest arena for free markets that there is. We promote and engender entrepreneurism. We generally hold in high esteem the people the best. So anyway, so think about this: The problem with having a $20tn net international investment deficit is that you're also beholden to the kindness of strangers. So now we're going to have this election. The next president is going to come in, whoever that is, and they're looking at, okay, I've got $20tn that could have wings on it, as well as I've got a fiscally unsustainable path. What do I do? And that's why, I'll tell you--I don't know if you've ever seen those goats that kind of perch themselves from the side of dams, and you go, Gosh, how do they do that? How do they hold themselves on the side of the dam like that? That's what I think the next administration, whoever it is, is going to be facing. You're going to have to have the smartest, and the most sensitive, president, treasury secretary--that Treasury Secretary damn well better be from Wall Street, no markets. It cannot be a corporate head who does not understand the plumbing of the financial system.

Andrew Ross Sorkin: So who do you think is going to get you that Treasury Secretary?

Paul Tudor Jones: I don't know. And frankly, and then--let me just say one last thing. And our Fed chairperson, our Fed chairman, and the next chairperson after that--the three of them have to be brilliantly connected to be able to stick this landing. Because again, if I look at debt/GDP, the path that we're on, it's rising faster than the ocean.

Andrew Ross Sorkin: Let me ask you this, because also, the only way to solve this is to figure out a way to raise enough money where at least the math starts to make some semblance of sense.

Paul Tudor Jones: Yeah, and--but let me just quickly show where we are in terms of our tax take relative the rest of the world. It goes from the US at the lowest end, 29.3% of GDP is what our tax take is, to France at the highest end, and you can kind of see there's Canada, Japan, the UK.

Andrew Ross Sorkin: Now, before we get into our own math, let me ask this question: One reason why some people would say the US is as successful as it is, is because it is a less of a regulatory state, less of a tax state. When you go down that list and say to yourself, how successful is the US relative to how successful is France? Do you say to yourself that France is less successful because its tax rate is higher?

Paul Tudor Jones: I would unequivocally agree with that. It's like everything. There's a fine line--there's a needle that you've got a thread. You can also say one of the reasons why the US is so dominant is because we fast forwarded so much future income by spending so much in a deficit standpoint. And it's really occurred, to be frank with you--the guy that started it was Trump. He inherited a 3% budget deficit in 2016. In 2019, that was close to 5% pre-COVID--before COVID. And then, of course, Biden gets in and sees what Trump has done, and says, Here, let me raise you one with the Inflation Reactivation Act, and here we are today. So can I just say, between Trump and Harris, you've probably got the two people least suited for the job that's ahead of them--least suited for the job that's ahead of them. And that's why it's going to be, again, after the election, is going to be so important. And I do think they know--I think we're doing also a political kayfabe with them. They know that they're not going to do these spending programs. I think they know that. It can't happen.

Andrew Ross Sorkin: Okay, but if both of these folks you think are the wrong people, but it's still a binary choice, what is your choice?

Paul Tudor Jones: I'm going to keep that private. And the reason I'm going to keep that private is because there's a lot of causes that I'm really invested in. Robin Hood's one of them. The environment. And I'm going to end up working with people on both sides. We're a really divided country right now, and I want to make sure I have great relations with whichever administration goes on, because I want to continue serving the millions of people that I do, and the billions of critters that I love.

Andrew Ross Sorkin: Let's talk about taxes, though, because that's how the money is going to get raised, one way or the other.

Paul Tudor Jones: Correct. Can I just say this? You have to let the tax cuts expire. You have to let those expire! That's $390bn. We're going to have--again--we're going to be broke really quickly, unless we get serious about dealing with our spending issues. And unless we--only--we can either--I don't know if we'll be able to cut spending that much. 60% of our spending are transfer payments.

Andrew Ross Sorkin: But if you think we're going broke, and you think Trump is going to be the president, he's not going to let those tax cuts expire if he can avoid it. He does not want the corporate tax rate to go to 25% as you're suggesting it'll have to, he's suggesting it should go to 15%.

Paul Tudor Jones: I'm saying that to just to get us to the point where we stabilize debt/GDP at where it is right now, here's what you need to do: You need to let the Trump tax cuts expire. That's $390bn. You need to raise the payroll tax on every single working person 1%. That's another big slug. You need to--

Andrew Ross Sorkin: What do you think that does to jobs?

Paul Tudor Jones: We're clearly going to have a period of contraction, which hopefully--that's why I was going to say, it's going to be really important for the Fed to be able to offset the fiscal contractionary that's going to come.

Andrew Ross Sorkin: Then you want to increase the individual tax rate--all the way to the top rate of close to 50%?

Paul Tudor Jones: No, no. Hold it. I don't want to do any of this stuff. What I'm telling you is, is that we've got to be serious about where we are fiscally. And so I'm giving you--there's a whole set of options. We could go in and cut 25% of the federal workforce. Some people may do that. There's a whole--there's a website where you can go look and play with all the options. You can raise the capital gains rate from 21% to 28%--that only gets you $10bn/year. It actually doesn't get you what you need. So I'm simply showing some of the things that you can do. Yes, you'd have to raise the tax rate on the top--I think probably everyone over 200k--probably have to raise that to 49.5%. If you do all these things, all these things--raise the Social Security from 65 to 70--if you do all these things--means test, Medicare--if you do all these things, all you do is you get to a primary balance. What that means is you stabilize debt/GDP. You're still actually increasing your debt. You're still actually increasing it because it excludes the interest cost, which, oh, by the way, the interest bill this year, is larger than every single line item except Social Security. It's larger than defense spending. Larger than Medicare.

Andrew Ross Sorkin: I want to talk about why you're here, which is Robin Hood, and this conference. But before we do that, is this--given all of the things you're saying, Are you off buying gold and Bitcoin, and hiding somewhere?

Paul Tudor Jones: All roads lead to inflation. We're going to end up--

Andrew Ross Sorkin: But does all roads lead to inflation, therefore gold is a good investment? Is Bitcoin a good investment to you?

Paul Tudor Jones: I'm long gold, I'm long Bitcoin. I think commodities are so ridiculously under owned. So I'm long commodities. I think most young people find their inflation hedges via the NASDAQ--that's also been great. It's probably some combination. I probably have some basket of gold, Bitcoin, commodities, and NASDAQ--something like that. And I would own zero fixed income. If I had my cash, it'd be very short term. The playbook to get out of this--you see it in Japan right now. They have 2% inflation, 30 basis points overnight. They don't want to raise rates. The playbook to get out of this is that you inflate your way out, and you have a small tax on the consumer, and you run interest rates below inflation and nominal growth above inflation. And that's how you reduce your debt/GDP. So you're going to have the Fed be--they should be easy. They should be easy.

Andrew Ross Sorkin: They should be easy. You want them to cut.

Paul Tudor Jones: So just real quickly. Every 100 basis points, given where our debt/GDP right now, every 100 basis points is worth about $90bn/year to the deficit--$90bn. So yes, if we're trying to stabilize debt/GDP, we want to run the most dovish monetary policy that we can without letting inflation become too much of a tax on the citizenry. So yes, all roads lead to inflation. That's historically the way every civilization has gotten out--is they've inflated away their debts.

Andrew Ross Sorkin: We're going to run out of time, but I want to talk about this--because this is also your Super Bowl of the Year.

Paul Tudor Jones: Best day of the year--best day of the Fall. And that's our investor conference. It's sold out. It's fantastic. We've got everyone from Seth Klarman, Jamie Diamond, David Einhorn, Bill Gates finishes the end of the day. I have a great talk with Ken Tropin. And most importantly, you have to think about--I think about Robin Hood and I think New York this way--you're only as strong as your weakest--the chain's only as strong is the weakest link. The weakest link in any society are the most needy, the underserved, the people who are at the bottom. So that's what we do. We're the spear point for helping those people in this city so we can keep a strong city and a strong society.

Andrew Ross Sorkin: Paul Tudor Jones. Kayfabe, right? That's the phrase?

Paul Tudor Jones: Economic kayfabe.

Andrew Ross Sorkin: Economic kayfabe. Fascinating. Thank you for this. Appreciate it very much.

Paul Tudor Jones: Thank you so much.

Andrew Ross Sorkin: You bet.

If you got this far and you liked this piece, please consider tapping the ❤️ above or sharing this letter! It helps me understand which types of letters you like best and helps me choose which ones to share in the future. Thank you!

Wrap-up

If you’ve got any thoughts, questions, or feedback, please drop me a line - I would love to chat! You can find me on twitter at @kevg1412 or my email at kevin@12mv2.com.

If you're a fan of business or technology in general, please check out some of my other projects!

Speedwell Research — Comprehensive research on great public companies including Constellation Software, Floor & Decor, Meta, RH, interesting new frameworks like the Consumer’s Hierarchy of Preferences (Part 1, Part 2, Part 3), and much more.

Cloud Valley — Easy to read, in-depth biographies that explore the defining moments, investments, and life decisions of investing, business, and tech legends like Dan Loeb, Bob Iger, Steve Jurvetson, and Cyan Banister.

DJY Research — Comprehensive research on publicly-traded Asian companies like Alibaba, Tencent, Nintendo, Sea Limited (FREE SAMPLE), Coupang (FREE SAMPLE), and more.

Compilations — “A national treasure — for every country.”

Memos — A selection of some of my favorite investor memos.

Bookshelves — Your favorite investors’/operators’ favorite books.